The following transactions are for Cullumber Company 1 On De

Solution

Answer:

A)

Date

Description

Debit $

Credit $

3-Dec

Account recivable

533400

Sales

533400

(To record the credit sale)

Cost of goods sold

312100

Merchandise Inventory

312100

(To record the cost of merchandise)

8-Dec

Sales returns and allowance

24700

Account recivable

24700

(To record the Allowance)

13-Dec

Cash (508700-10174)

498526

Sales Discount (508700)*2%

10174

Account Recivable(533400-24700)

508700

B)

Date

Description

Debit $

Credit $

2-Jan

Cash

508700

Account Recivable(533400-24700)

508700

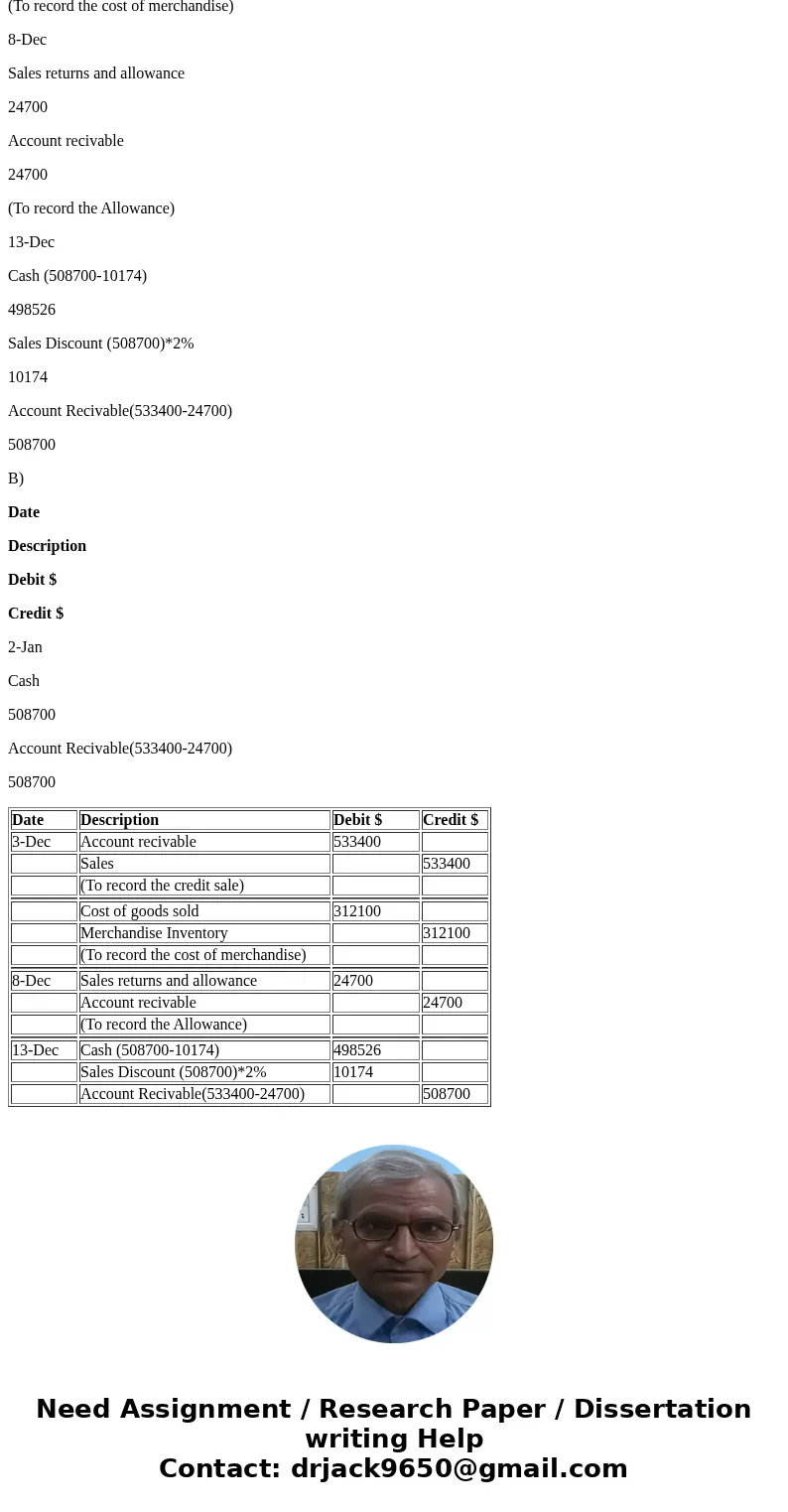

| Date | Description | Debit $ | Credit $ |

| 3-Dec | Account recivable | 533400 | |

| Sales | 533400 | ||

| (To record the credit sale) | |||

| Cost of goods sold | 312100 | ||

| Merchandise Inventory | 312100 | ||

| (To record the cost of merchandise) | |||

| 8-Dec | Sales returns and allowance | 24700 | |

| Account recivable | 24700 | ||

| (To record the Allowance) | |||

| 13-Dec | Cash (508700-10174) | 498526 | |

| Sales Discount (508700)*2% | 10174 | ||

| Account Recivable(533400-24700) | 508700 |

Homework Sourse

Homework Sourse