Use the information below to forecast the additional funds n

Use the information below to forecast the additional funds needed (AFN). Dollars are in millions.

Last year\'s sales = S0

$500

Sales growth rate = g

20%

Last year\'s total assets = A0*

$1000

Last year\'s profit margin = PM

5%

Last year\'s accounts payable

$80

Last year\'s notes payable

$60

Last year\'s accruals

$50

Target payout ratio

40%

| Last year\'s sales = S0 | $500 |

| Sales growth rate = g | 20% |

| Last year\'s total assets = A0* | $1000 |

| Last year\'s profit margin = PM | 5% |

| Last year\'s accounts payable | $80 |

| Last year\'s notes payable | $60 |

| Last year\'s accruals | $50 |

| Target payout ratio | 40% |

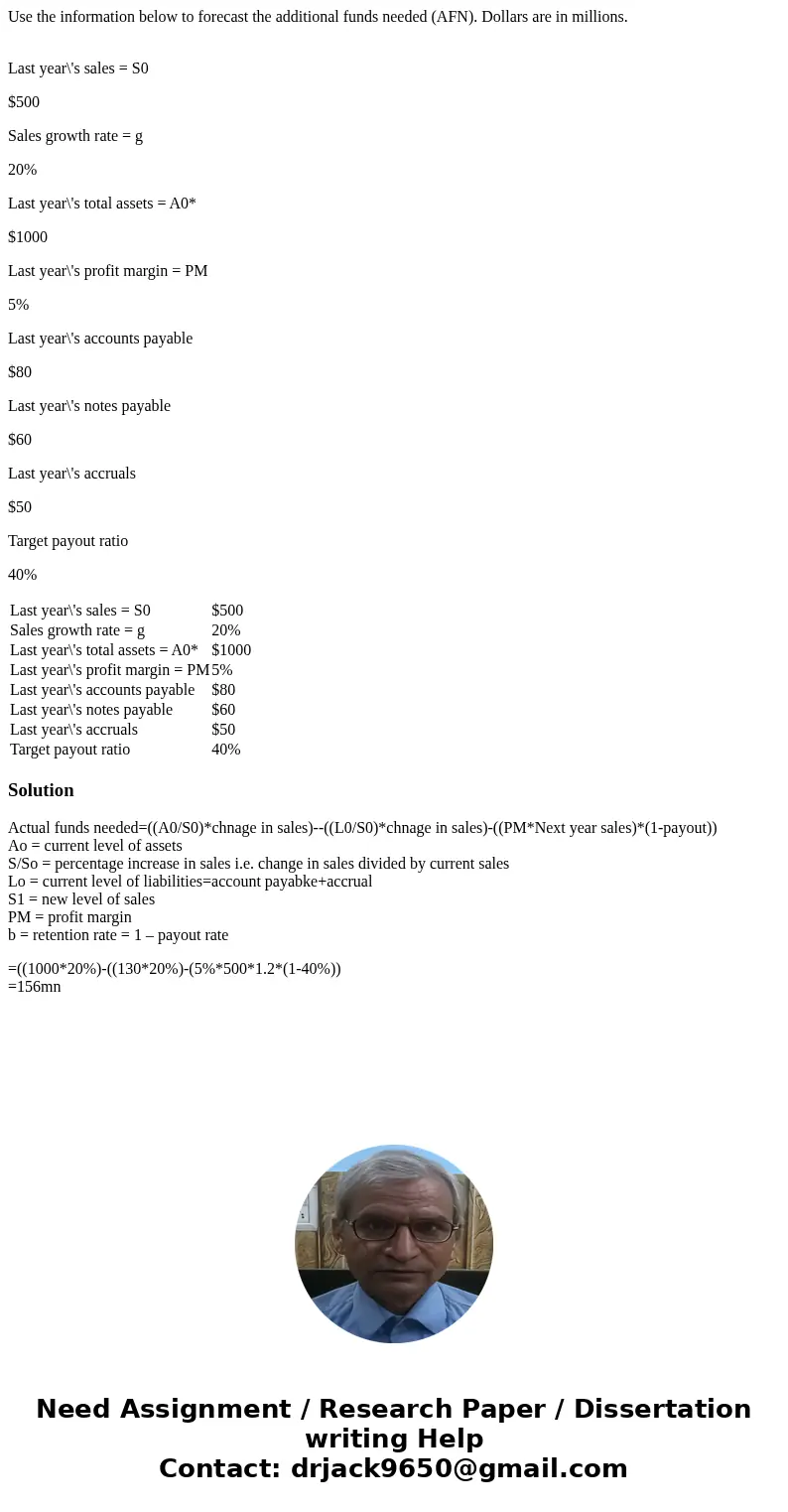

Solution

Actual funds needed=((A0/S0)*chnage in sales)--((L0/S0)*chnage in sales)-((PM*Next year sales)*(1-payout))

Ao = current level of assets

S/So = percentage increase in sales i.e. change in sales divided by current sales

Lo = current level of liabilities=account payabke+accrual

S1 = new level of sales

PM = profit margin

b = retention rate = 1 – payout rate

=((1000*20%)-((130*20%)-(5%*500*1.2*(1-40%))

=156mn

Homework Sourse

Homework Sourse