5 pt Question 3 Brookes Corporation has an expected dividend

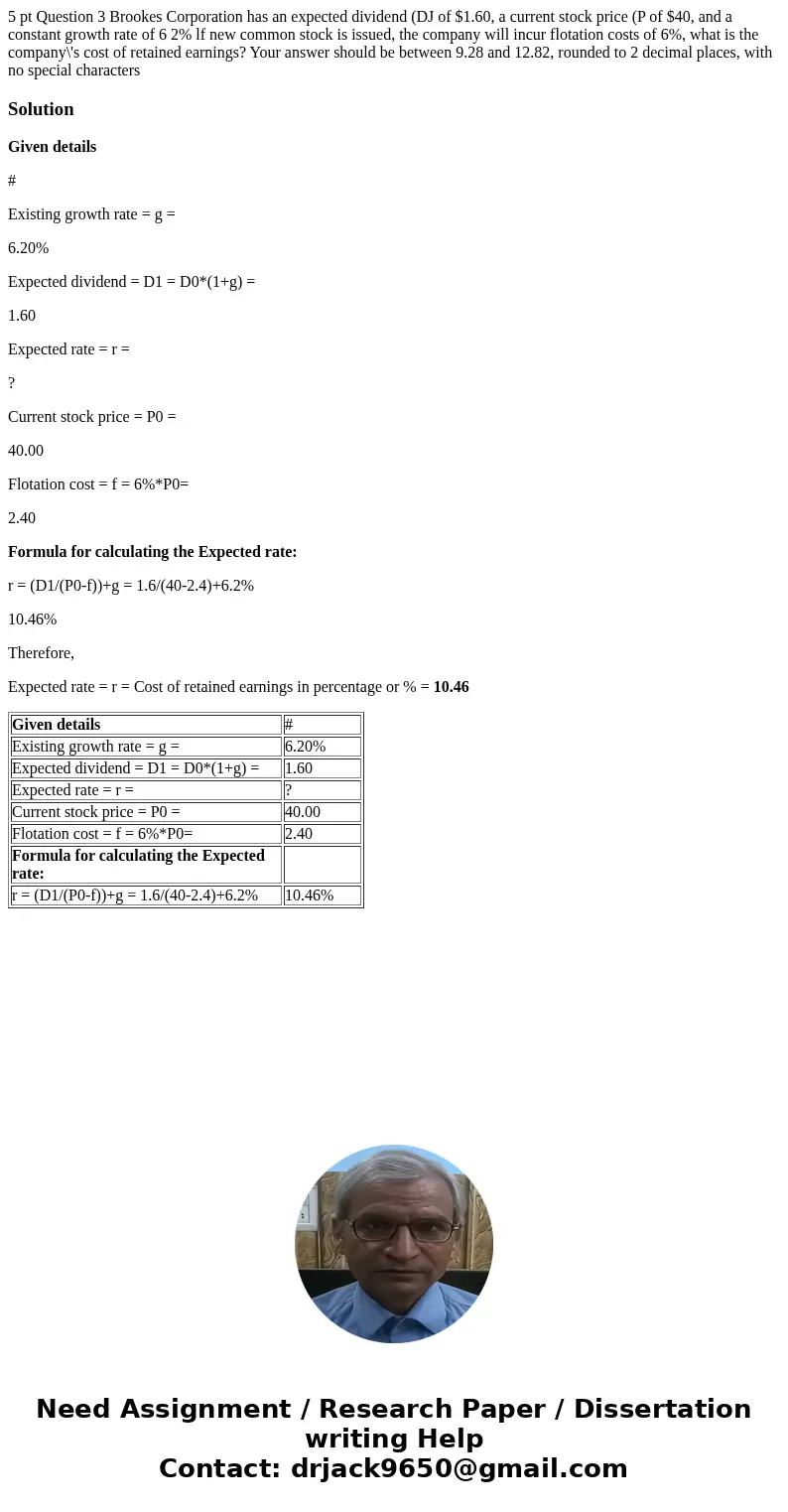

5 pt Question 3 Brookes Corporation has an expected dividend (DJ of $1.60, a current stock price (P of $40, and a constant growth rate of 6 2% lf new common stock is issued, the company will incur flotation costs of 6%, what is the company\'s cost of retained earnings? Your answer should be between 9.28 and 12.82, rounded to 2 decimal places, with no special characters

Solution

Given details

#

Existing growth rate = g =

6.20%

Expected dividend = D1 = D0*(1+g) =

1.60

Expected rate = r =

?

Current stock price = P0 =

40.00

Flotation cost = f = 6%*P0=

2.40

Formula for calculating the Expected rate:

r = (D1/(P0-f))+g = 1.6/(40-2.4)+6.2%

10.46%

Therefore,

Expected rate = r = Cost of retained earnings in percentage or % = 10.46

| Given details | # |

| Existing growth rate = g = | 6.20% |

| Expected dividend = D1 = D0*(1+g) = | 1.60 |

| Expected rate = r = | ? |

| Current stock price = P0 = | 40.00 |

| Flotation cost = f = 6%*P0= | 2.40 |

| Formula for calculating the Expected rate: | |

| r = (D1/(P0-f))+g = 1.6/(40-2.4)+6.2% | 10.46% |

Homework Sourse

Homework Sourse