Ming Chen began a professional practice on June I and plans

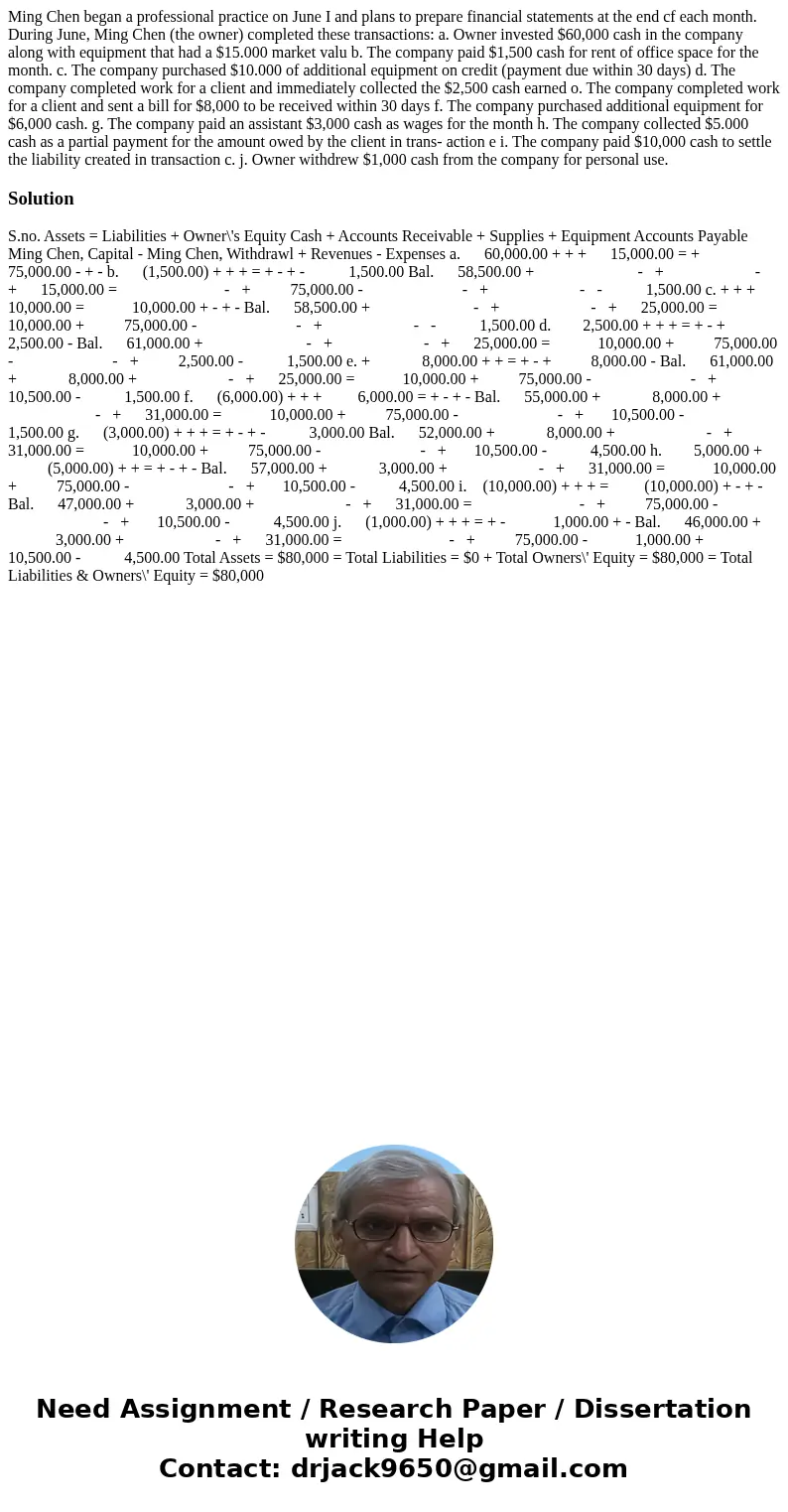

Ming Chen began a professional practice on June I and plans to prepare financial statements at the end cf each month. During June, Ming Chen (the owner) completed these transactions: a. Owner invested $60,000 cash in the company along with equipment that had a $15.000 market valu b. The company paid $1,500 cash for rent of office space for the month. c. The company purchased $10.000 of additional equipment on credit (payment due within 30 days) d. The company completed work for a client and immediately collected the $2,500 cash earned o. The company completed work for a client and sent a bill for $8,000 to be received within 30 days f. The company purchased additional equipment for $6,000 cash. g. The company paid an assistant $3,000 cash as wages for the month h. The company collected $5.000 cash as a partial payment for the amount owed by the client in trans- action e i. The company paid $10,000 cash to settle the liability created in transaction c. j. Owner withdrew $1,000 cash from the company for personal use.

Solution

S.no. Assets = Liabilities + Owner\'s Equity Cash + Accounts Receivable + Supplies + Equipment Accounts Payable Ming Chen, Capital - Ming Chen, Withdrawl + Revenues - Expenses a. 60,000.00 + + + 15,000.00 = + 75,000.00 - + - b. (1,500.00) + + + = + - + - 1,500.00 Bal. 58,500.00 + - + - + 15,000.00 = - + 75,000.00 - - + - - 1,500.00 c. + + + 10,000.00 = 10,000.00 + - + - Bal. 58,500.00 + - + - + 25,000.00 = 10,000.00 + 75,000.00 - - + - - 1,500.00 d. 2,500.00 + + + = + - + 2,500.00 - Bal. 61,000.00 + - + - + 25,000.00 = 10,000.00 + 75,000.00 - - + 2,500.00 - 1,500.00 e. + 8,000.00 + + = + - + 8,000.00 - Bal. 61,000.00 + 8,000.00 + - + 25,000.00 = 10,000.00 + 75,000.00 - - + 10,500.00 - 1,500.00 f. (6,000.00) + + + 6,000.00 = + - + - Bal. 55,000.00 + 8,000.00 + - + 31,000.00 = 10,000.00 + 75,000.00 - - + 10,500.00 - 1,500.00 g. (3,000.00) + + + = + - + - 3,000.00 Bal. 52,000.00 + 8,000.00 + - + 31,000.00 = 10,000.00 + 75,000.00 - - + 10,500.00 - 4,500.00 h. 5,000.00 + (5,000.00) + + = + - + - Bal. 57,000.00 + 3,000.00 + - + 31,000.00 = 10,000.00 + 75,000.00 - - + 10,500.00 - 4,500.00 i. (10,000.00) + + + = (10,000.00) + - + - Bal. 47,000.00 + 3,000.00 + - + 31,000.00 = - + 75,000.00 - - + 10,500.00 - 4,500.00 j. (1,000.00) + + + = + - 1,000.00 + - Bal. 46,000.00 + 3,000.00 + - + 31,000.00 = - + 75,000.00 - 1,000.00 + 10,500.00 - 4,500.00 Total Assets = $80,000 = Total Liabilities = $0 + Total Owners\' Equity = $80,000 = Total Liabilities & Owners\' Equity = $80,000

Homework Sourse

Homework Sourse