ing 13e ACC 171272 Gradebosk ORION Downloadable eTextbosk UR

Solution

Date

Account Titles and Explanation

Debit

Credit

2017

January 1

Investment in Bonds

$50000

Cash

$50000

(For recording purchase of bonds)

December 31

Interest Receivable

$4500

Interest Revenue

$4500

(For recording interest revenue on bonds)

2018

January 1

Cash

$4500

Interest Receivable

$4500

(For recording interest revenue on bonds)

January 1

Cash

$33000

Investment in Bonds

$30000

Gain on sale of Bonds

$3000

(For recording sale of 30 bonds for $33000)

Working Note;

1. Interest on bonds is calculated as follow;

($50000 * .09) = $4500

2. Gain on sale of bonds is calculated as follow;

($33000 – $30000) = $3000

Date

Account Titles and Explanation

Debit

Credit

January 1

Common Stock

$152000

Cash

$152000

(For recording purchase of 2500 shares)

July 1

Cash

$7500

Dividend Income

$7500

(For recording receipt of dividend income on 2500 shares)

December 1

Cash

$32000

Common Stock

$30400

Gain on Sale of Common Stock

$1600

(For recording sale of 500 common stock)

December 31

Cash

$6000

Dividend Income

$6000

(For recording receipt of dividend income on 2000 shares)

Working Note;

1. Dividend income on common stock is calculated as follow;

For July 1;

(2500 shares * $3) = $7500

For December 31;

(2000 shares * $3) = $6000

2. Gain on sale of shares is calculated as follow;

($32000 – $30400) = $1600

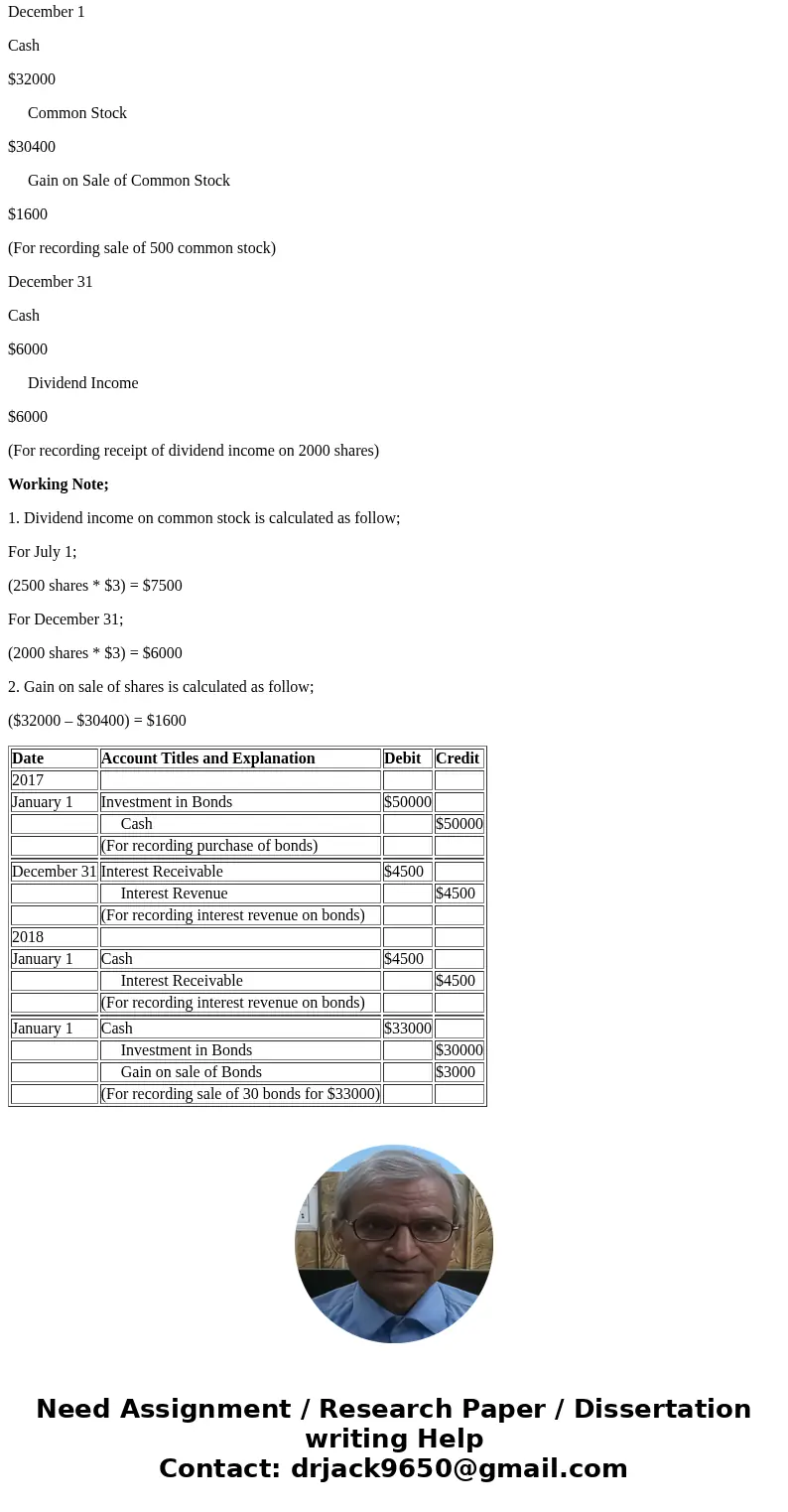

| Date | Account Titles and Explanation | Debit | Credit |

| 2017 | |||

| January 1 | Investment in Bonds | $50000 | |

| Cash | $50000 | ||

| (For recording purchase of bonds) | |||

| December 31 | Interest Receivable | $4500 | |

| Interest Revenue | $4500 | ||

| (For recording interest revenue on bonds) | |||

| 2018 | |||

| January 1 | Cash | $4500 | |

| Interest Receivable | $4500 | ||

| (For recording interest revenue on bonds) | |||

| January 1 | Cash | $33000 | |

| Investment in Bonds | $30000 | ||

| Gain on sale of Bonds | $3000 | ||

| (For recording sale of 30 bonds for $33000) |

Homework Sourse

Homework Sourse