a Weston Corporation just paid a dividend of 3 a share ie D0

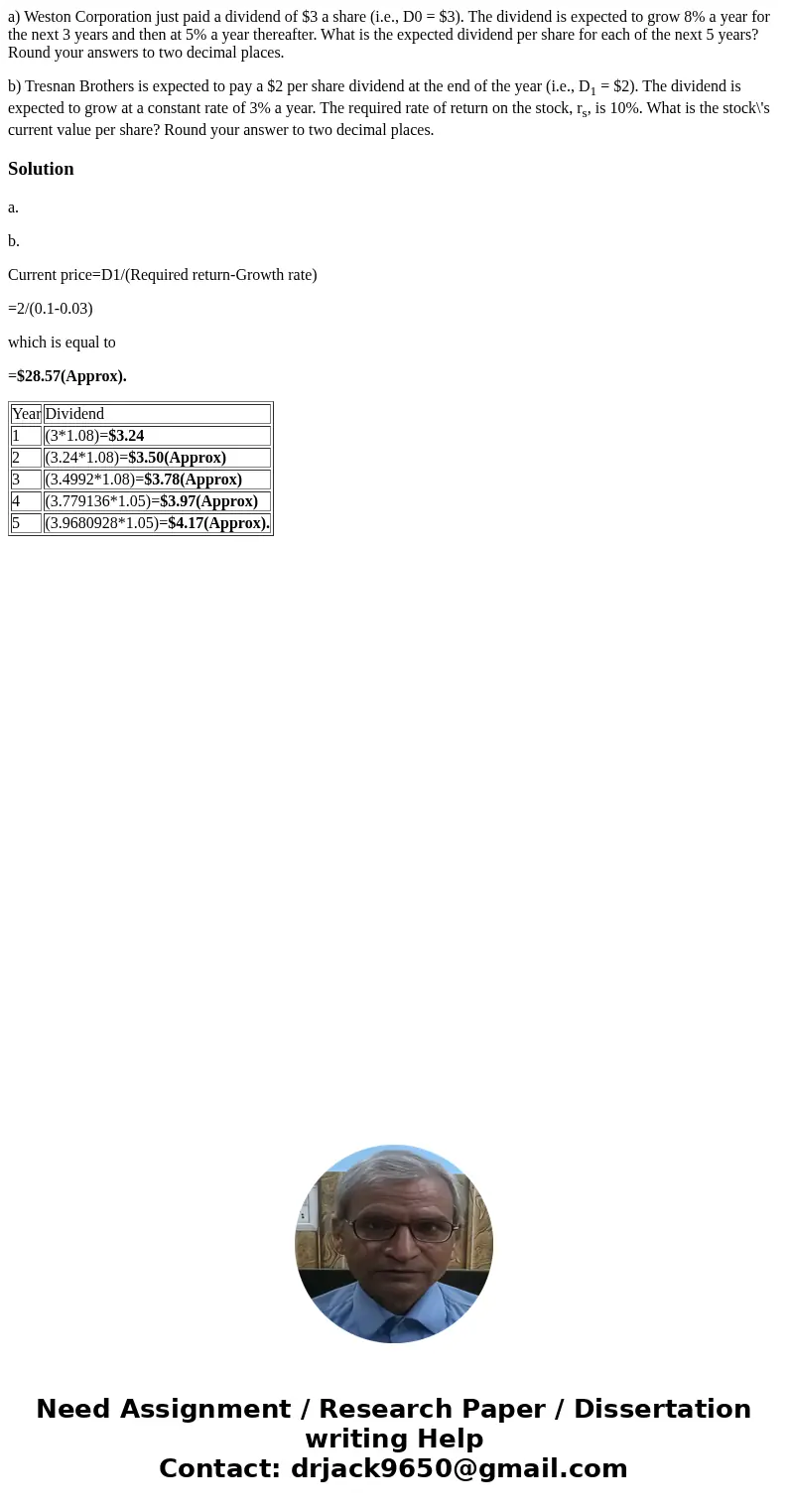

a) Weston Corporation just paid a dividend of $3 a share (i.e., D0 = $3). The dividend is expected to grow 8% a year for the next 3 years and then at 5% a year thereafter. What is the expected dividend per share for each of the next 5 years? Round your answers to two decimal places.

b) Tresnan Brothers is expected to pay a $2 per share dividend at the end of the year (i.e., D1 = $2). The dividend is expected to grow at a constant rate of 3% a year. The required rate of return on the stock, rs, is 10%. What is the stock\'s current value per share? Round your answer to two decimal places.

Solution

a.

b.

Current price=D1/(Required return-Growth rate)

=2/(0.1-0.03)

which is equal to

=$28.57(Approx).

| Year | Dividend |

| 1 | (3*1.08)=$3.24 |

| 2 | (3.24*1.08)=$3.50(Approx) |

| 3 | (3.4992*1.08)=$3.78(Approx) |

| 4 | (3.779136*1.05)=$3.97(Approx) |

| 5 | (3.9680928*1.05)=$4.17(Approx). |

Homework Sourse

Homework Sourse