Parent acquired Subsidiary on January 1 2016 at a price 3000

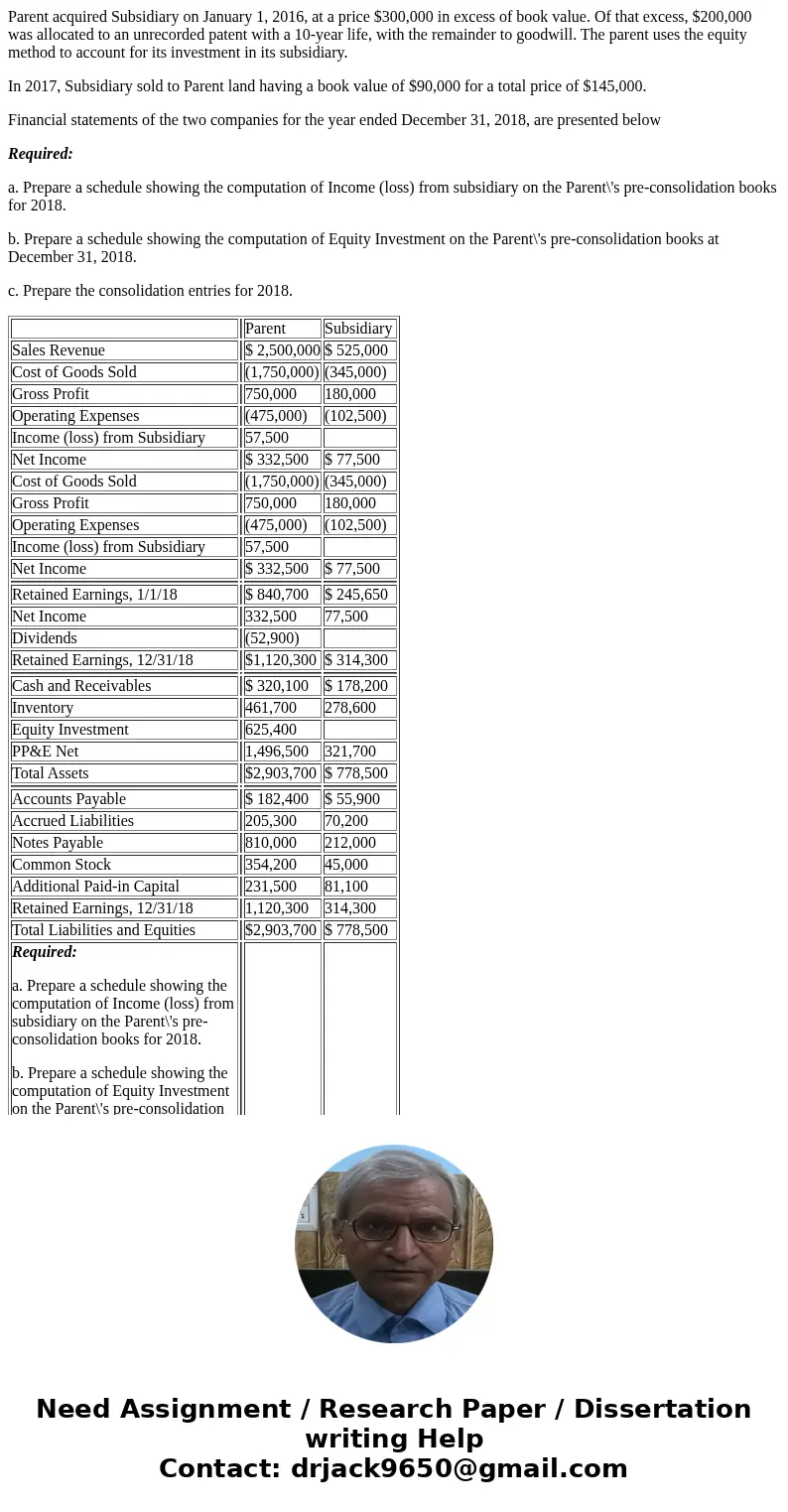

Parent acquired Subsidiary on January 1, 2016, at a price $300,000 in excess of book value. Of that excess, $200,000 was allocated to an unrecorded patent with a 10-year life, with the remainder to goodwill. The parent uses the equity method to account for its investment in its subsidiary.

In 2017, Subsidiary sold to Parent land having a book value of $90,000 for a total price of $145,000.

Financial statements of the two companies for the year ended December 31, 2018, are presented below

Required:

a. Prepare a schedule showing the computation of Income (loss) from subsidiary on the Parent\'s pre-consolidation books for 2018.

b. Prepare a schedule showing the computation of Equity Investment on the Parent\'s pre-consolidation books at December 31, 2018.

c. Prepare the consolidation entries for 2018.

| Parent | Subsidiary | ||

| Sales Revenue | $ 2,500,000 | $ 525,000 | |

| Cost of Goods Sold | (1,750,000) | (345,000) | |

| Gross Profit | 750,000 | 180,000 | |

| Operating Expenses | (475,000) | (102,500) | |

| Income (loss) from Subsidiary | 57,500 | ||

| Net Income | $ 332,500 | $ 77,500 | |

| Cost of Goods Sold | (1,750,000) | (345,000) | |

| Gross Profit | 750,000 | 180,000 | |

| Operating Expenses | (475,000) | (102,500) | |

| Income (loss) from Subsidiary | 57,500 | ||

| Net Income | $ 332,500 | $ 77,500 | |

| Retained Earnings, 1/1/18 | $ 840,700 | $ 245,650 | |

| Net Income | 332,500 | 77,500 | |

| Dividends | (52,900) | ||

| Retained Earnings, 12/31/18 | $1,120,300 | $ 314,300 | |

| Cash and Receivables | $ 320,100 | $ 178,200 | |

| Inventory | 461,700 | 278,600 | |

| Equity Investment | 625,400 | ||

| PP&E Net | 1,496,500 | 321,700 | |

| Total Assets | $2,903,700 | $ 778,500 | |

| Accounts Payable | $ 182,400 | $ 55,900 | |

| Accrued Liabilities | 205,300 | 70,200 | |

| Notes Payable | 810,000 | 212,000 | |

| Common Stock | 354,200 | 45,000 | |

| Additional Paid-in Capital | 231,500 | 81,100 | |

| Retained Earnings, 12/31/18 | 1,120,300 | 314,300 | |

| Total Liabilities and Equities | $2,903,700 | $ 778,500 | |

| Required: a. Prepare a schedule showing the computation of Income (loss) from subsidiary on the Parent\'s pre-consolidation books for 2018. b. Prepare a schedule showing the computation of Equity Investment on the Parent\'s pre-consolidation books at December 31, 2018. c. Prepare the consolidation entries for 2018. |

Solution

Computation of Income or loss from subsidary on pre consolidation books -

Net income of Subsidary -77500

Parent\'s share -74%

Income or loss to parent -57500

Computation of Equity Investment

Total Assets 778500

Accounts Payable 55900

Accrued Liabilities 70200

Notes Payable 212000

Equity Investment 440400

Share of Parent -74% 325896

Consolidation Entries

Subsidary a/c dr 325896

Patent in subsidary a/c dr 200000

Goodwill in subsidary a/c dr 100000

To cash A/c 625896

-

Homework Sourse

Homework Sourse