CAPITAL BUDGETING CRITERIA MUTUALLY EXCLUSIVE PROJECTS Proje

CAPITAL BUDGETING CRITERIA: MUTUALLY EXCLUSIVE PROJECTS Project s costs $15,000 and its expected cash flows would be $5,500 per year for 5 years. Mutually exclusive Project L costs $29,500 and its expected cash flows would be $10,100 per year tor 5 years. If both projects have a WACC of 14%, which project would you recommend? Select the correct answer a. Project L, since the NPV NPVs b. Neither Project S nor L, since each project\'s NPV O c. Project S, since the NPVs NPVL d. Both Projects S and L, since both projects have NPVs > 0. e.Both Projects S and L, since both projects have IRR\'s>O

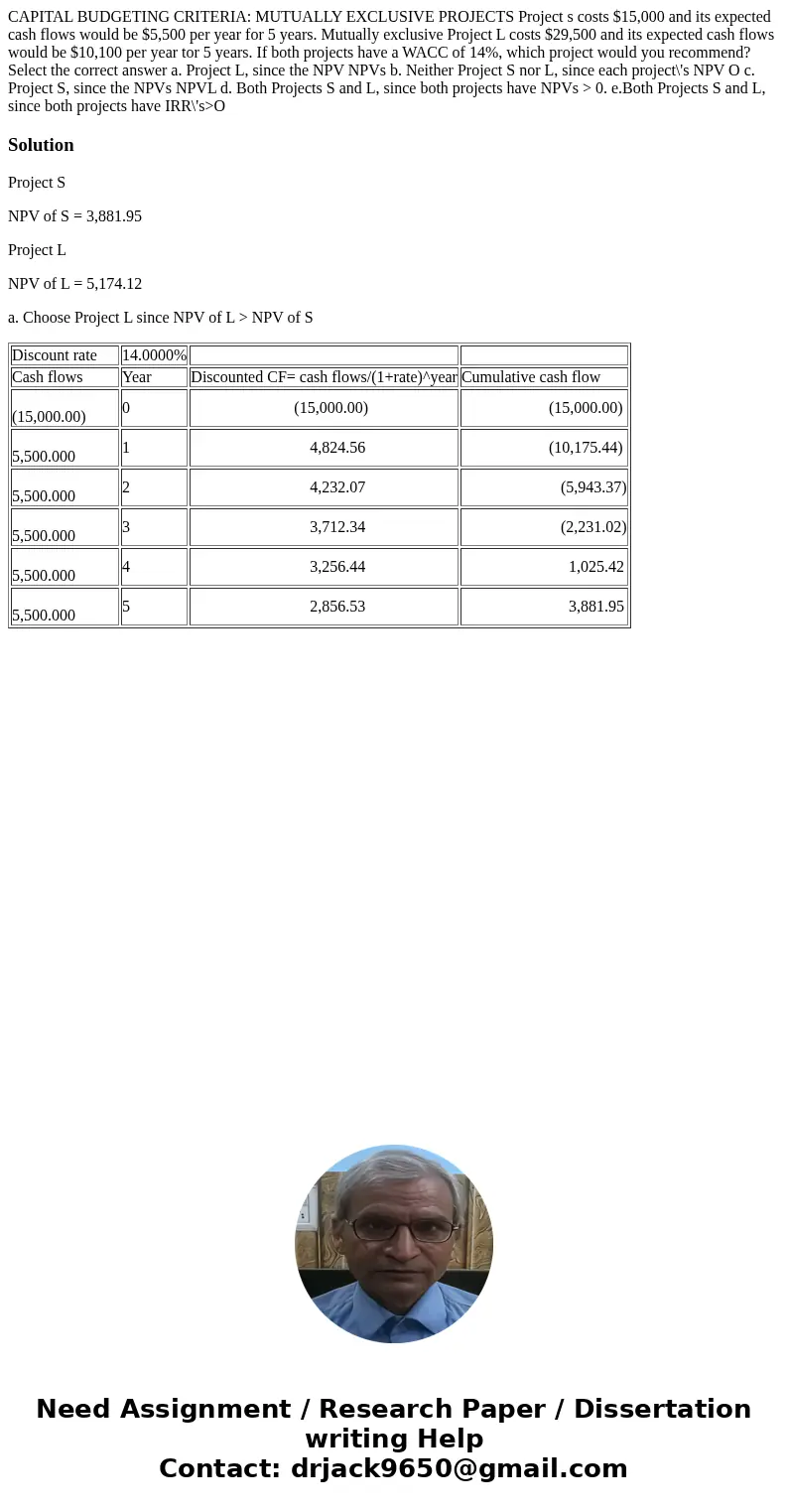

Solution

Project S

NPV of S = 3,881.95

Project L

NPV of L = 5,174.12

a. Choose Project L since NPV of L > NPV of S

| Discount rate | 14.0000% | ||

| Cash flows | Year | Discounted CF= cash flows/(1+rate)^year | Cumulative cash flow |

| (15,000.00) | 0 | (15,000.00) | (15,000.00) |

| 5,500.000 | 1 | 4,824.56 | (10,175.44) |

| 5,500.000 | 2 | 4,232.07 | (5,943.37) |

| 5,500.000 | 3 | 3,712.34 | (2,231.02) |

| 5,500.000 | 4 | 3,256.44 | 1,025.42 |

| 5,500.000 | 5 | 2,856.53 | 3,881.95 |

Homework Sourse

Homework Sourse