D Question 20 5 pts Morgan Companys last dividend Do was 200

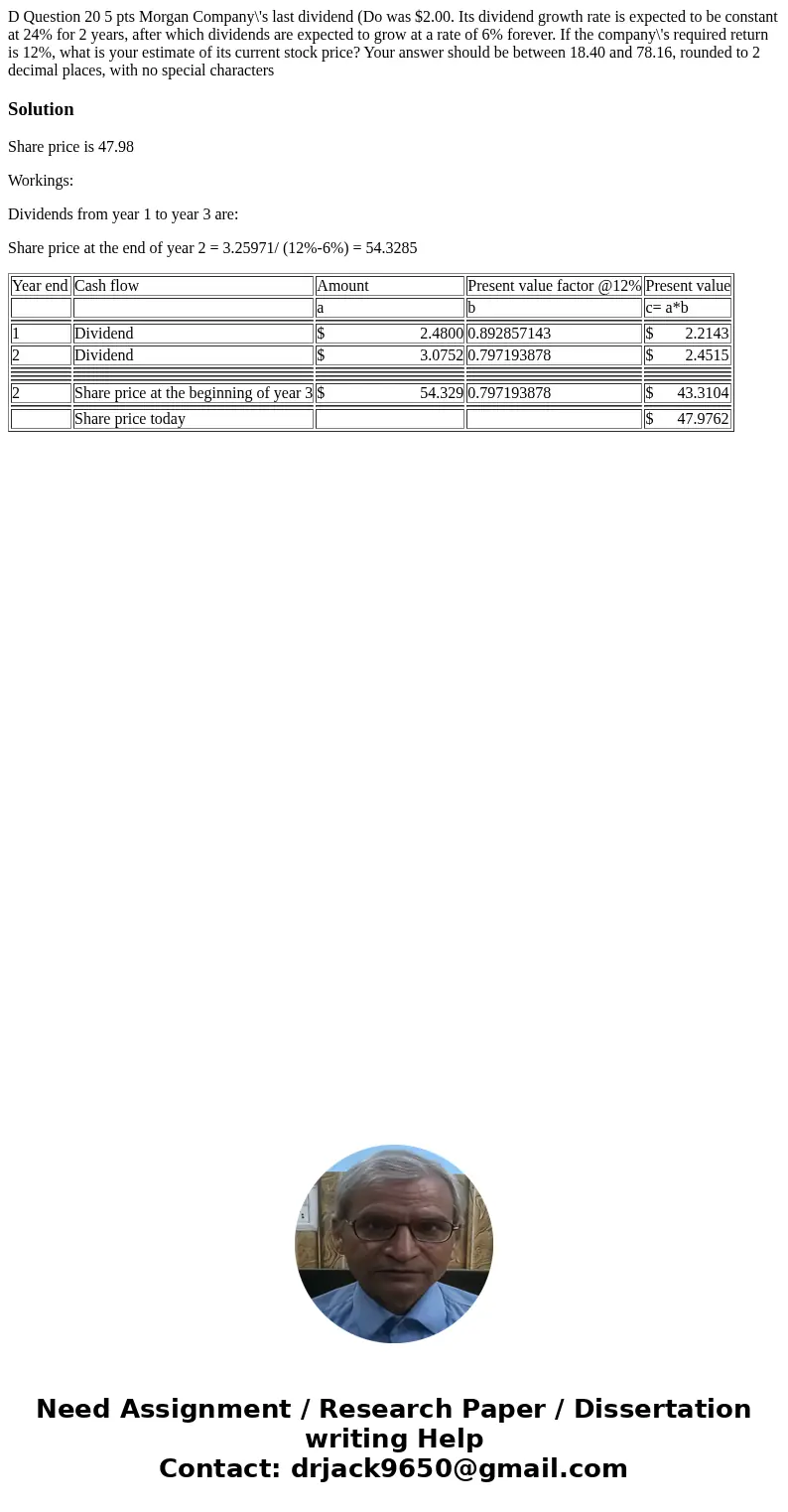

D Question 20 5 pts Morgan Company\'s last dividend (Do was $2.00. Its dividend growth rate is expected to be constant at 24% for 2 years, after which dividends are expected to grow at a rate of 6% forever. If the company\'s required return is 12%, what is your estimate of its current stock price? Your answer should be between 18.40 and 78.16, rounded to 2 decimal places, with no special characters

Solution

Share price is 47.98

Workings:

Dividends from year 1 to year 3 are:

Share price at the end of year 2 = 3.25971/ (12%-6%) = 54.3285

| Year end | Cash flow | Amount | Present value factor @12% | Present value |

| a | b | c= a*b | ||

| 1 | Dividend | $ 2.4800 | 0.892857143 | $ 2.2143 |

| 2 | Dividend | $ 3.0752 | 0.797193878 | $ 2.4515 |

| 2 | Share price at the beginning of year 3 | $ 54.329 | 0.797193878 | $ 43.3104 |

| Share price today | $ 47.9762 |

Homework Sourse

Homework Sourse