Exercise 186 Cost classification C3 Georgia Pacific a manufa

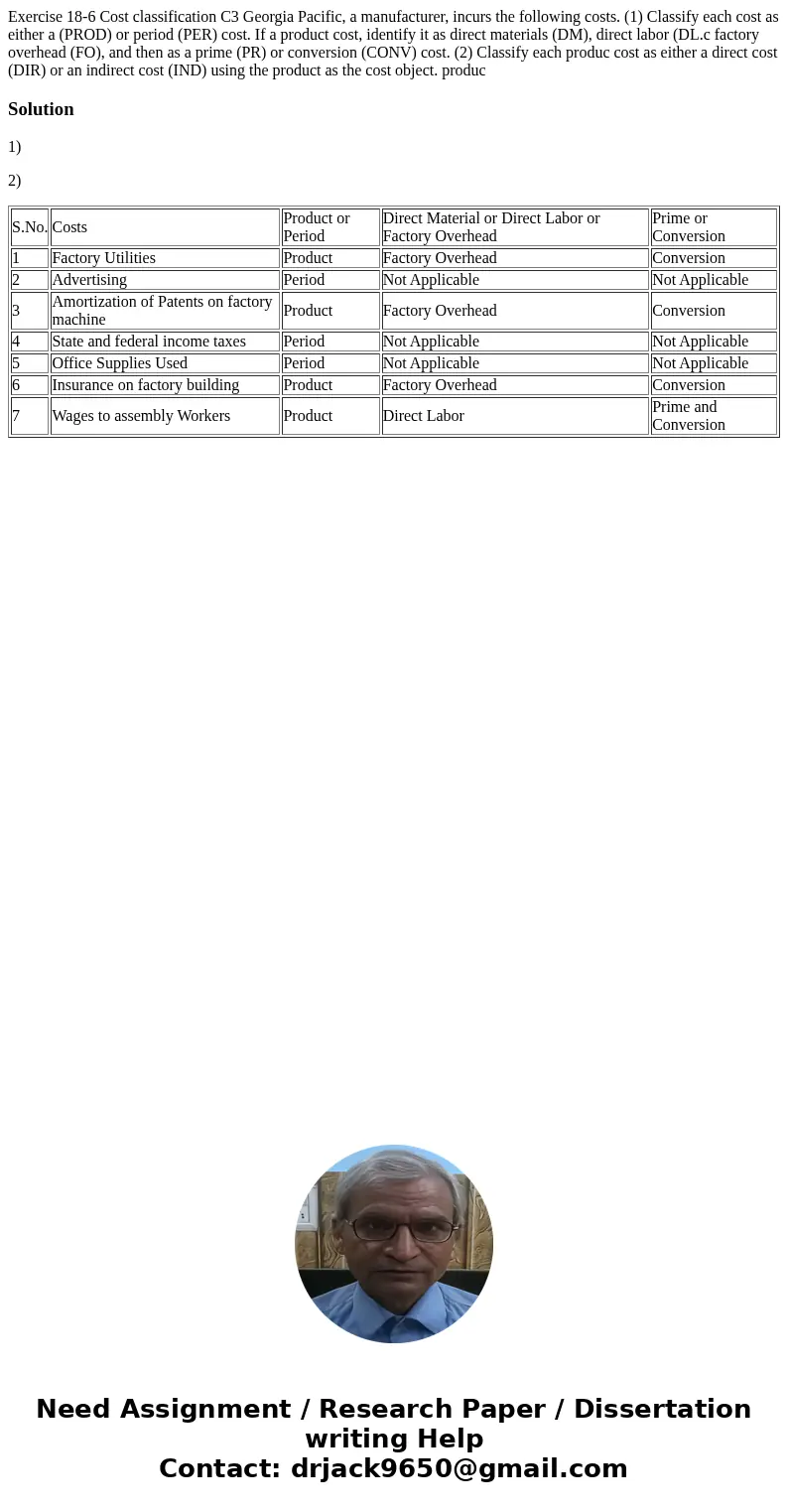

Exercise 18-6 Cost classification C3 Georgia Pacific, a manufacturer, incurs the following costs. (1) Classify each cost as either a (PROD) or period (PER) cost. If a product cost, identify it as direct materials (DM), direct labor (DL.c factory overhead (FO), and then as a prime (PR) or conversion (CONV) cost. (2) Classify each produc cost as either a direct cost (DIR) or an indirect cost (IND) using the product as the cost object. produc

Solution

1)

2)

| S.No. | Costs | Product or Period | Direct Material or Direct Labor or Factory Overhead | Prime or Conversion |

| 1 | Factory Utilities | Product | Factory Overhead | Conversion |

| 2 | Advertising | Period | Not Applicable | Not Applicable |

| 3 | Amortization of Patents on factory machine | Product | Factory Overhead | Conversion |

| 4 | State and federal income taxes | Period | Not Applicable | Not Applicable |

| 5 | Office Supplies Used | Period | Not Applicable | Not Applicable |

| 6 | Insurance on factory building | Product | Factory Overhead | Conversion |

| 7 | Wages to assembly Workers | Product | Direct Labor | Prime and Conversion |

Homework Sourse

Homework Sourse