On March 1 20Y8 Eric Keene and Renee Wallace form a partners

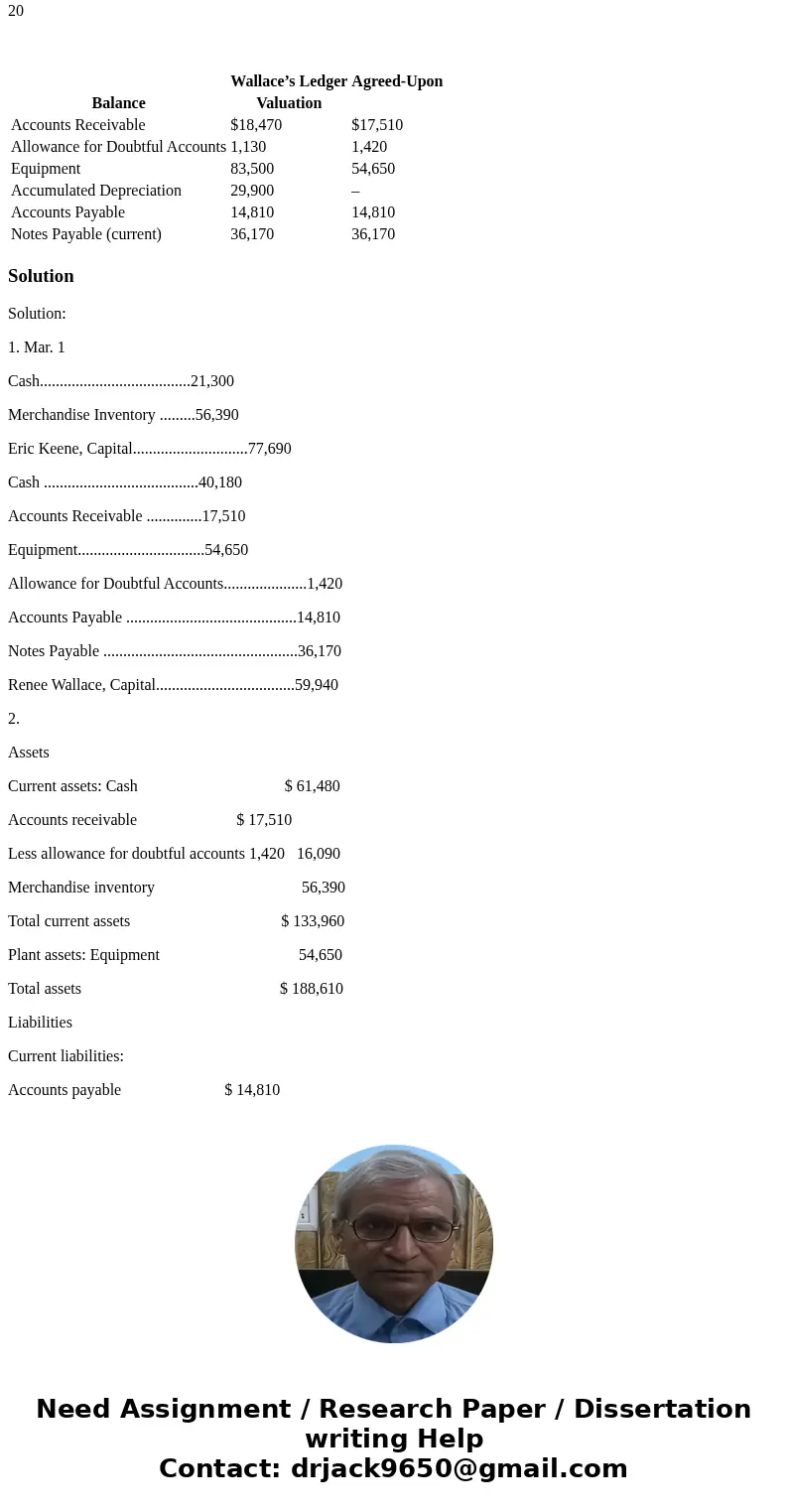

On March 1, 20Y8, Eric Keene and Renee Wallace form a partnership. Keene agrees to invest $21,300 in cash and merchandise inventory valued at $56,390. Wallace invests certain business assets at valuations agreed upon, transfers business liabilities, and contributes sufficient cash to bring her total capital to $59,940. Details regarding the book values of the business assets and liabilities, and the agreed valuations, follow:

