Your company is contemplating replacing their current fleet

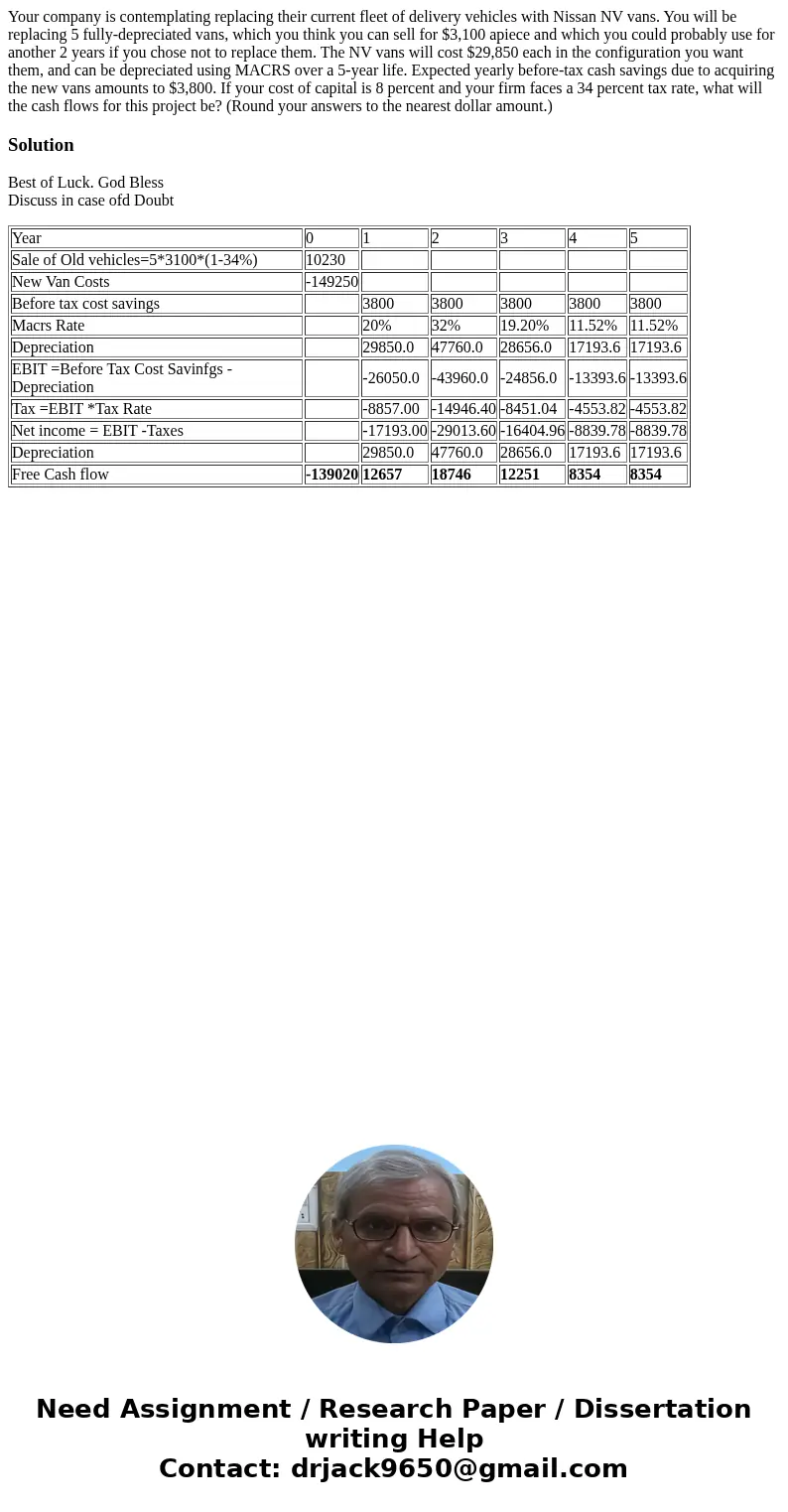

Your company is contemplating replacing their current fleet of delivery vehicles with Nissan NV vans. You will be replacing 5 fully-depreciated vans, which you think you can sell for $3,100 apiece and which you could probably use for another 2 years if you chose not to replace them. The NV vans will cost $29,850 each in the configuration you want them, and can be depreciated using MACRS over a 5-year life. Expected yearly before-tax cash savings due to acquiring the new vans amounts to $3,800. If your cost of capital is 8 percent and your firm faces a 34 percent tax rate, what will the cash flows for this project be? (Round your answers to the nearest dollar amount.)

Solution

Best of Luck. God Bless

Discuss in case ofd Doubt

| Year | 0 | 1 | 2 | 3 | 4 | 5 |

| Sale of Old vehicles=5*3100*(1-34%) | 10230 | |||||

| New Van Costs | -149250 | |||||

| Before tax cost savings | 3800 | 3800 | 3800 | 3800 | 3800 | |

| Macrs Rate | 20% | 32% | 19.20% | 11.52% | 11.52% | |

| Depreciation | 29850.0 | 47760.0 | 28656.0 | 17193.6 | 17193.6 | |

| EBIT =Before Tax Cost Savinfgs -Depreciation | -26050.0 | -43960.0 | -24856.0 | -13393.6 | -13393.6 | |

| Tax =EBIT *Tax Rate | -8857.00 | -14946.40 | -8451.04 | -4553.82 | -4553.82 | |

| Net income = EBIT -Taxes | -17193.00 | -29013.60 | -16404.96 | -8839.78 | -8839.78 | |

| Depreciation | 29850.0 | 47760.0 | 28656.0 | 17193.6 | 17193.6 | |

| Free Cash flow | -139020 | 12657 | 18746 | 12251 | 8354 | 8354 |

Homework Sourse

Homework Sourse