2017 Tax Rate Schedule Schedule XSingle Schedule ZHead of Ho

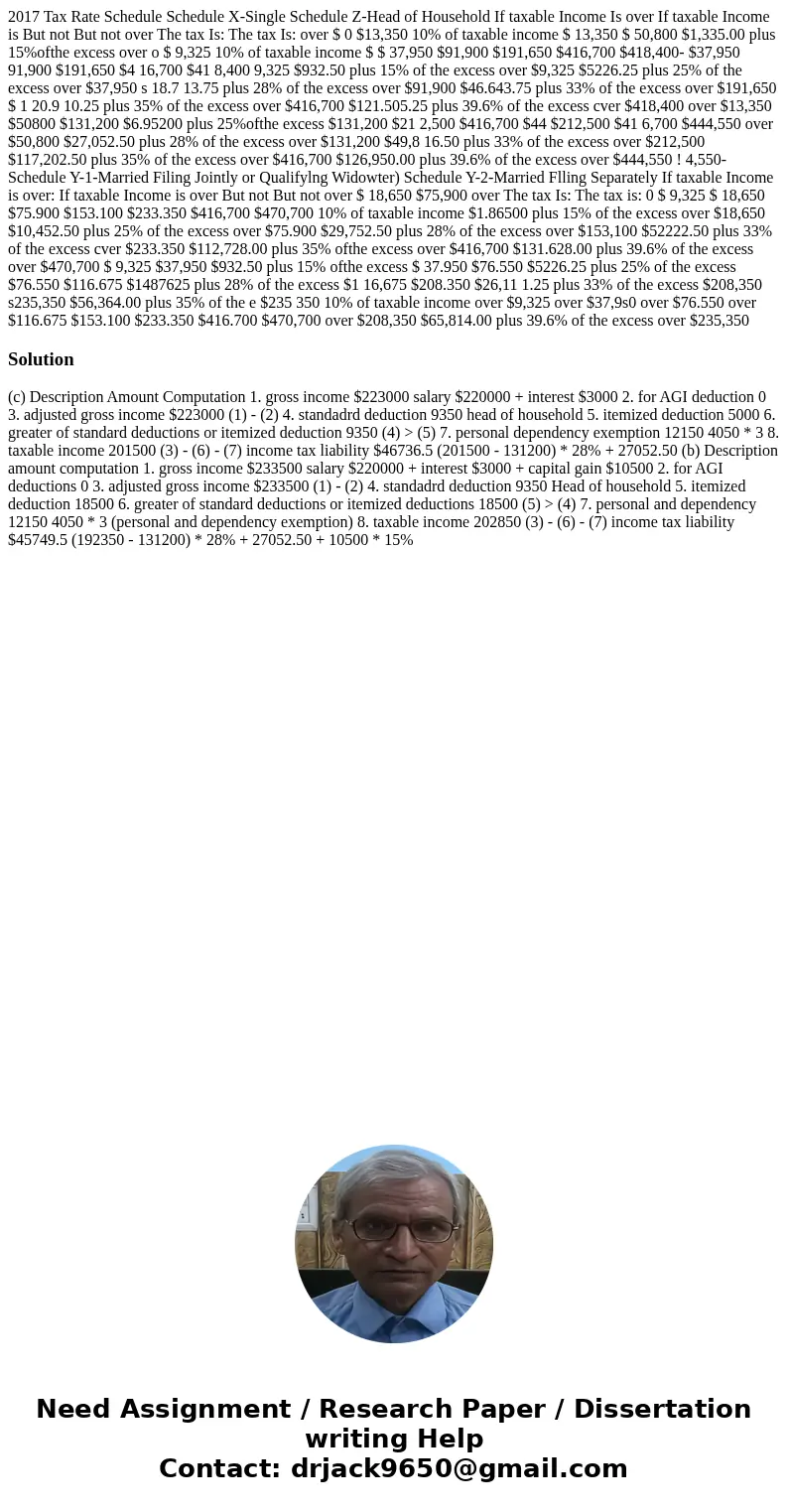

2017 Tax Rate Schedule Schedule X-Single Schedule Z-Head of Household If taxable Income Is over If taxable Income is But not But not over The tax Is: The tax Is: over $ 0 $13,350 10% of taxable income $ 13,350 $ 50,800 $1,335.00 plus 15%ofthe excess over o $ 9,325 10% of taxable income $ $ 37,950 $91,900 $191,650 $416,700 $418,400- $37,950 91,900 $191,650 $4 16,700 $41 8,400 9,325 $932.50 plus 15% of the excess over $9,325 $5226.25 plus 25% of the excess over $37,950 s 18.7 13.75 plus 28% of the excess over $91,900 $46.643.75 plus 33% of the excess over $191,650 $ 1 20.9 10.25 plus 35% of the excess over $416,700 $121.505.25 plus 39.6% of the excess cver $418,400 over $13,350 $50800 $131,200 $6.95200 plus 25%ofthe excess $131,200 $21 2,500 $416,700 $44 $212,500 $41 6,700 $444,550 over $50,800 $27,052.50 plus 28% of the excess over $131,200 $49,8 16.50 plus 33% of the excess over $212,500 $117,202.50 plus 35% of the excess over $416,700 $126,950.00 plus 39.6% of the excess over $444,550 ! 4,550- Schedule Y-1-Married Filing Jointly or Qualifylng Widowter) Schedule Y-2-Married Flling Separately If taxable Income is over: If taxable Income is over But not But not over $ 18,650 $75,900 over The tax Is: The tax is: 0 $ 9,325 $ 18,650 $75.900 $153.100 $233.350 $416,700 $470,700 10% of taxable income $1.86500 plus 15% of the excess over $18,650 $10,452.50 plus 25% of the excess over $75.900 $29,752.50 plus 28% of the excess over $153,100 $52222.50 plus 33% of the excess cver $233.350 $112,728.00 plus 35% ofthe excess over $416,700 $131.628.00 plus 39.6% of the excess over $470,700 $ 9,325 $37,950 $932.50 plus 15% ofthe excess $ 37.950 $76.550 $5226.25 plus 25% of the excess $76.550 $116.675 $1487625 plus 28% of the excess $1 16,675 $208.350 $26,11 1.25 plus 33% of the excess $208,350 s235,350 $56,364.00 plus 35% of the e $235 350 10% of taxable income over $9,325 over $37,9s0 over $76.550 over $116.675 $153.100 $233.350 $416.700 $470,700 over $208,350 $65,814.00 plus 39.6% of the excess over $235,350

Solution

(c) Description Amount Computation 1. gross income $223000 salary $220000 + interest $3000 2. for AGI deduction 0 3. adjusted gross income $223000 (1) - (2) 4. standadrd deduction 9350 head of household 5. itemized deduction 5000 6. greater of standard deductions or itemized deduction 9350 (4) > (5) 7. personal dependency exemption 12150 4050 * 3 8. taxable income 201500 (3) - (6) - (7) income tax liability $46736.5 (201500 - 131200) * 28% + 27052.50 (b) Description amount computation 1. gross income $233500 salary $220000 + interest $3000 + capital gain $10500 2. for AGI deductions 0 3. adjusted gross income $233500 (1) - (2) 4. standadrd deduction 9350 Head of household 5. itemized deduction 18500 6. greater of standard deductions or itemized deductions 18500 (5) > (4) 7. personal and dependency 12150 4050 * 3 (personal and dependency exemption) 8. taxable income 202850 (3) - (6) - (7) income tax liability $45749.5 (192350 - 131200) * 28% + 27052.50 + 10500 * 15%

Homework Sourse

Homework Sourse