Instructions On January 1 2016 Kelly Corporation acquired bo

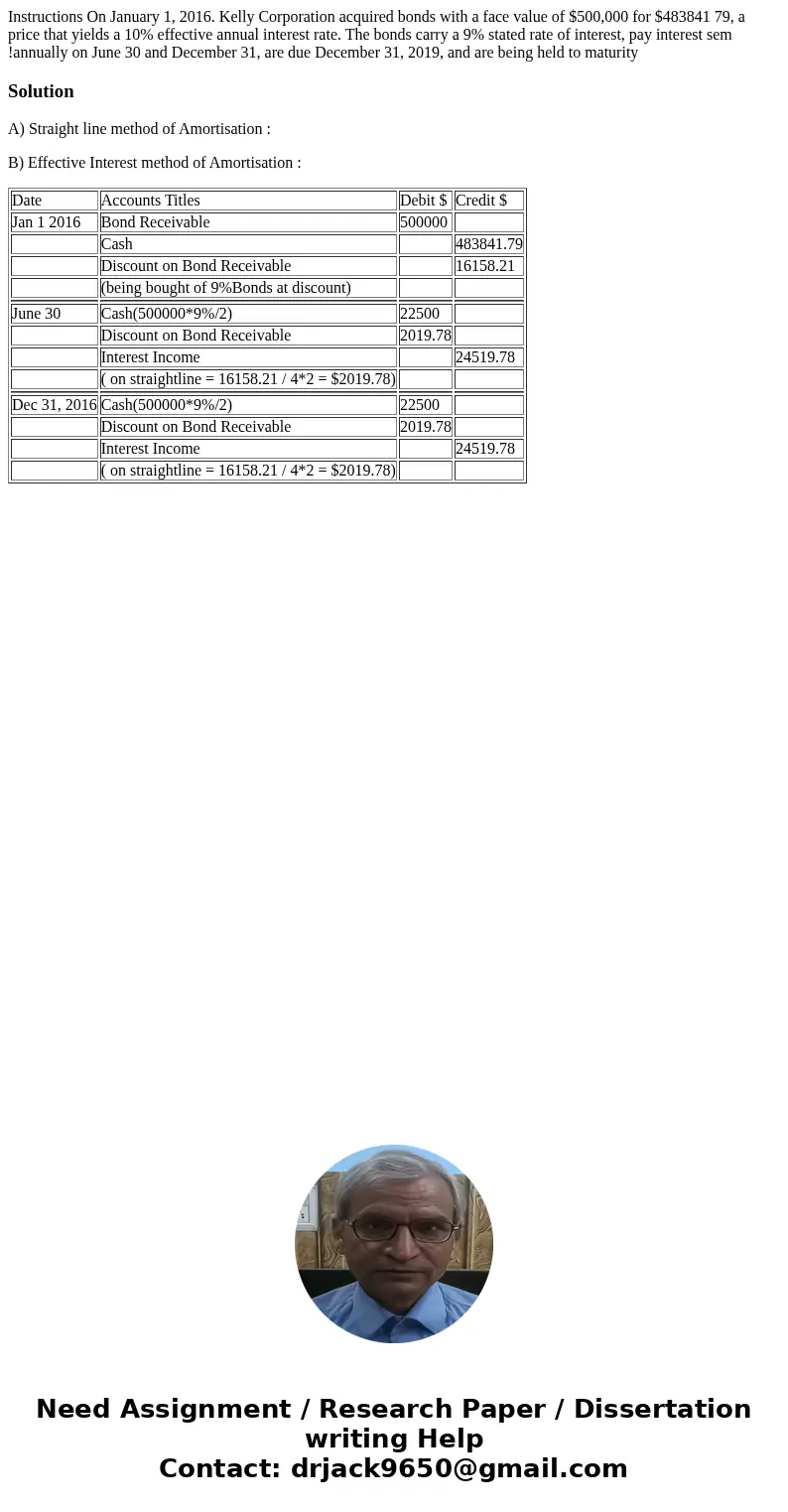

Instructions On January 1, 2016. Kelly Corporation acquired bonds with a face value of $500,000 for $483841 79, a price that yields a 10% effective annual interest rate. The bonds carry a 9% stated rate of interest, pay interest sem !annually on June 30 and December 31, are due December 31, 2019, and are being held to maturity

Solution

A) Straight line method of Amortisation :

B) Effective Interest method of Amortisation :

| Date | Accounts Titles | Debit $ | Credit $ |

| Jan 1 2016 | Bond Receivable | 500000 | |

| Cash | 483841.79 | ||

| Discount on Bond Receivable | 16158.21 | ||

| (being bought of 9%Bonds at discount) | |||

| June 30 | Cash(500000*9%/2) | 22500 | |

| Discount on Bond Receivable | 2019.78 | ||

| Interest Income | 24519.78 | ||

| ( on straightline = 16158.21 / 4*2 = $2019.78) | |||

| Dec 31, 2016 | Cash(500000*9%/2) | 22500 | |

| Discount on Bond Receivable | 2019.78 | ||

| Interest Income | 24519.78 | ||

| ( on straightline = 16158.21 / 4*2 = $2019.78) |

Homework Sourse

Homework Sourse