Given an unadjusted trial balance for the company below Debi

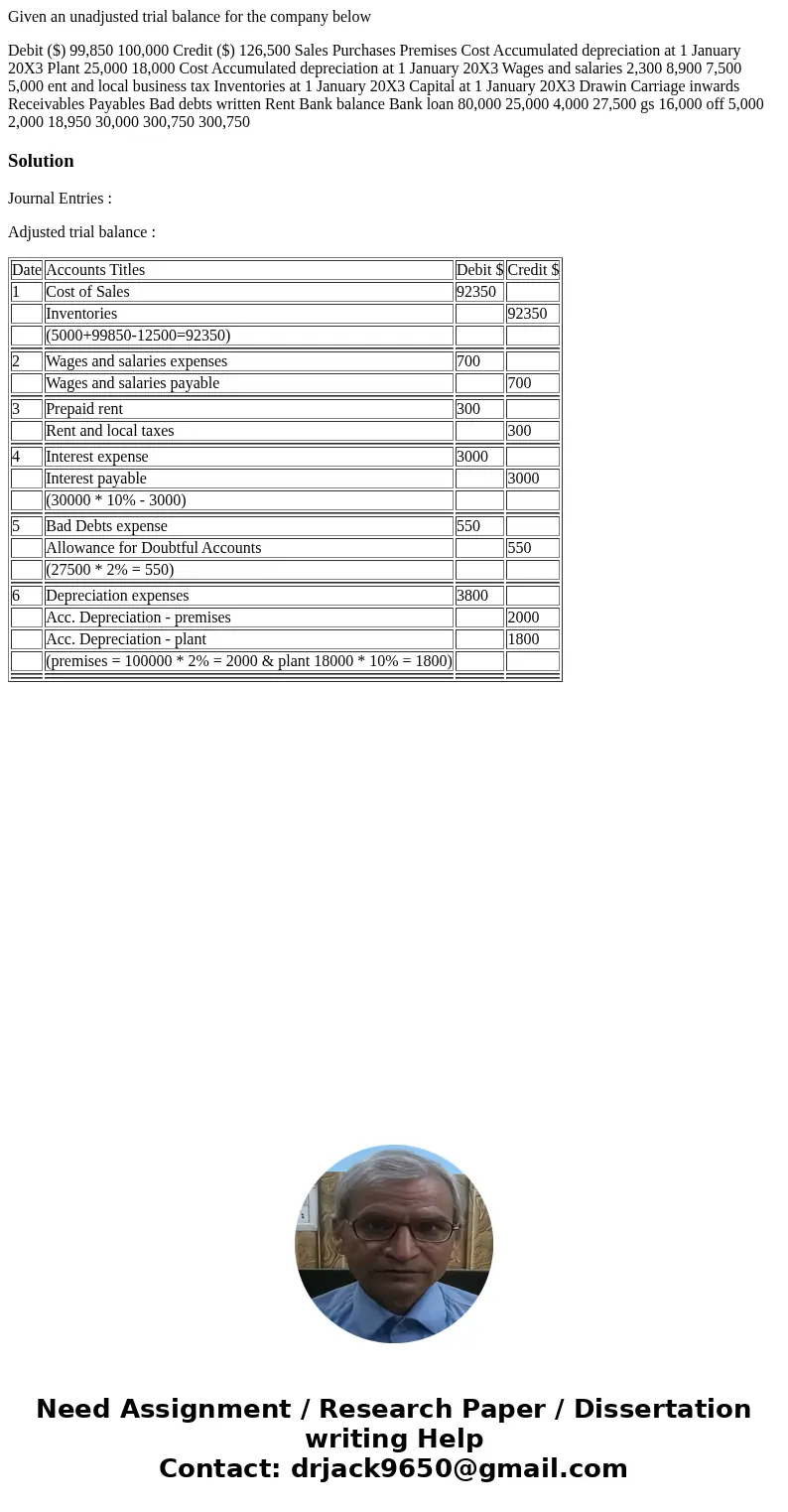

Given an unadjusted trial balance for the company below

Debit ($) 99,850 100,000 Credit ($) 126,500 Sales Purchases Premises Cost Accumulated depreciation at 1 January 20X3 Plant 25,000 18,000 Cost Accumulated depreciation at 1 January 20X3 Wages and salaries 2,300 8,900 7,500 5,000 ent and local business tax Inventories at 1 January 20X3 Capital at 1 January 20X3 Drawin Carriage inwards Receivables Payables Bad debts written Rent Bank balance Bank loan 80,000 25,000 4,000 27,500 gs 16,000 off 5,000 2,000 18,950 30,000 300,750 300,750Solution

Journal Entries :

Adjusted trial balance :

| Date | Accounts Titles | Debit $ | Credit $ |

| 1 | Cost of Sales | 92350 | |

| Inventories | 92350 | ||

| (5000+99850-12500=92350) | |||

| 2 | Wages and salaries expenses | 700 | |

| Wages and salaries payable | 700 | ||

| 3 | Prepaid rent | 300 | |

| Rent and local taxes | 300 | ||

| 4 | Interest expense | 3000 | |

| Interest payable | 3000 | ||

| (30000 * 10% - 3000) | |||

| 5 | Bad Debts expense | 550 | |

| Allowance for Doubtful Accounts | 550 | ||

| (27500 * 2% = 550) | |||

| 6 | Depreciation expenses | 3800 | |

| Acc. Depreciation - premises | 2000 | ||

| Acc. Depreciation - plant | 1800 | ||

| (premises = 100000 * 2% = 2000 & plant 18000 * 10% = 1800) | |||

Homework Sourse

Homework Sourse