Determine the amount of the standard deduction allowed for 2

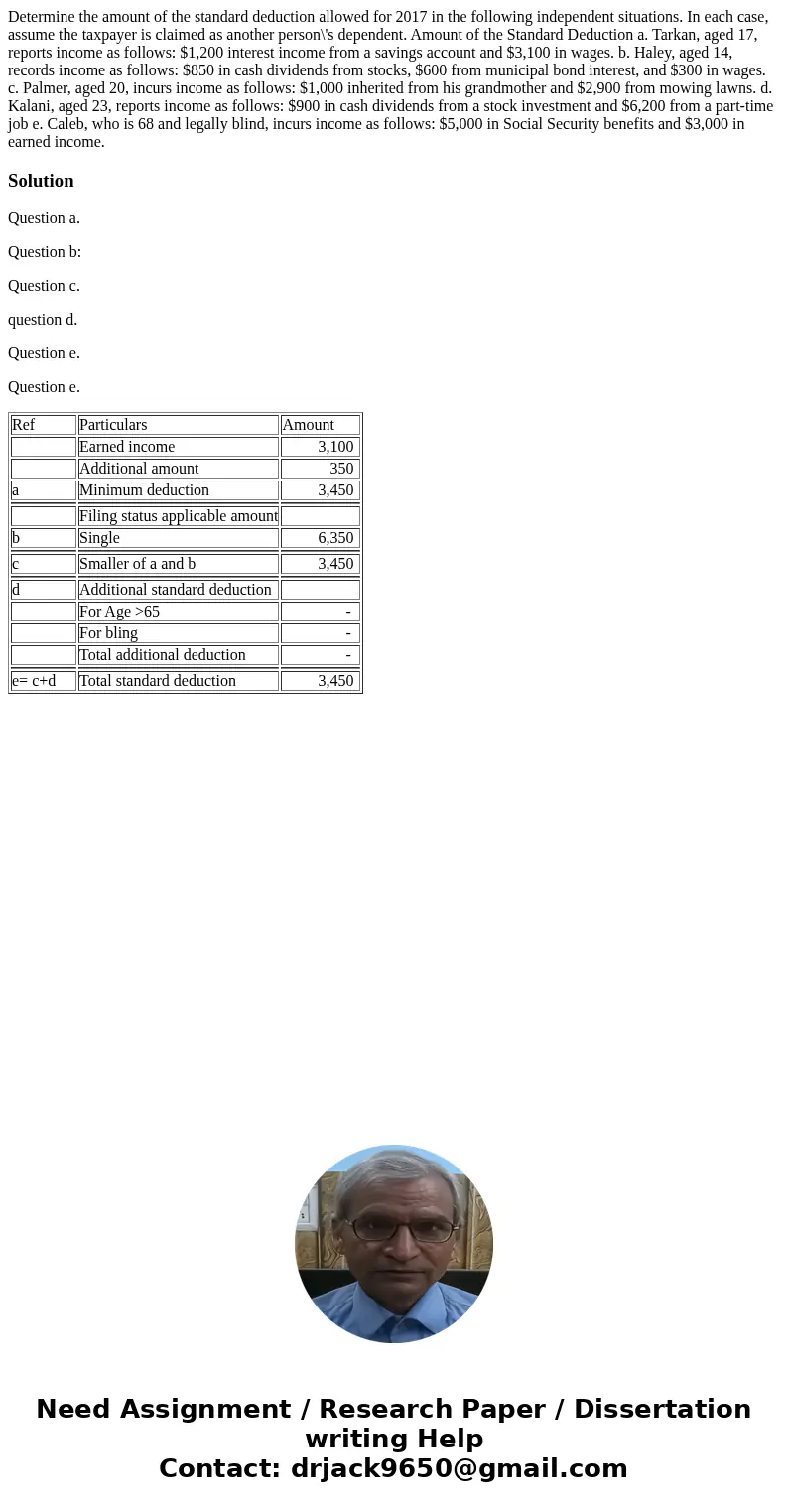

Determine the amount of the standard deduction allowed for 2017 in the following independent situations. In each case, assume the taxpayer is claimed as another person\'s dependent. Amount of the Standard Deduction a. Tarkan, aged 17, reports income as follows: $1,200 interest income from a savings account and $3,100 in wages. b. Haley, aged 14, records income as follows: $850 in cash dividends from stocks, $600 from municipal bond interest, and $300 in wages. c. Palmer, aged 20, incurs income as follows: $1,000 inherited from his grandmother and $2,900 from mowing lawns. d. Kalani, aged 23, reports income as follows: $900 in cash dividends from a stock investment and $6,200 from a part-time job e. Caleb, who is 68 and legally blind, incurs income as follows: $5,000 in Social Security benefits and $3,000 in earned income.

Solution

Question a.

Question b:

Question c.

question d.

Question e.

Question e.

| Ref | Particulars | Amount |

| Earned income | 3,100 | |

| Additional amount | 350 | |

| a | Minimum deduction | 3,450 |

| Filing status applicable amount | ||

| b | Single | 6,350 |

| c | Smaller of a and b | 3,450 |

| d | Additional standard deduction | |

| For Age >65 | - | |

| For bling | - | |

| Total additional deduction | - | |

| e= c+d | Total standard deduction | 3,450 |

Homework Sourse

Homework Sourse