The Accounting Cycle Nov 1 Luis Rulz invests 20000 to start

Solution

cash a/c

to capital

( being amount invested in business)

insurance a/c

to cash

( being amount paid for insurance policy)

computer a/c

to cash

to creditors of computers

( being computer purchased for cash and balance due in 60 days )

3500

6500

office supplies a/c

to taylor

( being office supplies purchased from taylor on account)

taylor a/c

to cash

( being cash payment made to taylor)

barkley insurance a/c

to sales

being services given to barkley insurance)

cash a/c

to barkley insurance

( being amount collected from barkley insurance)

cash a/c

to bryant realty

( being advance received from bryant realty)

wages a/c

to cash

( being secretary two weeks wages paid in cash)

bill expenses a/c

to cash

being expenses made in cash

telephone expenses a/c

to telephone bill outstanding

being amount outstanding for telephone bill expenses

bing enterprises a/c

to sales

being services performed for bing enterprises

drawings a/c

to cash

being amount withdrew from the business for personal expenses

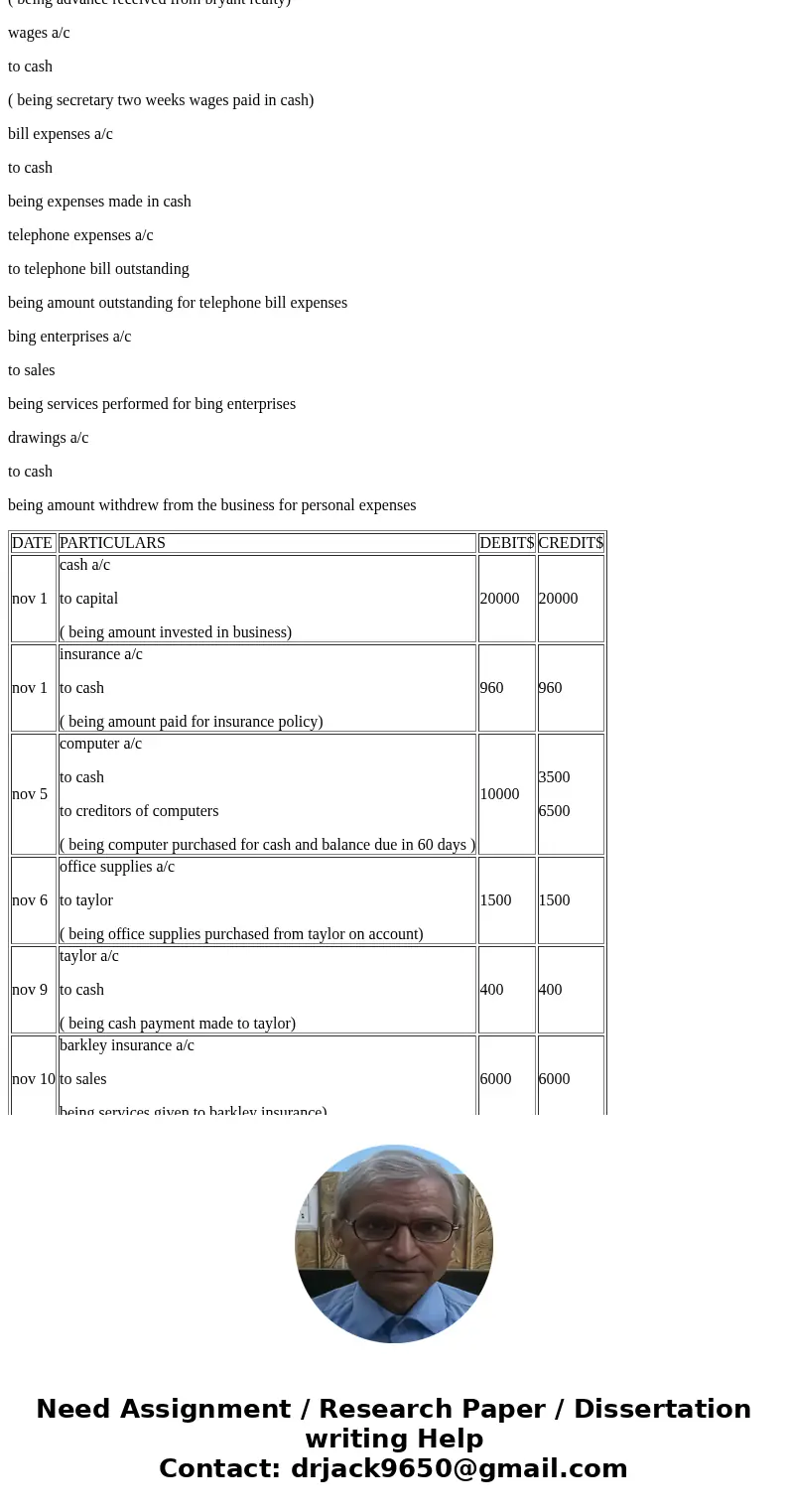

| DATE | PARTICULARS | DEBIT$ | CREDIT$ |

| nov 1 | cash a/c to capital ( being amount invested in business) | 20000 | 20000 |

| nov 1 | insurance a/c to cash ( being amount paid for insurance policy) | 960 | 960 |

| nov 5 | computer a/c to cash to creditors of computers ( being computer purchased for cash and balance due in 60 days ) | 10000 | 3500 6500 |

| nov 6 | office supplies a/c to taylor ( being office supplies purchased from taylor on account) | 1500 | 1500 |

| nov 9 | taylor a/c to cash ( being cash payment made to taylor) | 400 | 400 |

| nov 10 | barkley insurance a/c to sales being services given to barkley insurance) | 6000 | 6000 |

