Exercise 126 Sunland Company organized in 2016 has set up a

Exercise 12-6

Sunland Company, organized in 2016, has set up a single account for all intangible assets. The following summary discloses the debit entries that have been recorded during 2017.

$369,600

360,000

444,000

132,000

237,000

$1,542,600

Prepare the necessary entry to clear the Intangible Assets account and to set up separate accounts for distinct types of intangibles. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts.)

Account Titles and Explanation

Debit

Credit

Make the entry as of December 31, 2017, recording any necessary amortization. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts.)

Account Titles and Explanation

Debit

Credit

Reflect all balances accurately as of December 31, 2017.

| 1/2/17 | Purchased patent (7-year life) | $369,600 | ||

| 4/1/17 | Purchase goodwill (indefinite life) | 360,000 | ||

| 7/1/17 | Purchased franchise with 10-year life; expiration date 7/1/27 | 444,000 | ||

| 8/1/17 | Payment of copyright (5-year life) | 132,000 | ||

| 9/1/17 | Research and development costs | 237,000 | ||

| $1,542,600 |

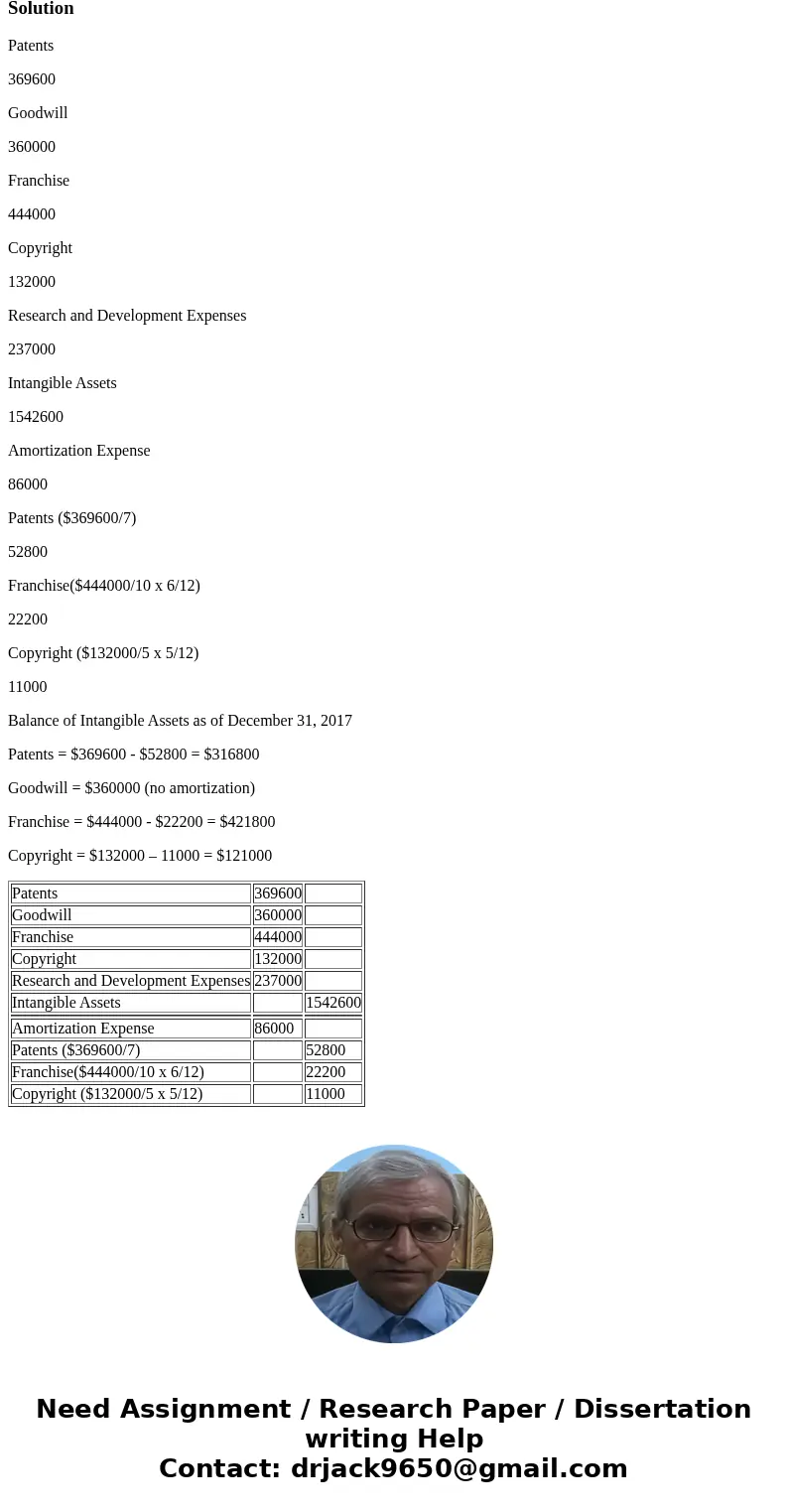

Solution

Patents

369600

Goodwill

360000

Franchise

444000

Copyright

132000

Research and Development Expenses

237000

Intangible Assets

1542600

Amortization Expense

86000

Patents ($369600/7)

52800

Franchise($444000/10 x 6/12)

22200

Copyright ($132000/5 x 5/12)

11000

Balance of Intangible Assets as of December 31, 2017

Patents = $369600 - $52800 = $316800

Goodwill = $360000 (no amortization)

Franchise = $444000 - $22200 = $421800

Copyright = $132000 – 11000 = $121000

| Patents | 369600 | |

| Goodwill | 360000 | |

| Franchise | 444000 | |

| Copyright | 132000 | |

| Research and Development Expenses | 237000 | |

| Intangible Assets | 1542600 | |

| Amortization Expense | 86000 | |

| Patents ($369600/7) | 52800 | |

| Franchise($444000/10 x 6/12) | 22200 | |

| Copyright ($132000/5 x 5/12) | 11000 |

Homework Sourse

Homework Sourse