Washington Air Company is considering the purchase of a heli

Washington Air Company is considering the purchase of a helicopter for connecting services between the company\'s base airport and the new intercounty airport being built about 30 miles away. It is believed that the chopper will be needed only for eight years until the Rapid Transit Connection is phased in. The estimates on two types of helicopters under consideration, the Whirl 2B and the ROT 8, are given in the table below. Assuming that the Whirl 2B will be available in the future with identical costs, what is the annual cost advantage of selecting the ROT 87( Use an interest rate of 9%.) ? Click the icon to view the estimates on two types of helicopters under consideration. More Info Click the icon to view the interest factors for discrete compounding when ,-9% per year The annual cost advantage of selecting the ROT 8 is(Round to the nearest dollar) First cost Annual maintenance Salvage value Useful life in years The Whirl 2B $95,000 $6,000 $12,000 The ROT8 $104,000 $9,500 $20,000 Print Done

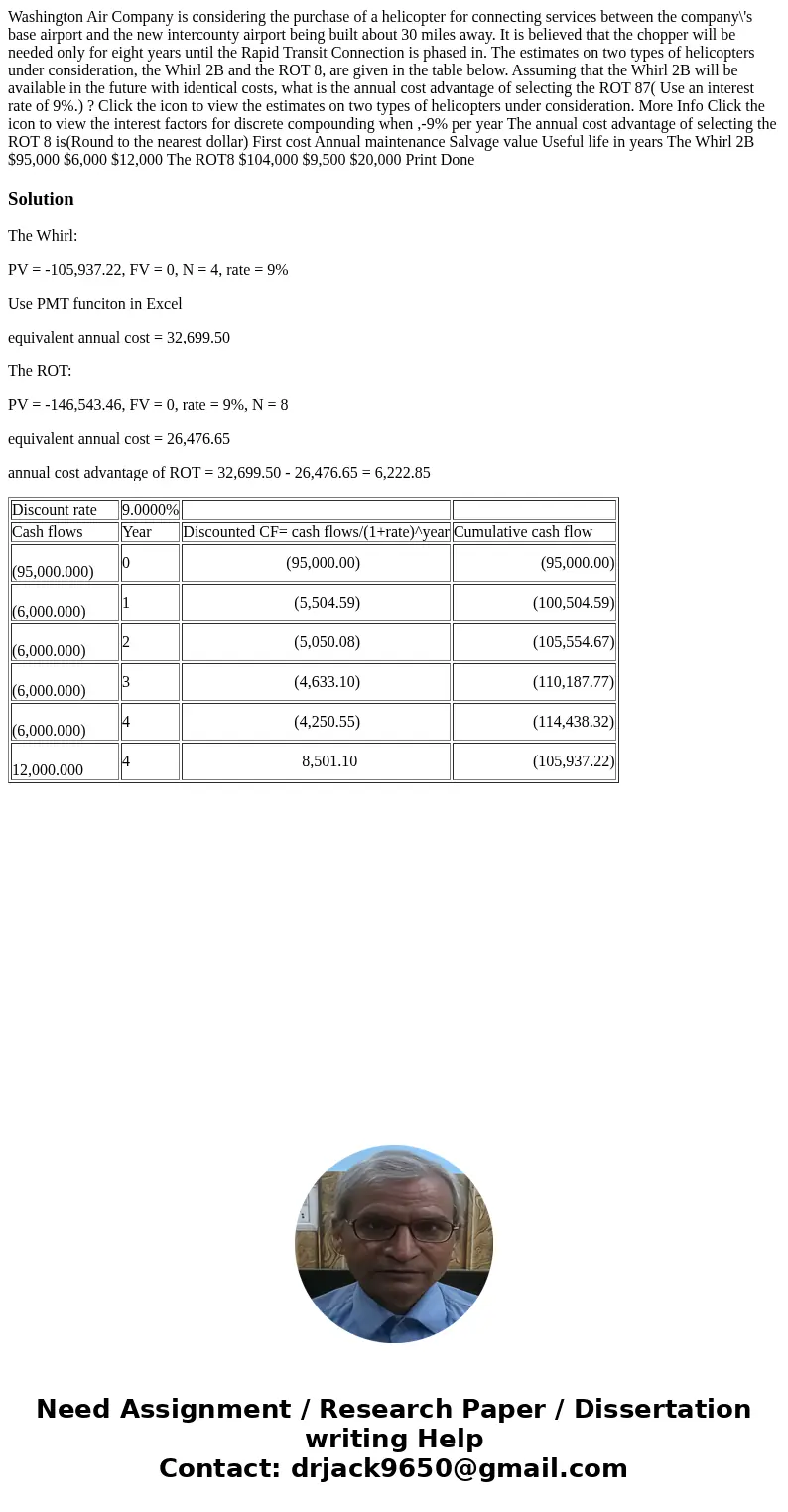

Solution

The Whirl:

PV = -105,937.22, FV = 0, N = 4, rate = 9%

Use PMT funciton in Excel

equivalent annual cost = 32,699.50

The ROT:

PV = -146,543.46, FV = 0, rate = 9%, N = 8

equivalent annual cost = 26,476.65

annual cost advantage of ROT = 32,699.50 - 26,476.65 = 6,222.85

| Discount rate | 9.0000% | ||

| Cash flows | Year | Discounted CF= cash flows/(1+rate)^year | Cumulative cash flow |

| (95,000.000) | 0 | (95,000.00) | (95,000.00) |

| (6,000.000) | 1 | (5,504.59) | (100,504.59) |

| (6,000.000) | 2 | (5,050.08) | (105,554.67) |

| (6,000.000) | 3 | (4,633.10) | (110,187.77) |

| (6,000.000) | 4 | (4,250.55) | (114,438.32) |

| 12,000.000 | 4 | 8,501.10 | (105,937.22) |

Homework Sourse

Homework Sourse