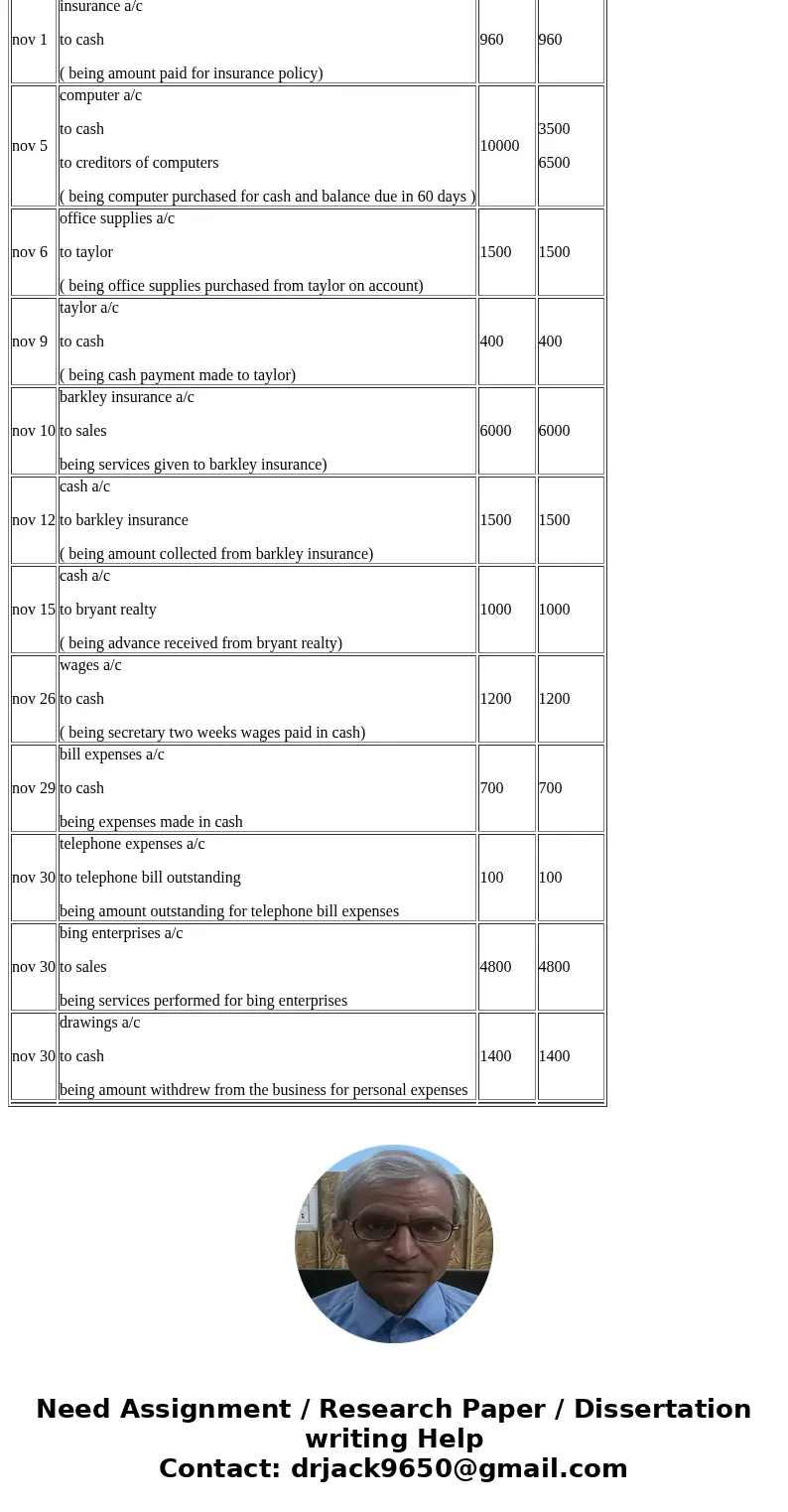

| nov 12 | cash a/c to barkley insurance ( being amount collected from barkley insurance) | 1500 | 1500 |

| nov 15 | cash a/c to bryant realty ( being advance received from bryant realty) | 1000 | 1000 |

| nov 26 | wages a/c to cash ( being secretary two weeks wages paid in cash) | 1200 | 1200 |

| nov 29 | bill expenses a/c to cash being expenses made in cash | 700 | 700 |

| nov 30 | telephone expenses a/c to telephone bill outstanding being amount outstanding for telephone bill expenses | 100 | 100 |

| nov 30 | bing enterprises a/c to sales being services performed for bing enterprises | 4800 | 4800 |

| nov 30 | drawings a/c to cash being amount withdrew from the business for personal expenses | 1400 | 1400 |

Homework Sourse

Homework Sourse