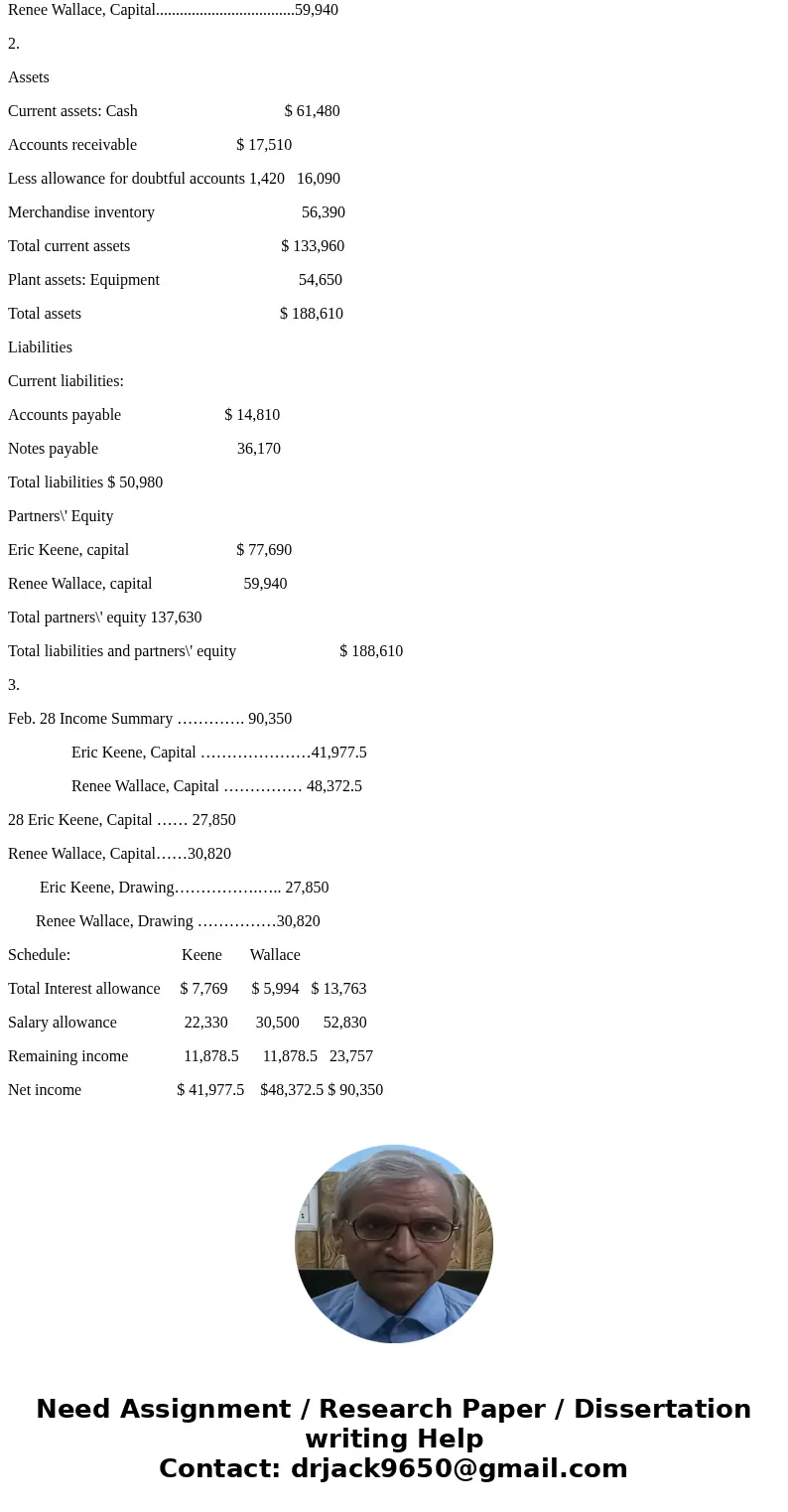

The partnership agreement includes the following provisions regarding the division of net income: interest on original investments at 10%, salary allowances of $22,330 (Keene) and $30,500 (Wallace), and the remainder equally.

