1st problem 2nd problem 3rd problemSolution1 Accumulated dep

1st problem)

2nd problem)

3rd problem)

Solution

1-

Accumulated depreciation

3000*5

15000

Book value of asset

30000-15000

15000

selling price

35000

profit or loss from sale

35000-15000

20000

taxes -25%

20000*25%

5000

b

selling price

25000

profit or loss from sale

25000-15000

10000

taxes -25%

10000*25%

2500

c

selling price

15000

profit or loss from sale

15000-15000

0

taxes -25%

0*25%

0

D

selling price

12000

profit or loss from sale

12000-15000

-3000

taxes -25%

0*25%

-750

2-

revenue

2000000

cash expense

800000

depreciation

200000

EBIT

1000000

taxes -34%

340000

EAT

660000

Add depreciation

200000

operating cash flow

860000

3-

sales

50439375

variable cost

25137000

revenue before fixed cost

25302375

fixed cost

10143000

EBIT

15159375

interest

1488375

EBT

13671000

taxes

6835500

EAT

6835500

BEP in sales

fixed cost/contribution margin ratio

10143000/.501639

20219719.76

Contribution margin ratio = revenue before fixed cost/sales

0.501639

current level

New level with 30% increase

sales

100%

50439375

65571187.5

variable cost

0.498361

25137000

32678100

revenue before fixed cost

25302375

32893087.5

fixed cost

10143000

10143000

EBIT

