CALCULATOR PRINTER VERSION BACK Problem 116A On January 1 20

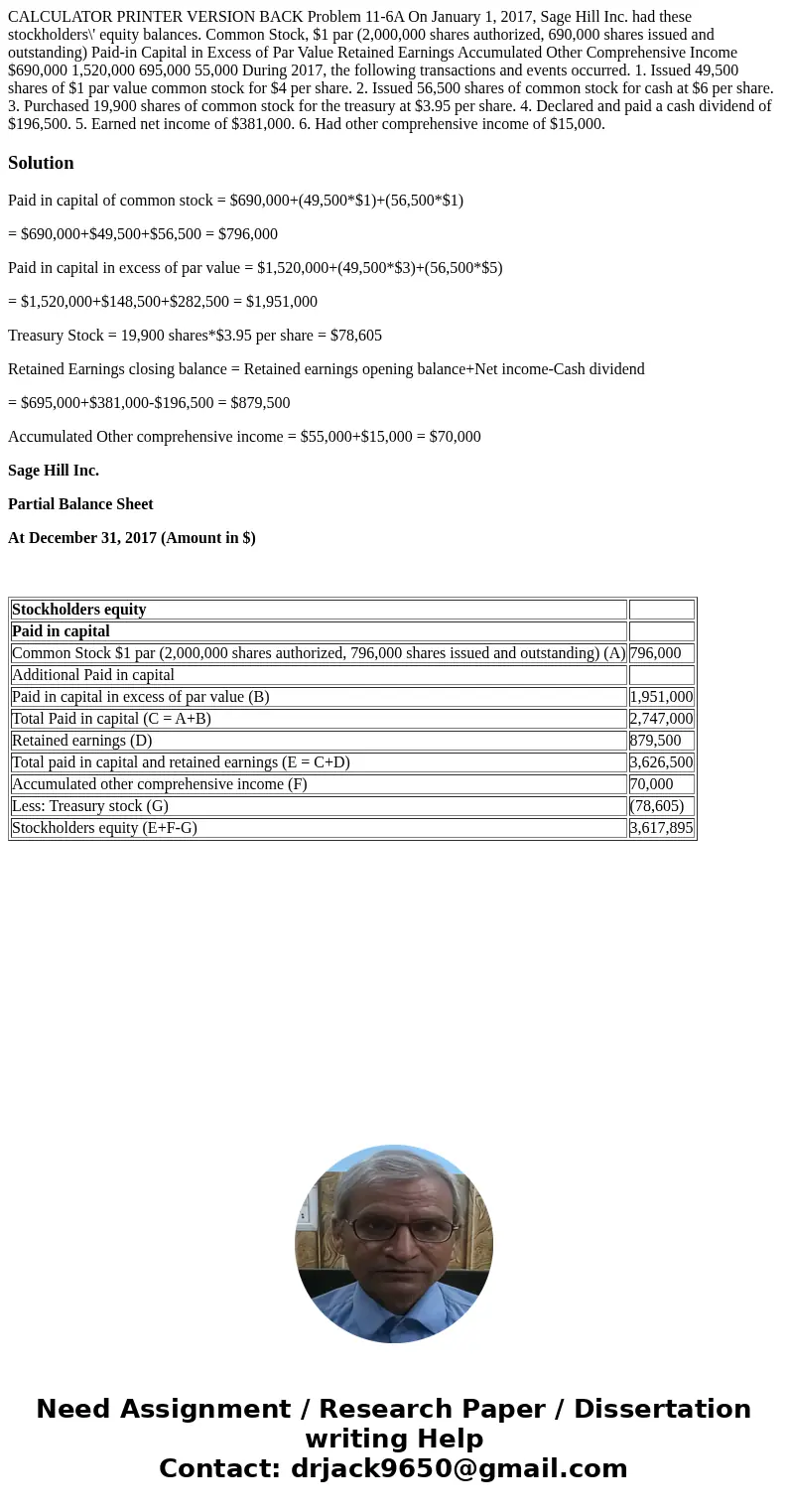

CALCULATOR PRINTER VERSION BACK Problem 11-6A On January 1, 2017, Sage Hill Inc. had these stockholders\' equity balances. Common Stock, $1 par (2,000,000 shares authorized, 690,000 shares issued and outstanding) Paid-in Capital in Excess of Par Value Retained Earnings Accumulated Other Comprehensive Income $690,000 1,520,000 695,000 55,000 During 2017, the following transactions and events occurred. 1. Issued 49,500 shares of $1 par value common stock for $4 per share. 2. Issued 56,500 shares of common stock for cash at $6 per share. 3. Purchased 19,900 shares of common stock for the treasury at $3.95 per share. 4. Declared and paid a cash dividend of $196,500. 5. Earned net income of $381,000. 6. Had other comprehensive income of $15,000.

Solution

Paid in capital of common stock = $690,000+(49,500*$1)+(56,500*$1)

= $690,000+$49,500+$56,500 = $796,000

Paid in capital in excess of par value = $1,520,000+(49,500*$3)+(56,500*$5)

= $1,520,000+$148,500+$282,500 = $1,951,000

Treasury Stock = 19,900 shares*$3.95 per share = $78,605

Retained Earnings closing balance = Retained earnings opening balance+Net income-Cash dividend

= $695,000+$381,000-$196,500 = $879,500

Accumulated Other comprehensive income = $55,000+$15,000 = $70,000

Sage Hill Inc.

Partial Balance Sheet

At December 31, 2017 (Amount in $)

| Stockholders equity | |

| Paid in capital | |

| Common Stock $1 par (2,000,000 shares authorized, 796,000 shares issued and outstanding) (A) | 796,000 |

| Additional Paid in capital | |

| Paid in capital in excess of par value (B) | 1,951,000 |

| Total Paid in capital (C = A+B) | 2,747,000 |

| Retained earnings (D) | 879,500 |

| Total paid in capital and retained earnings (E = C+D) | 3,626,500 |

| Accumulated other comprehensive income (F) | 70,000 |

| Less: Treasury stock (G) | (78,605) |

| Stockholders equity (E+F-G) | 3,617,895 |

Homework Sourse

Homework Sourse