Oil Well Supply offers 76 percent coupon bonds with semiannu

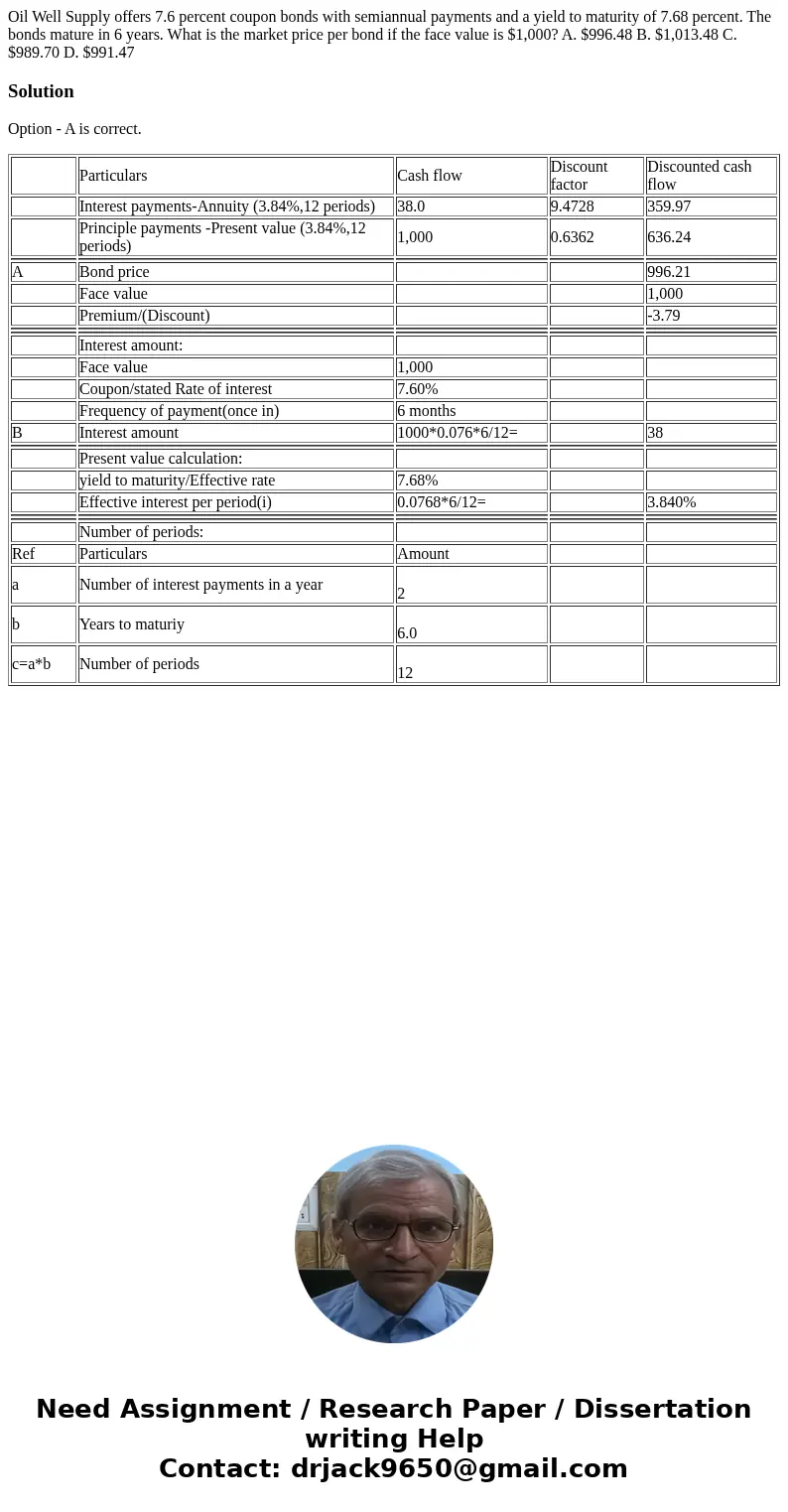

Oil Well Supply offers 7.6 percent coupon bonds with semiannual payments and a yield to maturity of 7.68 percent. The bonds mature in 6 years. What is the market price per bond if the face value is $1,000? A. $996.48 B. $1,013.48 C. $989.70 D. $991.47

Solution

Option - A is correct.

| Particulars | Cash flow | Discount factor | Discounted cash flow | |

| Interest payments-Annuity (3.84%,12 periods) | 38.0 | 9.4728 | 359.97 | |

| Principle payments -Present value (3.84%,12 periods) | 1,000 | 0.6362 | 636.24 | |

| A | Bond price | 996.21 | ||

| Face value | 1,000 | |||

| Premium/(Discount) | -3.79 | |||

| Interest amount: | ||||

| Face value | 1,000 | |||

| Coupon/stated Rate of interest | 7.60% | |||

| Frequency of payment(once in) | 6 months | |||

| B | Interest amount | 1000*0.076*6/12= | 38 | |

| Present value calculation: | ||||

| yield to maturity/Effective rate | 7.68% | |||

| Effective interest per period(i) | 0.0768*6/12= | 3.840% | ||

| Number of periods: | ||||

| Ref | Particulars | Amount | ||

| a | Number of interest payments in a year | 2 | ||

| b | Years to maturiy | 6.0 | ||

| c=a*b | Number of periods | 12 |

Homework Sourse

Homework Sourse