stockholdersequity sectionP118A On January 1 2017 Tacoma Cor

stockholders\'equity section,*P11-8A On January 1, 2017, Tacoma Corporation had these stockholders\' equity accounts. nd calculate ratios. Common Stock ($10 par value, 70,000 shares issued and outstanding) Paid-in Capital in Excess of Par Value Retained Earnings $700,000 500,000 620,000 0 3,4, 5), AP GLS During the year, the following transactions occurred.

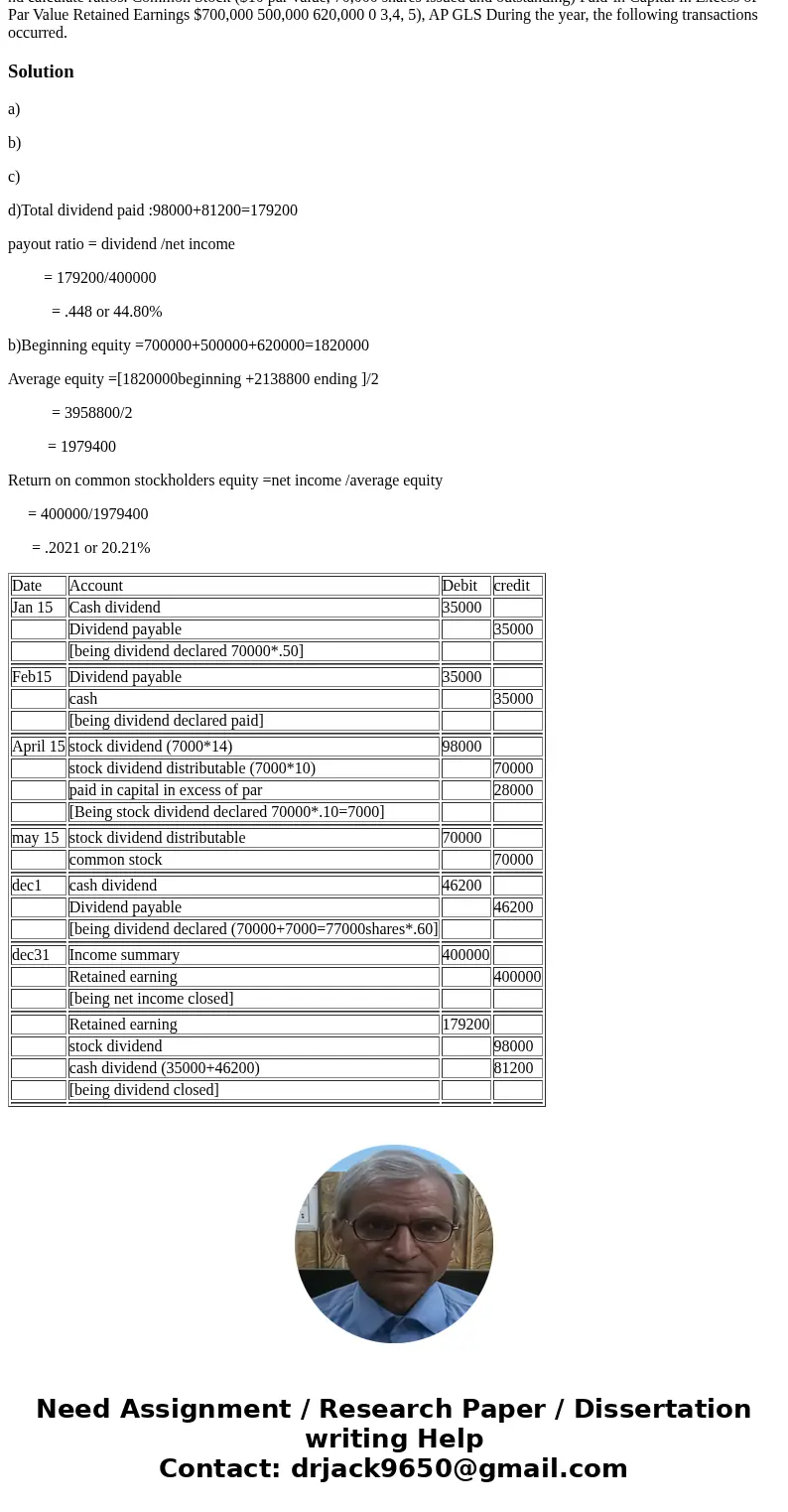

Solution

a)

b)

c)

d)Total dividend paid :98000+81200=179200

payout ratio = dividend /net income

= 179200/400000

= .448 or 44.80%

b)Beginning equity =700000+500000+620000=1820000

Average equity =[1820000beginning +2138800 ending ]/2

= 3958800/2

= 1979400

Return on common stockholders equity =net income /average equity

= 400000/1979400

= .2021 or 20.21%

| Date | Account | Debit | credit |

| Jan 15 | Cash dividend | 35000 | |

| Dividend payable | 35000 | ||

| [being dividend declared 70000*.50] | |||

| Feb15 | Dividend payable | 35000 | |

| cash | 35000 | ||

| [being dividend declared paid] | |||

| April 15 | stock dividend (7000*14) | 98000 | |

| stock dividend distributable (7000*10) | 70000 | ||

| paid in capital in excess of par | 28000 | ||

| [Being stock dividend declared 70000*.10=7000] | |||

| may 15 | stock dividend distributable | 70000 | |

| common stock | 70000 | ||

| dec1 | cash dividend | 46200 | |

| Dividend payable | 46200 | ||

| [being dividend declared (70000+7000=77000shares*.60] | |||

| dec31 | Income summary | 400000 | |

| Retained earning | 400000 | ||

| [being net income closed] | |||

| Retained earning | 179200 | ||

| stock dividend | 98000 | ||

| cash dividend (35000+46200) | 81200 | ||

| [being dividend closed] | |||

Homework Sourse

Homework Sourse