Alex Inc buys 40 percent of Steinbart Company on January 1 2

Alex, Inc., buys 40 percent of Steinbart Company on January 1, 2017, for $772,000. The equity method of accounting is to be used. Steinbart\'s net assets on that date were $1.70 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Steinbart immediately begins supplying inventory to Alex as follows: Amount Held by Alex at Year-End Year Cost to Steinbart Transfer Price (at Transfer Price) 2017 2018 $204,480 139,860 $284,000 222,000 $71,000 69,000 Inventory held at the end of one year by Alex is sold at the beginning of the next. Steinbart reports net income of $92,000 in 2017 and $129,500 in 2018 and declares $30,000 in dividends each year. What is the equity income in Steinbart to be reported by Alex in 2018?

Solution

2018:- Gross Profit Rate

Gross profit = Transfer price - Cost to Steinbart

= $222,000 - $139,860 = $82,140

Gross Profit Rate = ($82,140 ÷ $222,000) × 100 = 37%

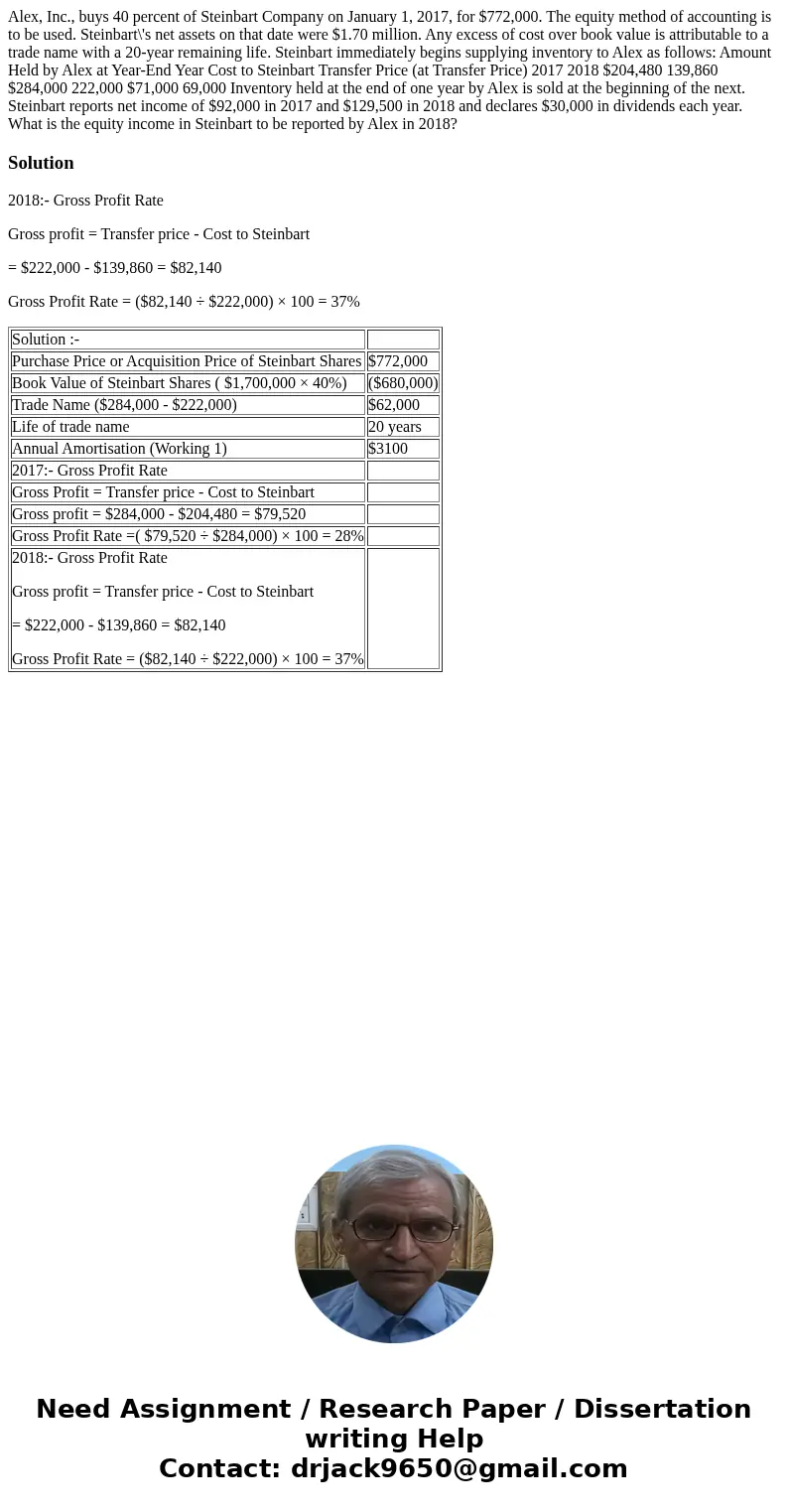

| Solution :- | |

| Purchase Price or Acquisition Price of Steinbart Shares | $772,000 |

| Book Value of Steinbart Shares ( $1,700,000 × 40%) | ($680,000) |

| Trade Name ($284,000 - $222,000) | $62,000 |

| Life of trade name | 20 years |

| Annual Amortisation (Working 1) | $3100 |

| 2017:- Gross Profit Rate | |

| Gross Profit = Transfer price - Cost to Steinbart | |

| Gross profit = $284,000 - $204,480 = $79,520 | |

| Gross Profit Rate =( $79,520 ÷ $284,000) × 100 = 28% | |

| 2018:- Gross Profit Rate Gross profit = Transfer price - Cost to Steinbart = $222,000 - $139,860 = $82,140 Gross Profit Rate = ($82,140 ÷ $222,000) × 100 = 37% |

Homework Sourse

Homework Sourse