Exercise 315 Presented below is financial information for tw

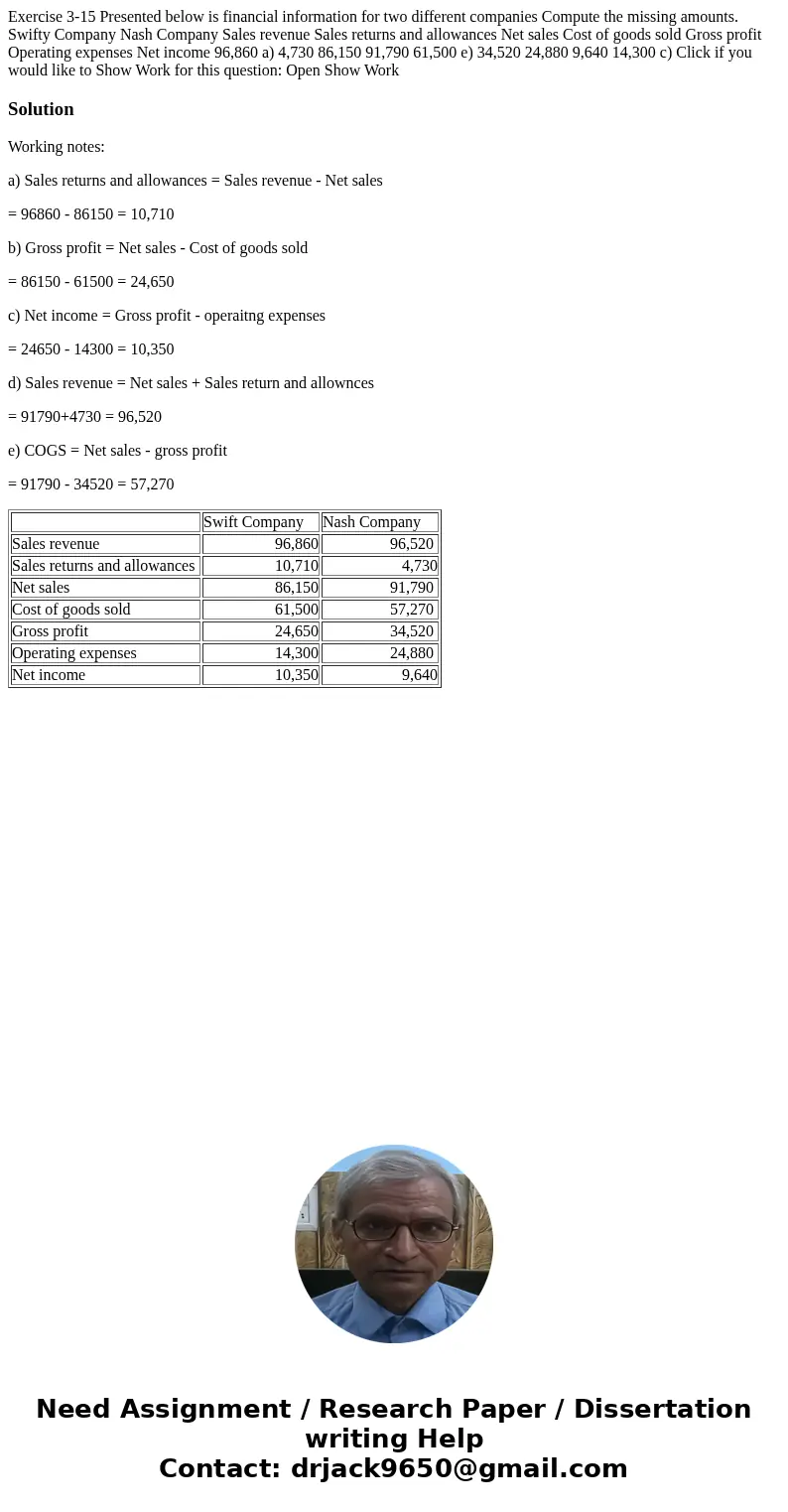

Exercise 3-15 Presented below is financial information for two different companies Compute the missing amounts. Swifty Company Nash Company Sales revenue Sales returns and allowances Net sales Cost of goods sold Gross profit Operating expenses Net income 96,860 a) 4,730 86,150 91,790 61,500 e) 34,520 24,880 9,640 14,300 c) Click if you would like to Show Work for this question: Open Show Work

Solution

Working notes:

a) Sales returns and allowances = Sales revenue - Net sales

= 96860 - 86150 = 10,710

b) Gross profit = Net sales - Cost of goods sold

= 86150 - 61500 = 24,650

c) Net income = Gross profit - operaitng expenses

= 24650 - 14300 = 10,350

d) Sales revenue = Net sales + Sales return and allownces

= 91790+4730 = 96,520

e) COGS = Net sales - gross profit

= 91790 - 34520 = 57,270

| Swift Company | Nash Company | |

| Sales revenue | 96,860 | 96,520 |

| Sales returns and allowances | 10,710 | 4,730 |

| Net sales | 86,150 | 91,790 |

| Cost of goods sold | 61,500 | 57,270 |

| Gross profit | 24,650 | 34,520 |

| Operating expenses | 14,300 | 24,880 |

| Net income | 10,350 | 9,640 |

Homework Sourse

Homework Sourse