1 Consider an 18yearold who is about to embark on a threeyea

1. Consider an 18-year-old who is about to embark on a three-year course of study. The total costs of the course are $18,000, payable in advance. The returns take the form of annual $5,000 earnings premiums (paid at year end) that the individual receives from age 21 through to age 25. Calculate the net present value of this investment assuming a discount rate of 5%. Should the project go ahead? (10 marks) a. Should governments subsidize human resource programs? If so, why? Be precise in your answer indicating where, if anywhere, the private market may fail to yield a socially optimal amount of human resource development. (10 marks) b.

Solution

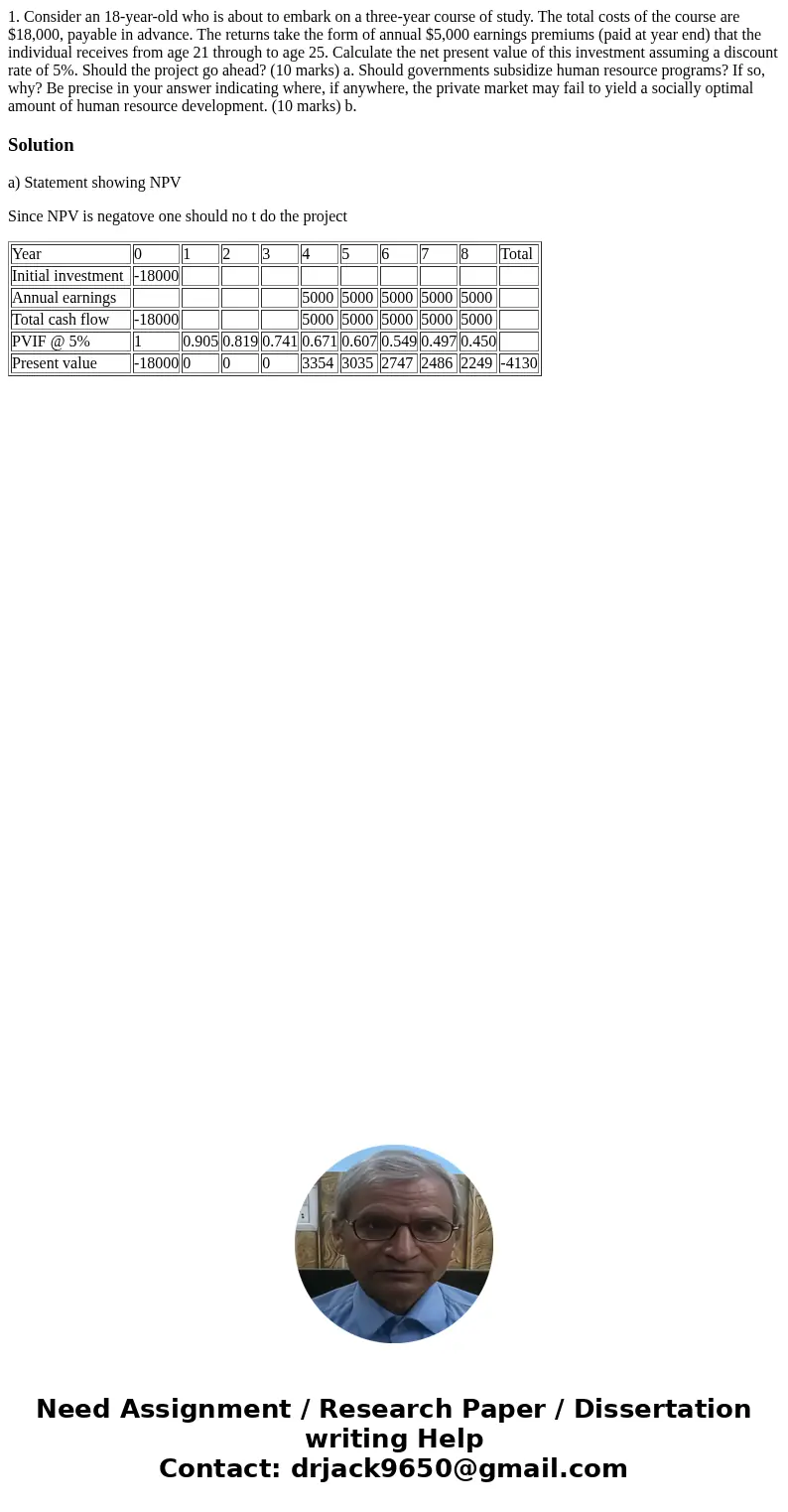

a) Statement showing NPV

Since NPV is negatove one should no t do the project

| Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | Total |

| Initial investment | -18000 | |||||||||

| Annual earnings | 5000 | 5000 | 5000 | 5000 | 5000 | |||||

| Total cash flow | -18000 | 5000 | 5000 | 5000 | 5000 | 5000 | ||||

| PVIF @ 5% | 1 | 0.905 | 0.819 | 0.741 | 0.671 | 0.607 | 0.549 | 0.497 | 0.450 | |

| Present value | -18000 | 0 | 0 | 0 | 3354 | 3035 | 2747 | 2486 | 2249 | -4130 |

Homework Sourse

Homework Sourse