Bracken Corporation is a small wholesaler of gourmet food pr

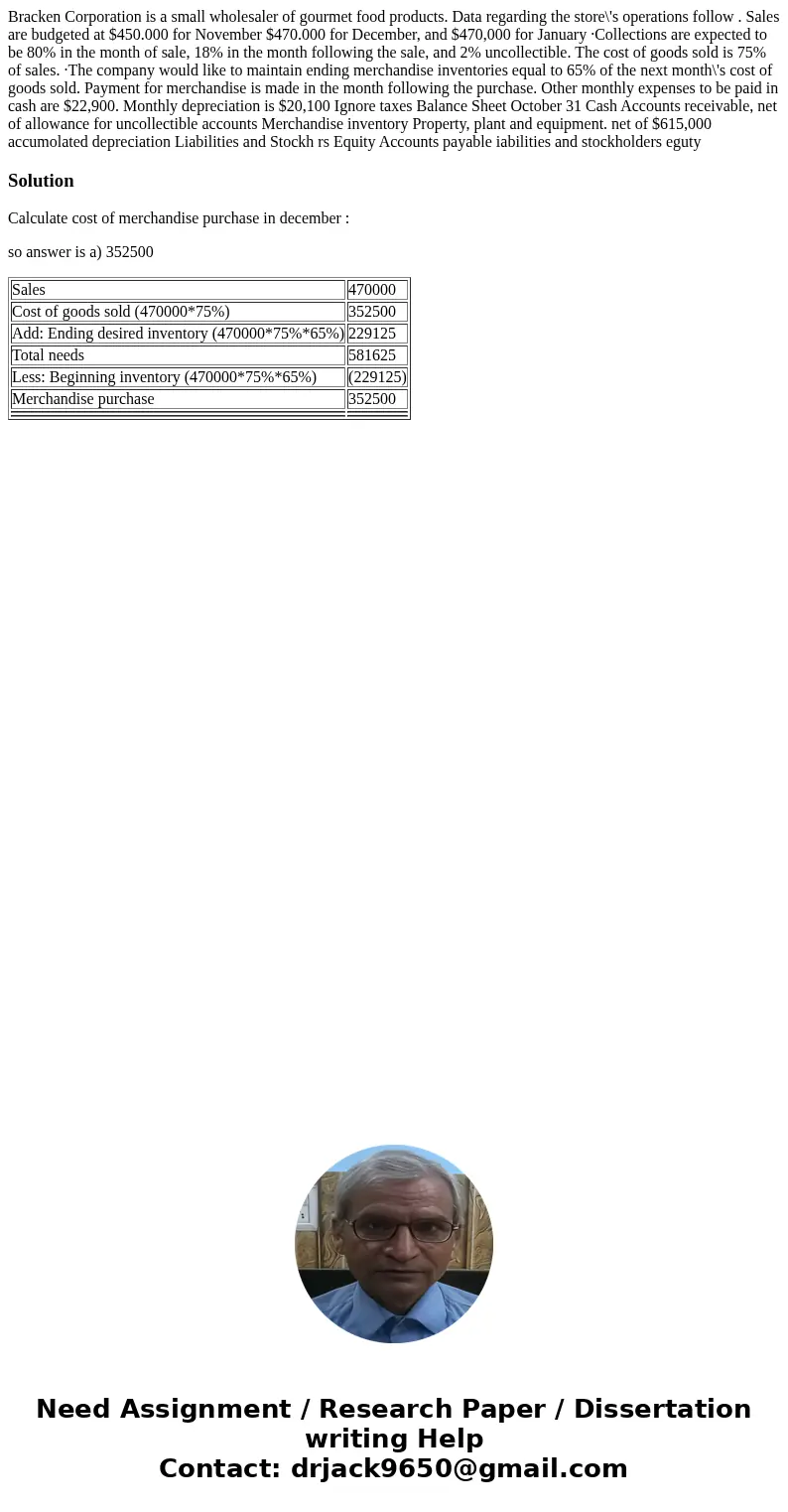

Bracken Corporation is a small wholesaler of gourmet food products. Data regarding the store\'s operations follow . Sales are budgeted at $450.000 for November $470.000 for December, and $470,000 for January ·Collections are expected to be 80% in the month of sale, 18% in the month following the sale, and 2% uncollectible. The cost of goods sold is 75% of sales. ·The company would like to maintain ending merchandise inventories equal to 65% of the next month\'s cost of goods sold. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $22,900. Monthly depreciation is $20,100 Ignore taxes Balance Sheet October 31 Cash Accounts receivable, net of allowance for uncollectible accounts Merchandise inventory Property, plant and equipment. net of $615,000 accumolated depreciation Liabilities and Stockh rs Equity Accounts payable iabilities and stockholders eguty

Solution

Calculate cost of merchandise purchase in december :

so answer is a) 352500

| Sales | 470000 |

| Cost of goods sold (470000*75%) | 352500 |

| Add: Ending desired inventory (470000*75%*65%) | 229125 |

| Total needs | 581625 |

| Less: Beginning inventory (470000*75%*65%) | (229125) |

| Merchandise purchase | 352500 |

Homework Sourse

Homework Sourse