Holmes Inc stock just paid a dividend of 175 and dividends a

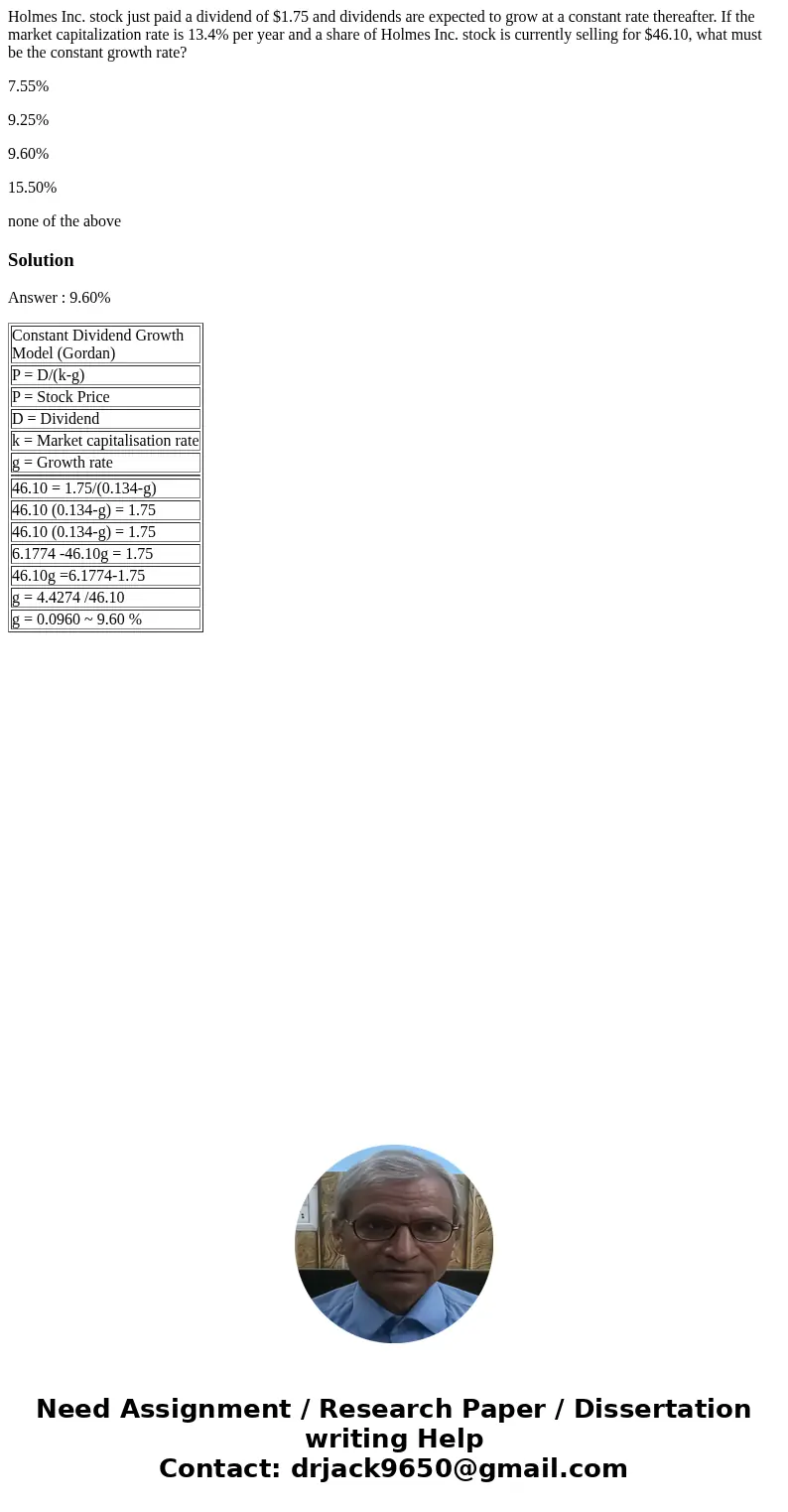

Holmes Inc. stock just paid a dividend of $1.75 and dividends are expected to grow at a constant rate thereafter. If the market capitalization rate is 13.4% per year and a share of Holmes Inc. stock is currently selling for $46.10, what must be the constant growth rate?

7.55%

9.25%

9.60%

15.50%

none of the above

Solution

Answer : 9.60%

| Constant Dividend Growth Model (Gordan) |

| P = D/(k-g) |

| P = Stock Price |

| D = Dividend |

| k = Market capitalisation rate |

| g = Growth rate |

| 46.10 = 1.75/(0.134-g) |

| 46.10 (0.134-g) = 1.75 |

| 46.10 (0.134-g) = 1.75 |

| 6.1774 -46.10g = 1.75 |

| 46.10g =6.1774-1.75 |

| g = 4.4274 /46.10 |

| g = 0.0960 ~ 9.60 % |

Homework Sourse

Homework Sourse