Problem 33-11

Yellow Company acquired a delivery truck, making payment of $2,680,000, the payment being analyzed as follows:

Price of truck 2,500,000

Charge of extra equipment 50,000

Value added tax 300,000

Insurance for one year 120,000

Motor vehicle registration 10,000

—————

Total 2,980,000

Less: trade in value allowed on

old truck 300,000

——————

Cash paid 2,680,000

The old truck cost $1,500,000 and has a carrying amount of $200,000, and fair value of $50,000. The value added tax is refundable or recoverable.

Required:

Prepare journal entry to record the exchange transaction.

Problem 33-11

Yellow Company acquired a delivery truck, making payment of $2,680,000, the payment being analyzed as follows:

Price of truck 2,500,000

Charge of extra equipment 50,000

Value added tax 300,000

Insurance for one year 120,000

Motor vehicle registration 10,000

—————

Total 2,980,000

Less: trade in value allowed on

old truck 300,000

——————

Cash paid 2,680,000

The old truck cost $1,500,000 and has a carrying amount of $200,000, and fair value of $50,000. The value added tax is refundable or recoverable.

Required:

Prepare journal entry to record the exchange transaction.

Yellow Company acquired a delivery truck, making payment of $2,680,000, the payment being analyzed as follows:

Price of truck 2,500,000

Charge of extra equipment 50,000

Value added tax 300,000

Insurance for one year 120,000

Motor vehicle registration 10,000

—————

Total 2,980,000

Less: trade in value allowed on

old truck 300,000

——————

Cash paid 2,680,000

The old truck cost $1,500,000 and has a carrying amount of $200,000, and fair value of $50,000. The value added tax is refundable or recoverable.

Required:

Prepare journal entry to record the exchange transaction.

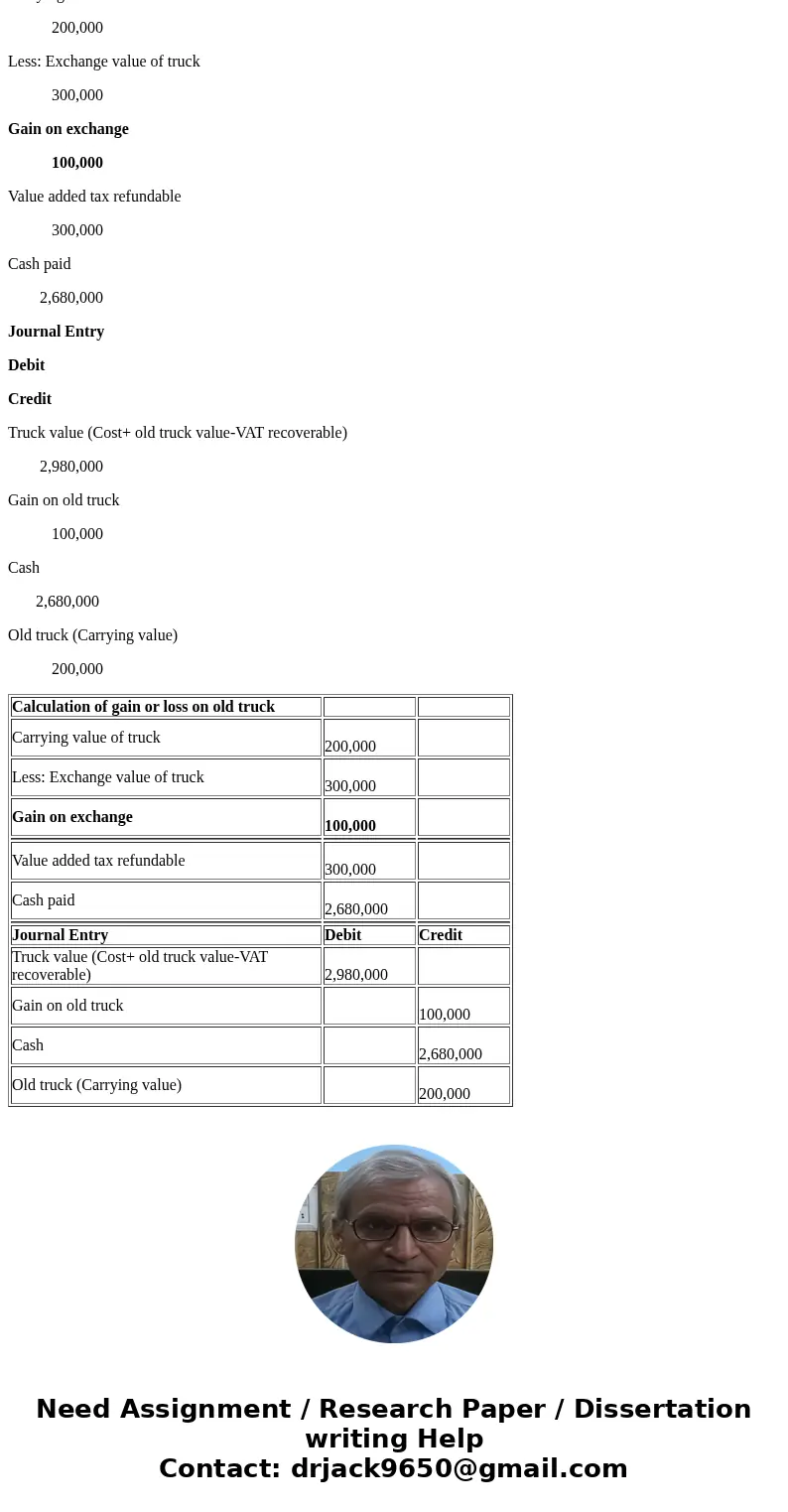

Calculation of Gain or Loa

Calculation of gain or loss on old truck

Carrying value of truck

200,000

Less: Exchange value of truck

300,000

Gain on exchange

100,000

Value added tax refundable

300,000

Cash paid

2,680,000

Journal Entry

Debit

Credit

Truck value (Cost+ old truck value-VAT recoverable)

2,980,000

Gain on old truck

100,000

Cash

2,680,000

Old truck (Carrying value)

200,000

| Calculation of gain or loss on old truck | | |

| Carrying value of truck | 200,000 | |

| Less: Exchange value of truck | 300,000 | |

| Gain on exchange | 100,000 | |

| | |

| Value added tax refundable | 300,000 | |

| Cash paid | 2,680,000 | |

| | |

| Journal Entry | Debit | Credit |

| Truck value (Cost+ old truck value-VAT recoverable) | 2,980,000 | |

| Gain on old truck | | 100,000 |

| Cash | | 2,680,000 |

| Old truck (Carrying value) | | 200,000 |

Homework Sourse

Homework Sourse