20 Given the following earnings and dividends an 85 discount

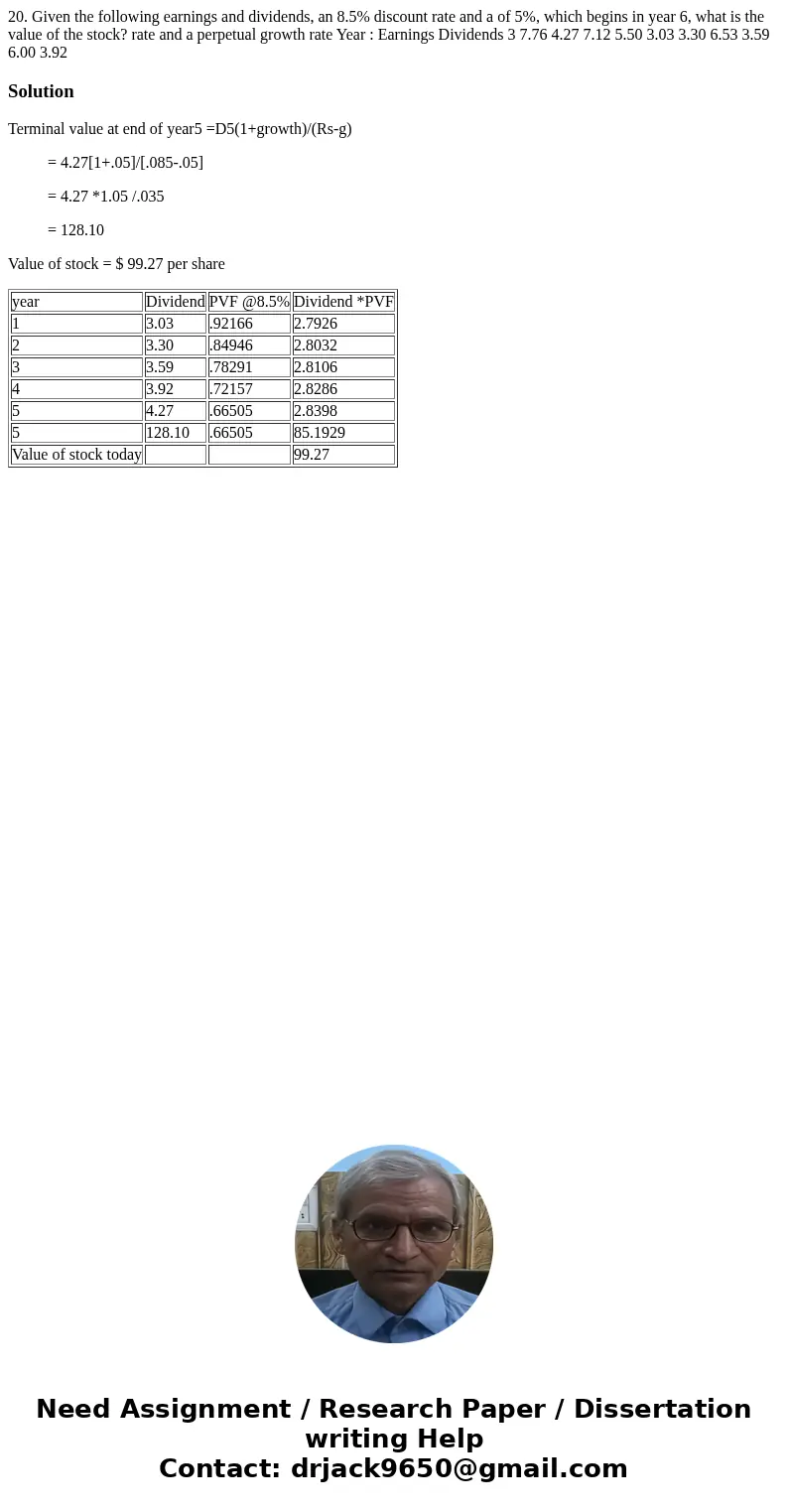

20. Given the following earnings and dividends, an 8.5% discount rate and a of 5%, which begins in year 6, what is the value of the stock? rate and a perpetual growth rate Year : Earnings Dividends 3 7.76 4.27 7.12 5.50 3.03 3.30 6.53 3.59 6.00 3.92

Solution

Terminal value at end of year5 =D5(1+growth)/(Rs-g)

= 4.27[1+.05]/[.085-.05]

= 4.27 *1.05 /.035

= 128.10

Value of stock = $ 99.27 per share

| year | Dividend | PVF @8.5% | Dividend *PVF |

| 1 | 3.03 | .92166 | 2.7926 |

| 2 | 3.30 | .84946 | 2.8032 |

| 3 | 3.59 | .78291 | 2.8106 |

| 4 | 3.92 | .72157 | 2.8286 |

| 5 | 4.27 | .66505 | 2.8398 |

| 5 | 128.10 | .66505 | 85.1929 |

| Value of stock today | 99.27 |

Homework Sourse

Homework Sourse