ahn Corporation Hahn Corporation produces a single product t

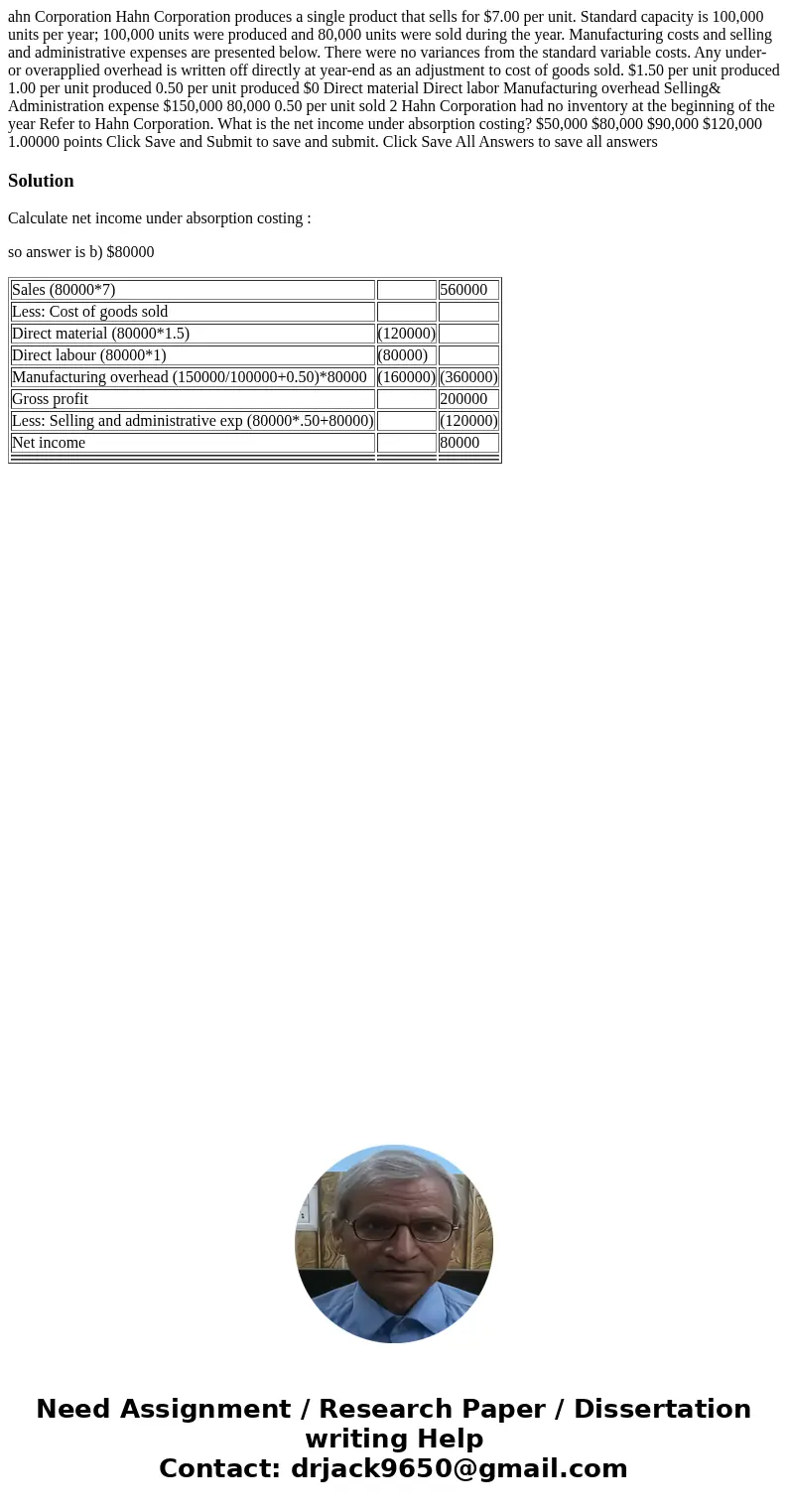

ahn Corporation Hahn Corporation produces a single product that sells for $7.00 per unit. Standard capacity is 100,000 units per year; 100,000 units were produced and 80,000 units were sold during the year. Manufacturing costs and selling and administrative expenses are presented below. There were no variances from the standard variable costs. Any under- or overapplied overhead is written off directly at year-end as an adjustment to cost of goods sold. $1.50 per unit produced 1.00 per unit produced 0.50 per unit produced $0 Direct material Direct labor Manufacturing overhead Selling& Administration expense $150,000 80,000 0.50 per unit sold 2 Hahn Corporation had no inventory at the beginning of the year Refer to Hahn Corporation. What is the net income under absorption costing? $50,000 $80,000 $90,000 $120,000 1.00000 points Click Save and Submit to save and submit. Click Save All Answers to save all answers

Solution

Calculate net income under absorption costing :

so answer is b) $80000

| Sales (80000*7) | 560000 | |

| Less: Cost of goods sold | ||

| Direct material (80000*1.5) | (120000) | |

| Direct labour (80000*1) | (80000) | |

| Manufacturing overhead (150000/100000+0.50)*80000 | (160000) | (360000) |

| Gross profit | 200000 | |

| Less: Selling and administrative exp (80000*.50+80000) | (120000) | |

| Net income | 80000 | |

Homework Sourse

Homework Sourse