What is the net present value of a project that has an initi

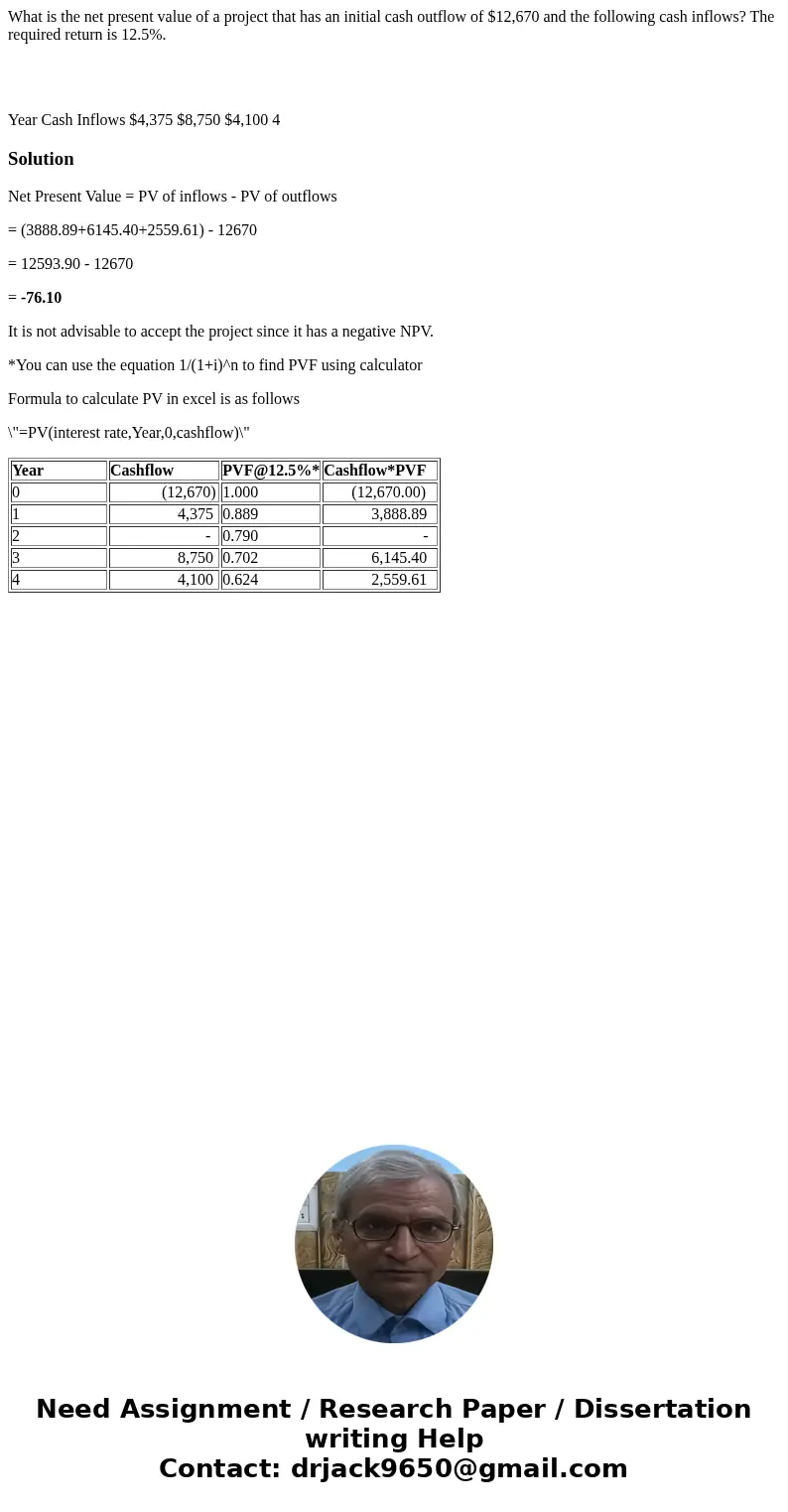

What is the net present value of a project that has an initial cash outflow of $12,670 and the following cash inflows? The required return is 12.5%.

Year Cash Inflows $4,375 $8,750 $4,100 4

Solution

Net Present Value = PV of inflows - PV of outflows

= (3888.89+6145.40+2559.61) - 12670

= 12593.90 - 12670

= -76.10

It is not advisable to accept the project since it has a negative NPV.

*You can use the equation 1/(1+i)^n to find PVF using calculator

Formula to calculate PV in excel is as follows

\"=PV(interest rate,Year,0,cashflow)\"

| Year | Cashflow | PVF@12.5%* | Cashflow*PVF |

| 0 | (12,670) | 1.000 | (12,670.00) |

| 1 | 4,375 | 0.889 | 3,888.89 |

| 2 | - | 0.790 | - |

| 3 | 8,750 | 0.702 | 6,145.40 |

| 4 | 4,100 | 0.624 | 2,559.61 |

Homework Sourse

Homework Sourse