15159375

22750087.5

interest

1488375

1488375

EBT

13671000

21261712.5

taxes

0.5

6835500

10630856.25

EAT

6835500

10630856.25

percentage of increase in sales

30%

Operating leverage = contribution/EBIT

0.50

Financial leverage = EBIT/EBT

1.07

Combined leverage = contribution/EBT

1.55

% of earning increase

(22750087.5-15159375)/15159375

50.07%

% change in net income

(10630856.25-6835500)/6835500

55.52%

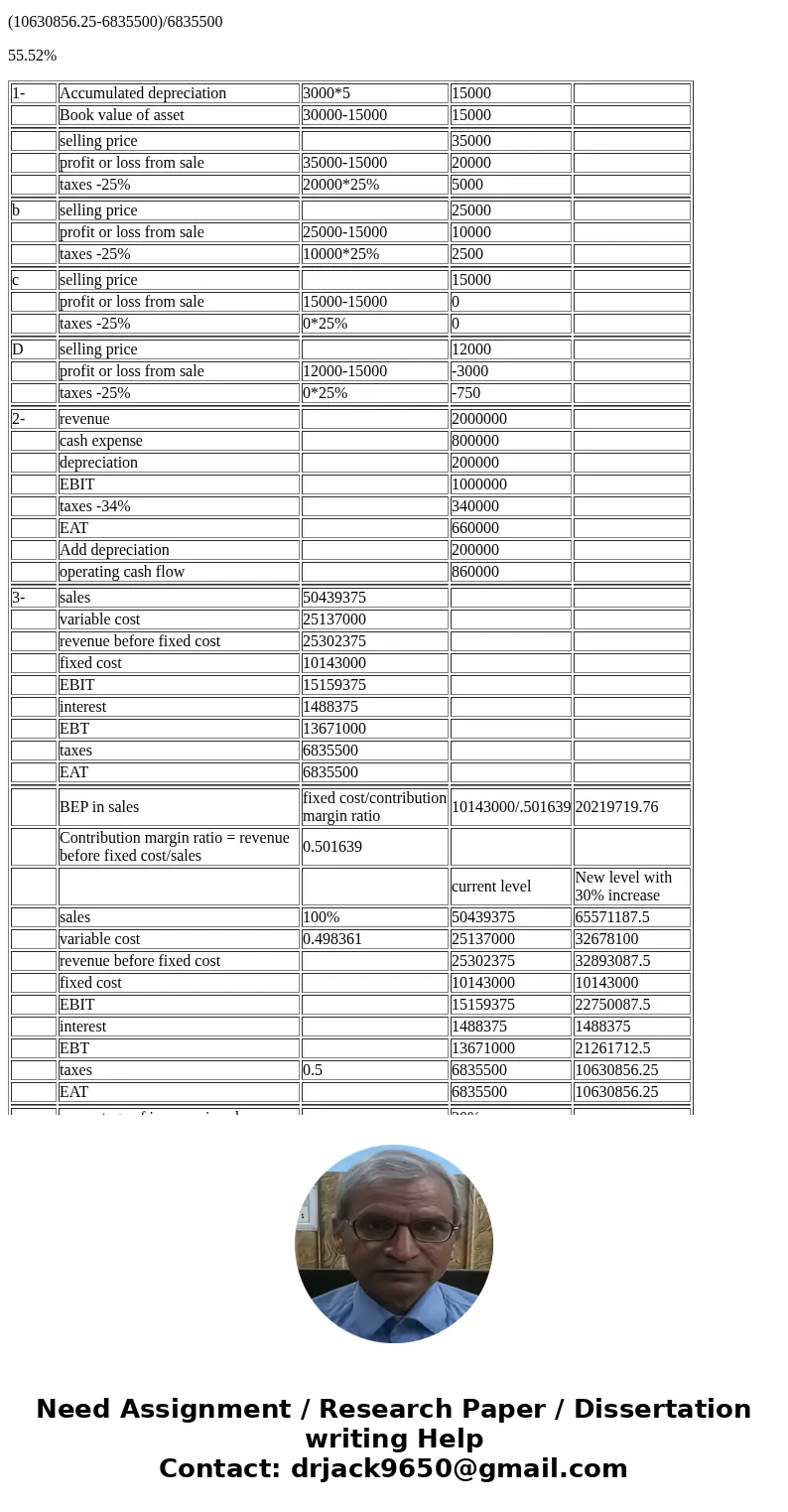

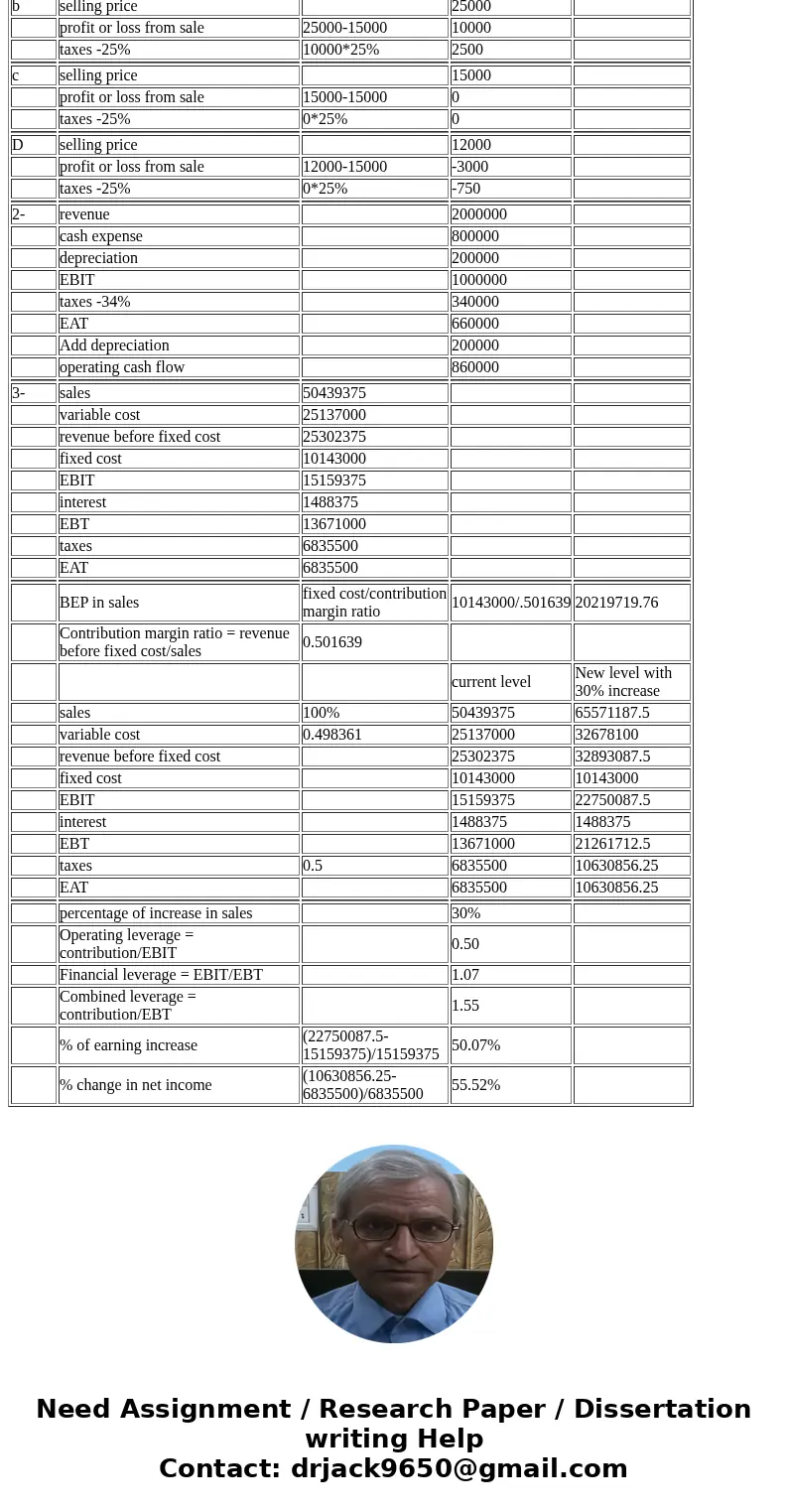

| 1- | Accumulated depreciation | 3000*5 | 15000 | |

| Book value of asset | 30000-15000 | 15000 | ||

| selling price | 35000 | |||

| profit or loss from sale | 35000-15000 | 20000 | ||

| taxes -25% | 20000*25% | 5000 | ||

| b | selling price | 25000 | ||

| profit or loss from sale | 25000-15000 | 10000 | ||

| taxes -25% | 10000*25% | 2500 | ||

| c | selling price | 15000 | ||

| profit or loss from sale | 15000-15000 | 0 | ||

| taxes -25% | 0*25% | 0 | ||

| D | selling price | 12000 | ||

| profit or loss from sale | 12000-15000 | -3000 | ||

| taxes -25% | 0*25% | -750 | ||

| 2- | revenue | 2000000 | ||

| cash expense | 800000 | |||

| depreciation | 200000 | |||

| EBIT | 1000000 | |||

| taxes -34% | 340000 | |||

| EAT | 660000 | |||

| Add depreciation | 200000 | |||

