QUESTION Proven Ltd manufactures specialpurpose computers ac

Solution

Answer

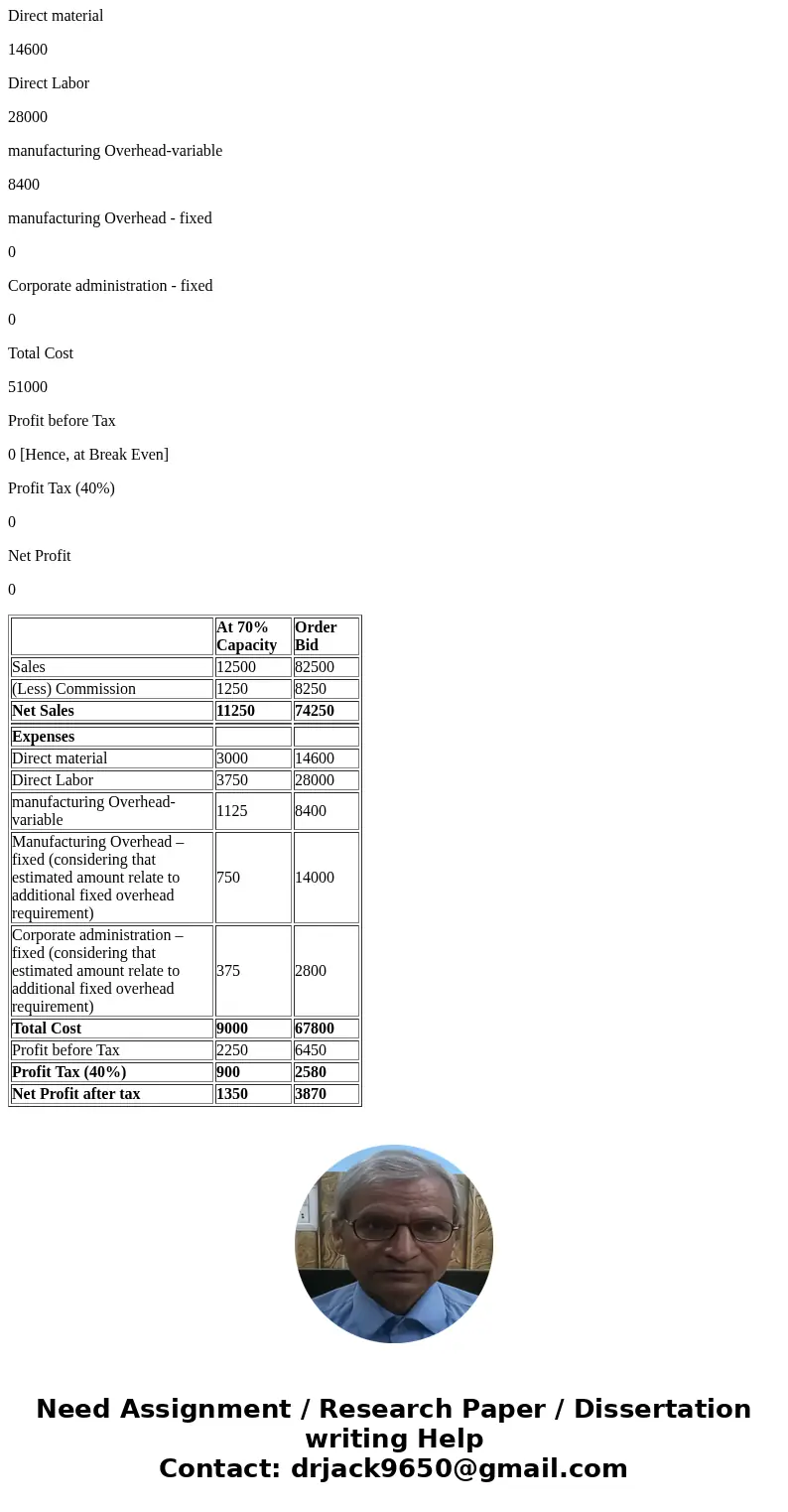

At 70% Capacity

Order Bid

Sales

12500

82500

(Less) Commission

1250

8250

Net Sales

11250

74250

Expenses

Direct material

3000

14600

Direct Labor

3750

28000

manufacturing Overhead-variable

1125

8400

Manufacturing Overhead – fixed (considering that estimated amount relate to additional fixed overhead requirement)

750

14000

Corporate administration – fixed (considering that estimated amount relate to additional fixed overhead requirement)

375

2800

Total Cost

9000

67800

Profit before Tax

2250

6450

Profit Tax (40%)

900

2580

Net Profit after tax

1350

3870

Hence, if the offer is accepted, the Net Profit after tax will increase by $3870000.

Then, Proven should not accept the COUNTER OFFER. This is because any Offer is only to be accepted if its giving additional benefits. This means that Bid price should atleast cover the VARIABLE COSTs to be incurred for production of that ORDER.

In this case, Variable cost adds up to $51000000 (DM 14600 + DL 28000 + Variable manufacturing overhead (30% of 28000=)8400 = 14600 +28000 + 8400 = 51000) which is more than the counter offered bid price of $50000000

Hence, counter offer not to be accepted.

Break Even should be that level of Bid price where the additional offer neither gives Net Income/Net Loss. For that it is assumed that Fixed Cost will not increase. Solving the following equation will give us a Break Even Bid price

A

Direct material

14600

B

Direct Labor

28000

C

manufacturing Overhead-variable

8400

D

Commission 10%

0.1x

E=A+B+C+D

Bid price

x

Hence, 14600+28000+8400+0.1x = x

51000 = x – 0.1x

51000 = 0.9x

x=56666 approx.

Hence, the Bid price should be approx 56666666.

Verifying the above---

Sales

56667

(Less) Commission

5667

Net Sales

51000

Expenses

Direct material

14600

Direct Labor

28000

manufacturing Overhead-variable

8400

manufacturing Overhead - fixed

0

Corporate administration - fixed

0

Total Cost

51000

Profit before Tax

0 [Hence, at Break Even]

Profit Tax (40%)

0

Net Profit

0

| At 70% Capacity | Order Bid | |

| Sales | 12500 | 82500 |

| (Less) Commission | 1250 | 8250 |

| Net Sales | 11250 | 74250 |

| Expenses | ||

| Direct material | 3000 | 14600 |

| Direct Labor | 3750 | 28000 |

| manufacturing Overhead-variable | 1125 | 8400 |

| Manufacturing Overhead – fixed (considering that estimated amount relate to additional fixed overhead requirement) | 750 | 14000 |

| Corporate administration – fixed (considering that estimated amount relate to additional fixed overhead requirement) | 375 | 2800 |

| Total Cost | 9000 | 67800 |

| Profit before Tax | 2250 | 6450 |

| Profit Tax (40%) | 900 | 2580 |

| Net Profit after tax | 1350 | 3870 |

Homework Sourse

Homework Sourse