An investor wants to find the duration of an 10year 9 semian

An investor wants to find the duration of a(n) 10-year, 9% semiannual pay, noncallable bond that\'s currently priced in the market at $1,067.95, to yield 8%. Using a 50 basis point change in yield, find the effective duration of this bond (Hint: use Equation 11.11)

Solution

Using financial calculator. The PV of the bond if interest rate rise by 50 Bps:

FV

1000

n

20

PMT

45

YTM

4.25

PV

($1,033.24)

The PV of the bond if interest rate falls 50 Bps:

FV

1000

n

20

PMT

45

YTM

3.75

PV

($1,104.22)

Therefore, Effective Duration:

1104.22-1033.24/(2* 0.005 *1067.95) =6.64

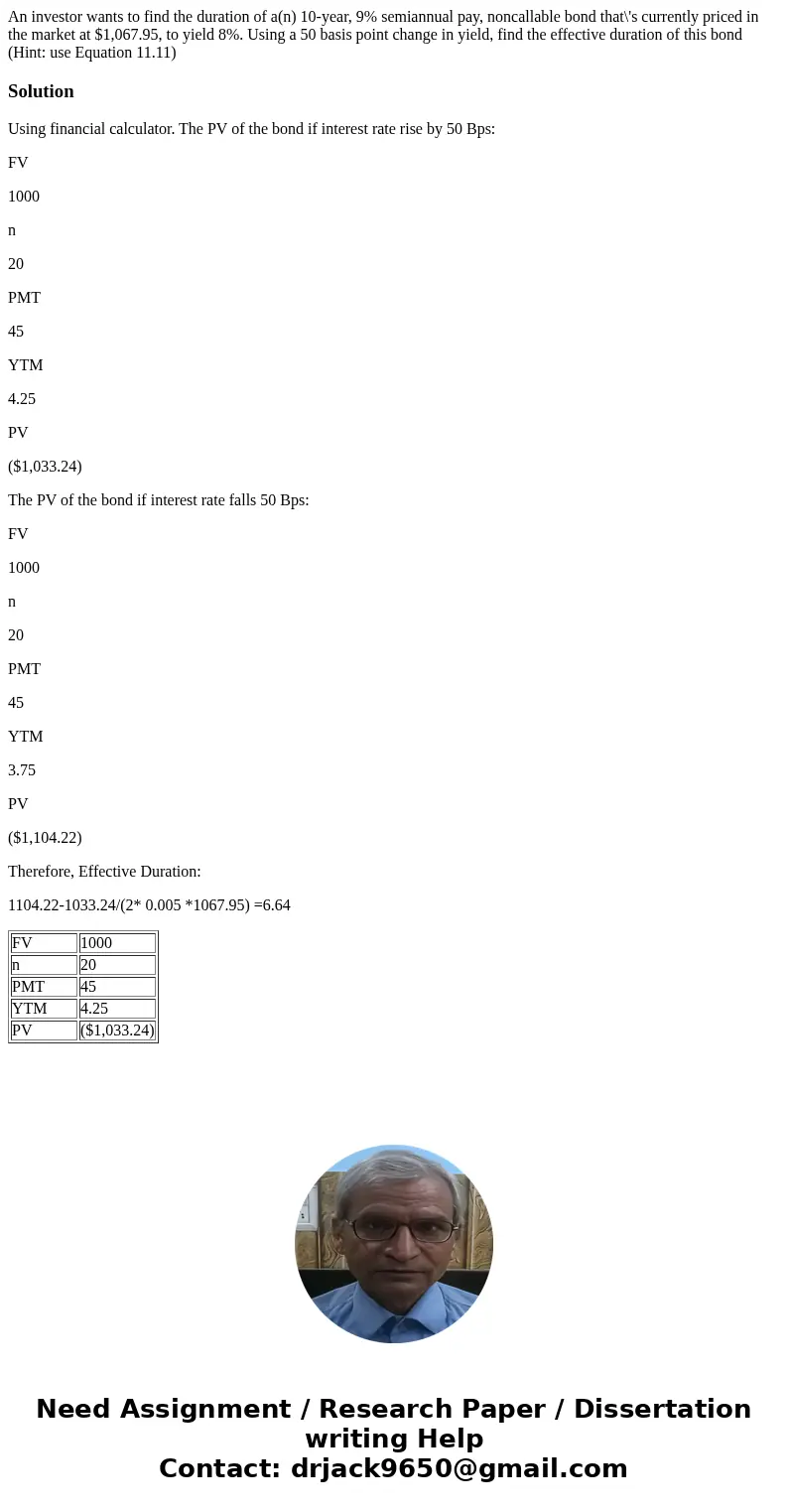

| FV | 1000 |

| n | 20 |

| PMT | 45 |

| YTM | 4.25 |

| PV | ($1,033.24) |

Homework Sourse

Homework Sourse