| operating cash flow | 860000 | |||

| 3- | sales | 50439375 | ||

| variable cost | 25137000 | |||

| revenue before fixed cost | 25302375 | |||

| fixed cost | 10143000 | |||

| EBIT | 15159375 | |||

| interest | 1488375 | |||

| EBT | 13671000 | |||

| taxes | 6835500 | |||

| EAT | 6835500 | |||

| BEP in sales | fixed cost/contribution margin ratio | 10143000/.501639 | 20219719.76 | |

| Contribution margin ratio = revenue before fixed cost/sales | 0.501639 | |||

| current level | New level with 30% increase | |||

| sales | 100% | 50439375 | 65571187.5 | |

| variable cost | 0.498361 | 25137000 | 32678100 | |

| revenue before fixed cost | 25302375 | 32893087.5 | ||

| fixed cost | 10143000 | 10143000 | ||

| EBIT | 15159375 | 22750087.5 | ||

| interest | 1488375 | 1488375 | ||

| EBT | 13671000 | 21261712.5 | ||

| taxes | 0.5 | 6835500 | 10630856.25 | |

| EAT | 6835500 | 10630856.25 | ||

| percentage of increase in sales | 30% | |||

| Operating leverage = contribution/EBIT | 0.50 | |||

| Financial leverage = EBIT/EBT | 1.07 | |||

| Combined leverage = contribution/EBT | 1.55 | |||

| % of earning increase | (22750087.5-15159375)/15159375 | 50.07% | ||

| % change in net income | (10630856.25-6835500)/6835500 | 55.52% |

Homework Sourse

Homework Sourse