Exercise 1212 On July 1 2017 Grouper Corporation purchased Y

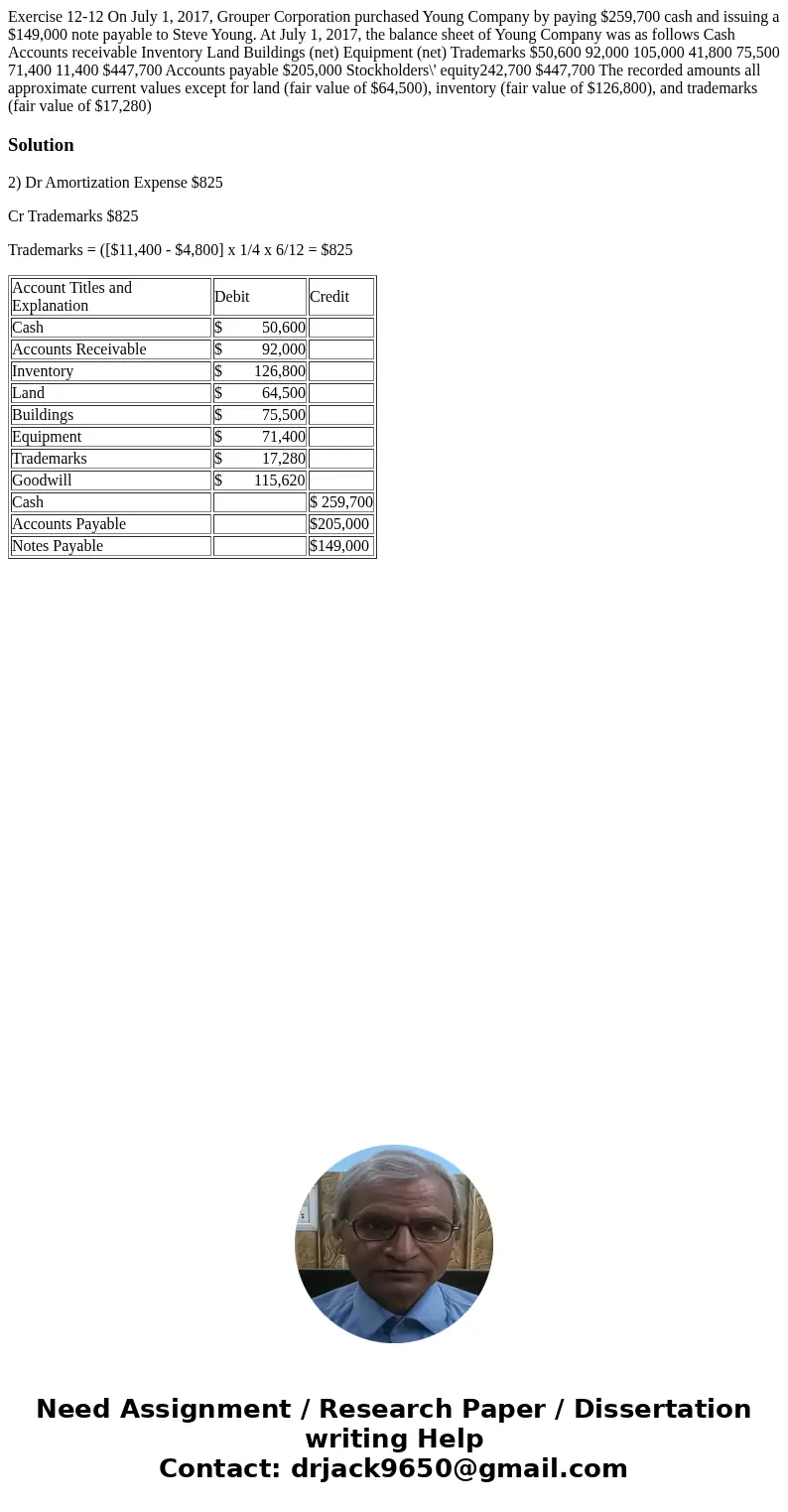

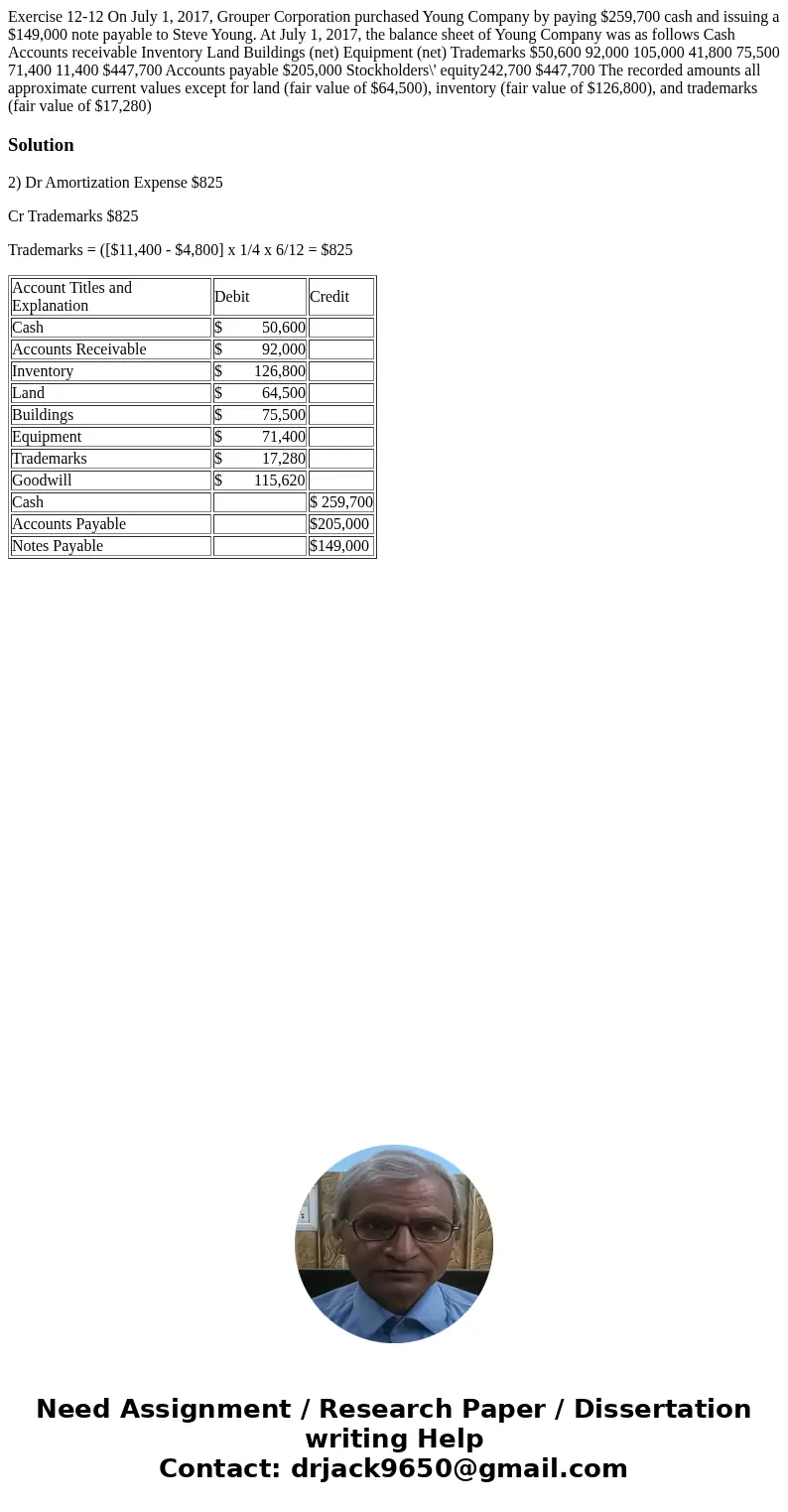

Exercise 12-12 On July 1, 2017, Grouper Corporation purchased Young Company by paying $259,700 cash and issuing a $149,000 note payable to Steve Young. At July 1, 2017, the balance sheet of Young Company was as follows Cash Accounts receivable Inventory Land Buildings (net) Equipment (net) Trademarks $50,600 92,000 105,000 41,800 75,500 71,400 11,400 $447,700 Accounts payable $205,000 Stockholders\' equity242,700 $447,700 The recorded amounts all approximate current values except for land (fair value of $64,500), inventory (fair value of $126,800), and trademarks (fair value of $17,280)

Solution

2) Dr Amortization Expense $825

Cr Trademarks $825

Trademarks = ([$11,400 - $4,800] x 1/4 x 6/12 = $825

| Account Titles and Explanation | Debit | Credit |

| Cash | $ 50,600 | |

| Accounts Receivable | $ 92,000 | |

| Inventory | $ 126,800 | |

| Land | $ 64,500 | |

| Buildings | $ 75,500 | |

| Equipment | $ 71,400 | |

| Trademarks | $ 17,280 | |

| Goodwill | $ 115,620 | |

| Cash | $ 259,700 | |

| Accounts Payable | $205,000 | |

| Notes Payable | $149,000 |

Homework Sourse

Homework Sourse