1000 points Diana Mark is the president of ServicePro Inc a

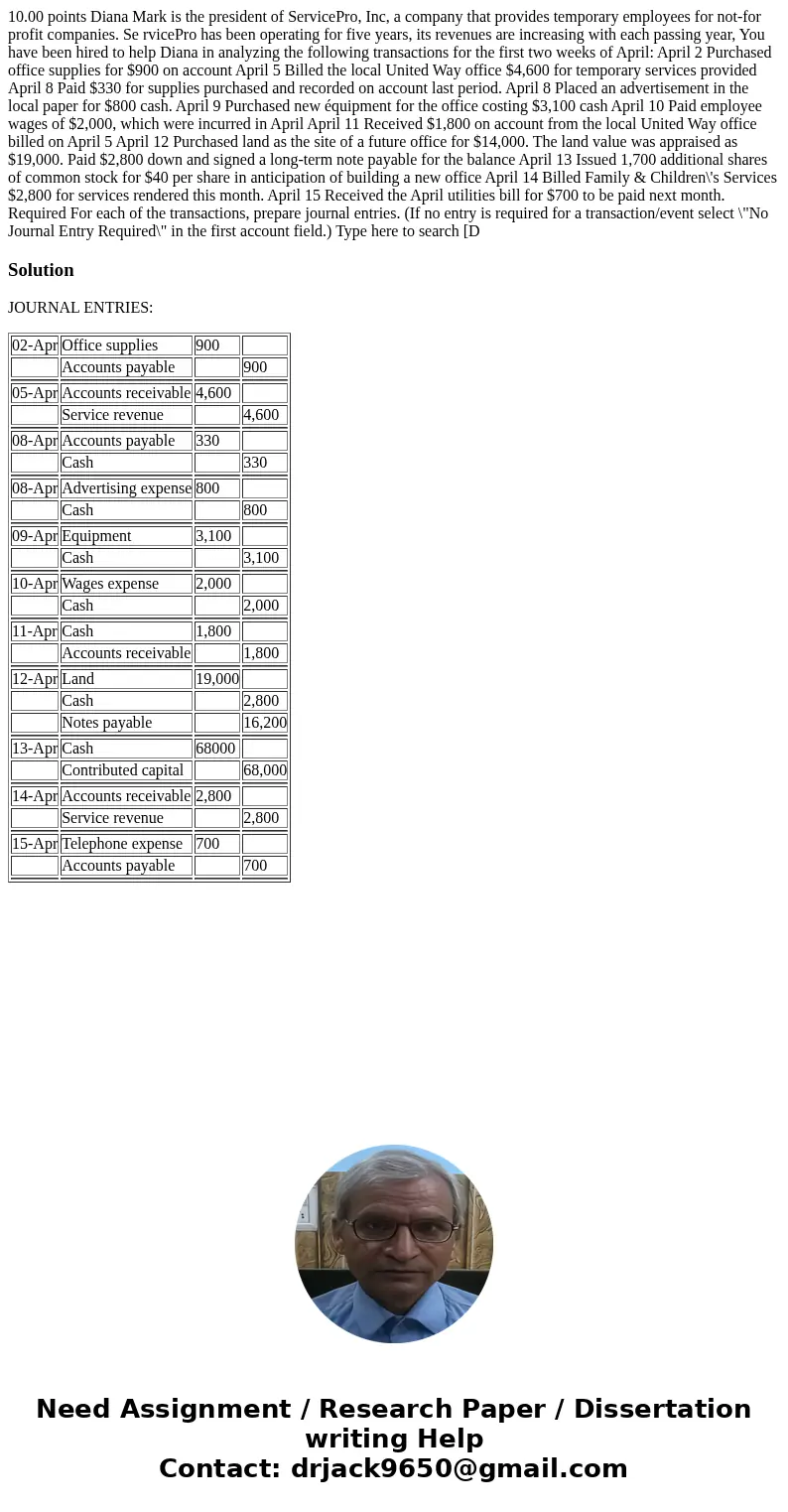

10.00 points Diana Mark is the president of ServicePro, Inc, a company that provides temporary employees for not-for profit companies. Se rvicePro has been operating for five years, its revenues are increasing with each passing year, You have been hired to help Diana in analyzing the following transactions for the first two weeks of April: April 2 Purchased office supplies for $900 on account April 5 Billed the local United Way office $4,600 for temporary services provided April 8 Paid $330 for supplies purchased and recorded on account last period. April 8 Placed an advertisement in the local paper for $800 cash. April 9 Purchased new équipment for the office costing $3,100 cash April 10 Paid employee wages of $2,000, which were incurred in April April 11 Received $1,800 on account from the local United Way office billed on April 5 April 12 Purchased land as the site of a future office for $14,000. The land value was appraised as $19,000. Paid $2,800 down and signed a long-term note payable for the balance April 13 Issued 1,700 additional shares of common stock for $40 per share in anticipation of building a new office April 14 Billed Family & Children\'s Services $2,800 for services rendered this month. April 15 Received the April utilities bill for $700 to be paid next month. Required For each of the transactions, prepare journal entries. (If no entry is required for a transaction/event select \"No Journal Entry Required\" in the first account field.) Type here to search [D

Solution

JOURNAL ENTRIES:

| 02-Apr | Office supplies | 900 | |

| Accounts payable | 900 | ||

| 05-Apr | Accounts receivable | 4,600 | |

| Service revenue | 4,600 | ||

| 08-Apr | Accounts payable | 330 | |

| Cash | 330 | ||

| 08-Apr | Advertising expense | 800 | |

| Cash | 800 | ||

| 09-Apr | Equipment | 3,100 | |

| Cash | 3,100 | ||

| 10-Apr | Wages expense | 2,000 | |

| Cash | 2,000 | ||

| 11-Apr | Cash | 1,800 | |

| Accounts receivable | 1,800 | ||

| 12-Apr | Land | 19,000 | |

| Cash | 2,800 | ||

| Notes payable | 16,200 | ||

| 13-Apr | Cash | 68000 | |

| Contributed capital | 68,000 | ||

| 14-Apr | Accounts receivable | 2,800 | |

| Service revenue | 2,800 | ||

| 15-Apr | Telephone expense | 700 | |

| Accounts payable | 700 | ||

Homework Sourse

Homework Sourse