The following is a December 31 2018 postclosing trial balanc

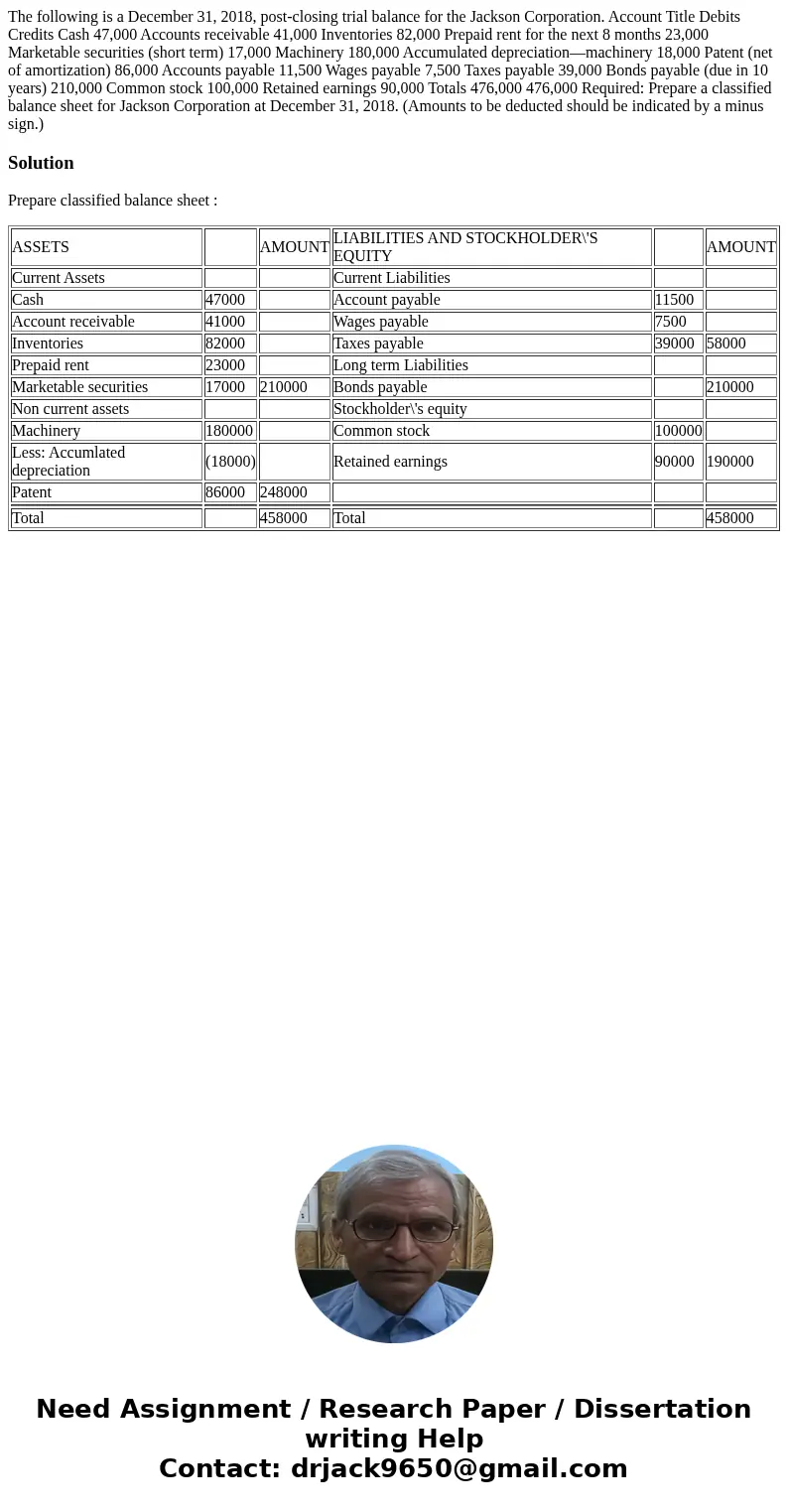

The following is a December 31, 2018, post-closing trial balance for the Jackson Corporation. Account Title Debits Credits Cash 47,000 Accounts receivable 41,000 Inventories 82,000 Prepaid rent for the next 8 months 23,000 Marketable securities (short term) 17,000 Machinery 180,000 Accumulated depreciation—machinery 18,000 Patent (net of amortization) 86,000 Accounts payable 11,500 Wages payable 7,500 Taxes payable 39,000 Bonds payable (due in 10 years) 210,000 Common stock 100,000 Retained earnings 90,000 Totals 476,000 476,000 Required: Prepare a classified balance sheet for Jackson Corporation at December 31, 2018. (Amounts to be deducted should be indicated by a minus sign.)

Solution

Prepare classified balance sheet :

| ASSETS | AMOUNT | LIABILITIES AND STOCKHOLDER\'S EQUITY | AMOUNT | ||

| Current Assets | Current Liabilities | ||||

| Cash | 47000 | Account payable | 11500 | ||

| Account receivable | 41000 | Wages payable | 7500 | ||

| Inventories | 82000 | Taxes payable | 39000 | 58000 | |

| Prepaid rent | 23000 | Long term Liabilities | |||

| Marketable securities | 17000 | 210000 | Bonds payable | 210000 | |

| Non current assets | Stockholder\'s equity | ||||

| Machinery | 180000 | Common stock | 100000 | ||

| Less: Accumlated depreciation | (18000) | Retained earnings | 90000 | 190000 | |

| Patent | 86000 | 248000 | |||

| Total | 458000 | Total | 458000 |

Homework Sourse

Homework Sourse