*Refer to the Chart of Accounts and the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries.

CHART OF ACCOUNTSKeene and WallaceGeneral Ledger

Miscellaneous Expense

Journalize the entries on March 1 to record the investments of Keene and Wallacein the partnership accounts. Refer to the Chart of Accounts for exact wording of account titles.

PAGE 5

JOURNAL

ACCOUNTING EQUATION

1

2

3

4

5

6

7

8

9

10

3. After adjustments at February 28, 20Y9, the end of the first full year of operations, the revenues were $303,250 and expenses were $212,900, for a net income of $90,350. The drawing accounts have debit balances of $27,850 (Keene) and $30,820 (Wallace). Journalizethe entries to close the revenues and expenses and the drawing accounts at February 28, 20Y9. Refer to the Chart of Accounts for exact wording of account titles. If required, round your answers to two decimal places.

PAGE 20

JOURNAL

ACCOUNTING EQUATION

1

Closing Entries

2

3

4

5

6

7

8

9

2. Prepare a balance sheet as of March 1, 20Y8, the date of formation of the partnership of Keene and Wallace. Refer to the Chart of Accounts and the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. Enter current assets in order of liquidity. “Less”, “Add”, or colons (:) will automatically appear if required.

Keene and Wallace

Balance Sheet

March 1, 20Y8

1

Assets

2

3

4

5

6

7

8

9

10

11

Liabilities

12

13

14

15

16

Partners’ Equity

17

18

19

20

| Wallace’s Ledger | Agreed-Upon | |

|---|---|---|

| Balance | Valuation | |

| Accounts Receivable | $18,470 | $17,510 |

| Allowance for Doubtful Accounts | 1,130 | 1,420 |

| Equipment | 83,500 | 54,650 |

| Accumulated Depreciation | 29,900 | – |

| Accounts Payable | 14,810 | 14,810 |

| Notes Payable (current) | 36,170 | 36,170 |

Solution

Solution:

1. Mar. 1

Cash......................................21,300

Merchandise Inventory .........56,390

Eric Keene, Capital.............................77,690

Cash .......................................40,180

Accounts Receivable ..............17,510

Equipment................................54,650

Allowance for Doubtful Accounts.....................1,420

Accounts Payable ...........................................14,810

Notes Payable .................................................36,170

Renee Wallace, Capital...................................59,940

2.

Assets

Current assets: Cash $ 61,480

Accounts receivable $ 17,510

Less allowance for doubtful accounts 1,420 16,090

Merchandise inventory 56,390

Total current assets $ 133,960

Plant assets: Equipment 54,650

Total assets $ 188,610

Liabilities

Current liabilities:

Accounts payable $ 14,810

Notes payable 36,170

Total liabilities $ 50,980

Partners\' Equity

Eric Keene, capital $ 77,690

Renee Wallace, capital 59,940

Total partners\' equity 137,630

Total liabilities and partners\' equity $ 188,610

3.

Feb. 28 Income Summary …………. 90,350

Eric Keene, Capital …………………41,977.5

Renee Wallace, Capital …………… 48,372.5

28 Eric Keene, Capital …… 27,850

Renee Wallace, Capital……30,820

Eric Keene, Drawing…………….….. 27,850

Renee Wallace, Drawing ……………30,820

Schedule: Keene Wallace

Total Interest allowance $ 7,769 $ 5,994 $ 13,763

Salary allowance 22,330 30,500 52,830

Remaining income 11,878.5 11,878.5 23,757

Net income $ 41,977.5 $48,372.5 $ 90,350

Homework Sourse

Homework Sourse