CBE 20 The following information is from financial statement

Solution

PART-1) Solution: 75

Working: Net financial assets minus Financial obligation = 90-15 = 75

PART-2)

1) Solution: 11.40%

Working:

return on common equity = 7.4 /6.9 = 11.40%

2) Solution:

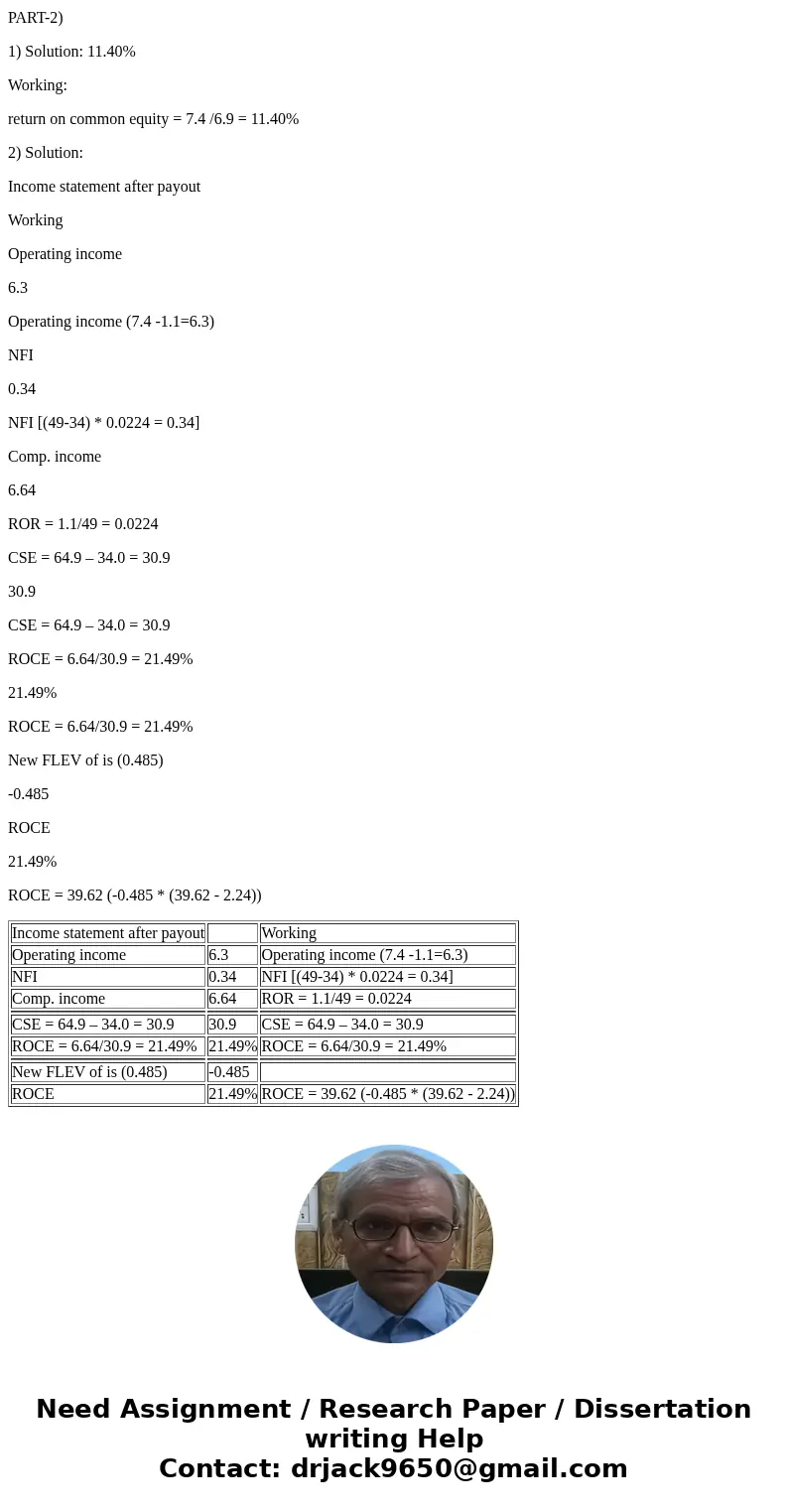

Income statement after payout

Working

Operating income

6.3

Operating income (7.4 -1.1=6.3)

NFI

0.34

NFI [(49-34) * 0.0224 = 0.34]

Comp. income

6.64

ROR = 1.1/49 = 0.0224

CSE = 64.9 – 34.0 = 30.9

30.9

CSE = 64.9 – 34.0 = 30.9

ROCE = 6.64/30.9 = 21.49%

21.49%

ROCE = 6.64/30.9 = 21.49%

New FLEV of is (0.485)

-0.485

ROCE

21.49%

ROCE = 39.62 (-0.485 * (39.62 - 2.24))

| Income statement after payout | Working | |

| Operating income | 6.3 | Operating income (7.4 -1.1=6.3) |

| NFI | 0.34 | NFI [(49-34) * 0.0224 = 0.34] |

| Comp. income | 6.64 | ROR = 1.1/49 = 0.0224 |

| CSE = 64.9 – 34.0 = 30.9 | 30.9 | CSE = 64.9 – 34.0 = 30.9 |

| ROCE = 6.64/30.9 = 21.49% | 21.49% | ROCE = 6.64/30.9 = 21.49% |

| New FLEV of is (0.485) | -0.485 | |

| ROCE | 21.49% | ROCE = 39.62 (-0.485 * (39.62 - 2.24)) |

Homework Sourse

Homework Sourse