P39 L02345 Adjusting and Closing Presented below is the tria

Solution

Step 1 : Firstly, Adjusting entries needs to be passed which is shown as follows:-

b) Adjusting Journal Entries (Amount in $)

Step 2 : The ledger accounts are prepared after step 1 which is shown as follows:-

Cash (Amount in $)

Accounts Receivable (Amount in $)

Allowance for Accounts Receivable (Amount in $)

Prepaid Insurance (Amount in $)

Land (Amount in $)

Buildings (Amount in $)

Accumulated Depreciation-Buildings (Amount in $)

Equipment (Amount in $)

Accumulated Depreciation-Equipment (Amount in $)

Common Stock (Amount in $)

Retained Earnings (Amount in $)

Dues Revenue (Amount in $)

Green Fees Revenue (Amount in $)

Rent Revenue (Amount in $)

Utilities Expense (Amount in $)

Maintenance & Repairs Expense (Amount in $)

Salaries and Wages Expense (Amount in $)

Depreciation Expense-Buildings (Amount in $)

Depreciation Expense-Equipment (Amount in $)

Bad Debt Expense (Amount in $)

Insurance Expense (Amount in $)

Rent Receivable (Amount in $)

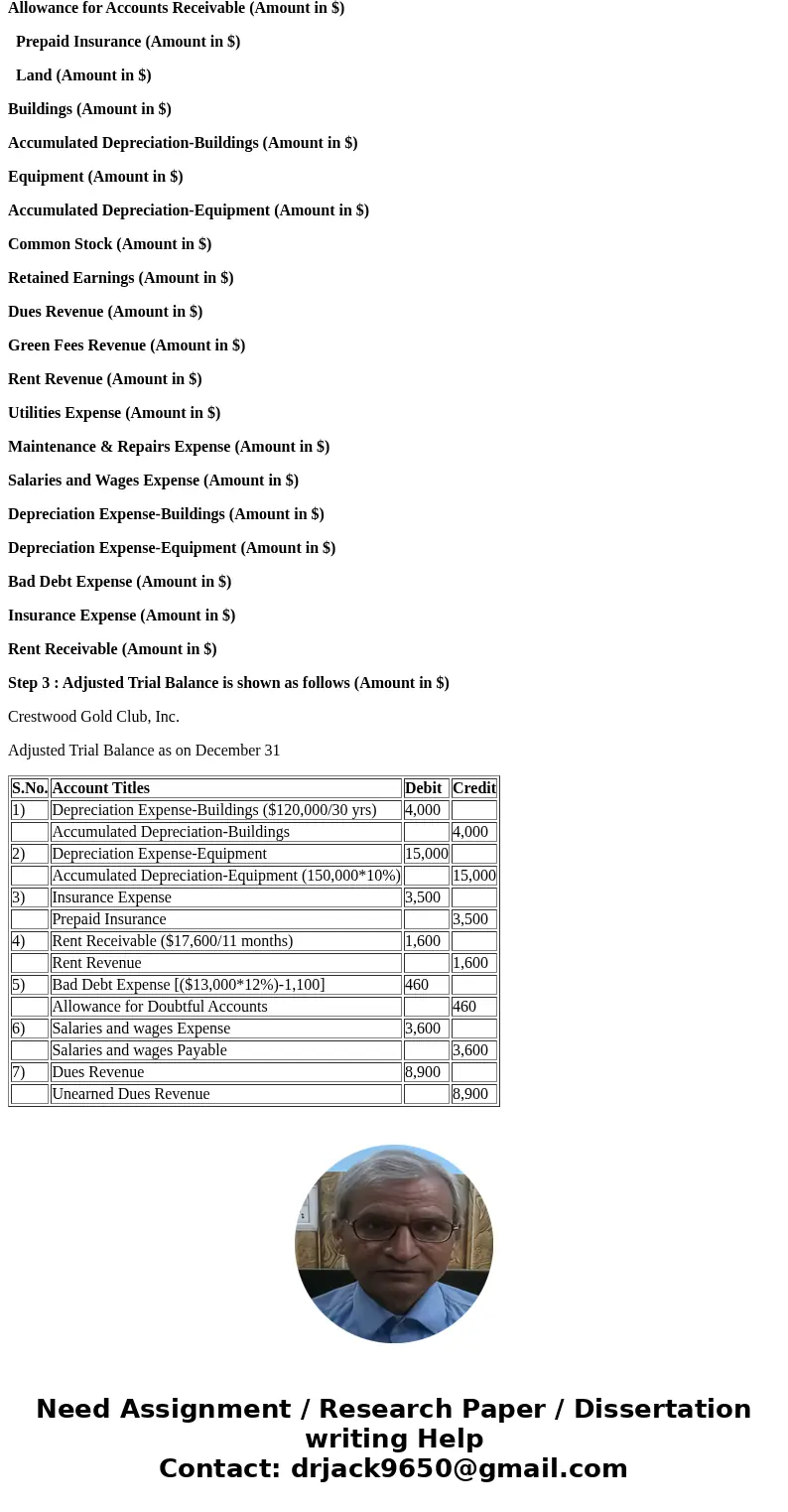

Step 3 : Adjusted Trial Balance is shown as follows (Amount in $)

Crestwood Gold Club, Inc.

Adjusted Trial Balance as on December 31

| S.No. | Account Titles | Debit | Credit |

| 1) | Depreciation Expense-Buildings ($120,000/30 yrs) | 4,000 | |

| Accumulated Depreciation-Buildings | 4,000 | ||

| 2) | Depreciation Expense-Equipment | 15,000 | |

| Accumulated Depreciation-Equipment (150,000*10%) | 15,000 | ||

| 3) | Insurance Expense | 3,500 | |

| Prepaid Insurance | 3,500 | ||

| 4) | Rent Receivable ($17,600/11 months) | 1,600 | |

| Rent Revenue | 1,600 | ||

| 5) | Bad Debt Expense [($13,000*12%)-1,100] | 460 | |

| Allowance for Doubtful Accounts | 460 | ||

| 6) | Salaries and wages Expense | 3,600 | |

| Salaries and wages Payable | 3,600 | ||

| 7) | Dues Revenue | 8,900 | |

| Unearned Dues Revenue | 8,900 |

Homework Sourse

Homework Sourse