Data related to the acquisition of timber rights and intanai

Data related to the acquisition of timber rights and intanaible assets during the current year ended December 31 are as follows: A. Timber rights on a tract of land were purchased for $3,589,500 on February 22. The stand of timber is estimated at 4,786,000 board feet. During the current year, 1,127,100 board feet of timber were cut and sold. B. On December 31, the company determined that $3,599,000 of goodwill was impaired. C. Governmental and legal costs of $7,140,000 were incurred on April 3 in obtaining a patent with an estimated economic life of 10 years. Amortization is to be for three-fourths of a year. Required 1. Determine the amount of the amortization, depletion, or impairment for the current year for each of the foregoing items. 2. Journalize the adjusting entries required to record the amortization, depletion, or impairment for each item. Refer to the Chart of Accounts for exact wording of account titles.

Solution

1 Answer :-

A. Depletion of timber rights :-

(Original Cost ÷ Total Board Feet) × Board Feet Cut and Sold

= ($3,589,000 ÷ $4,786,000) × $1,127,100

= $ 845,325

B. Loss on Impairment of goodwill - $ 3,599,000

C. Amortisation of governmental and legal costs -

Formula :- Amortisation = (Original Cost ÷ Years (Life) × Portion of year)

( $7,140,000 ÷ 10) × 3/4

= $5,355,000

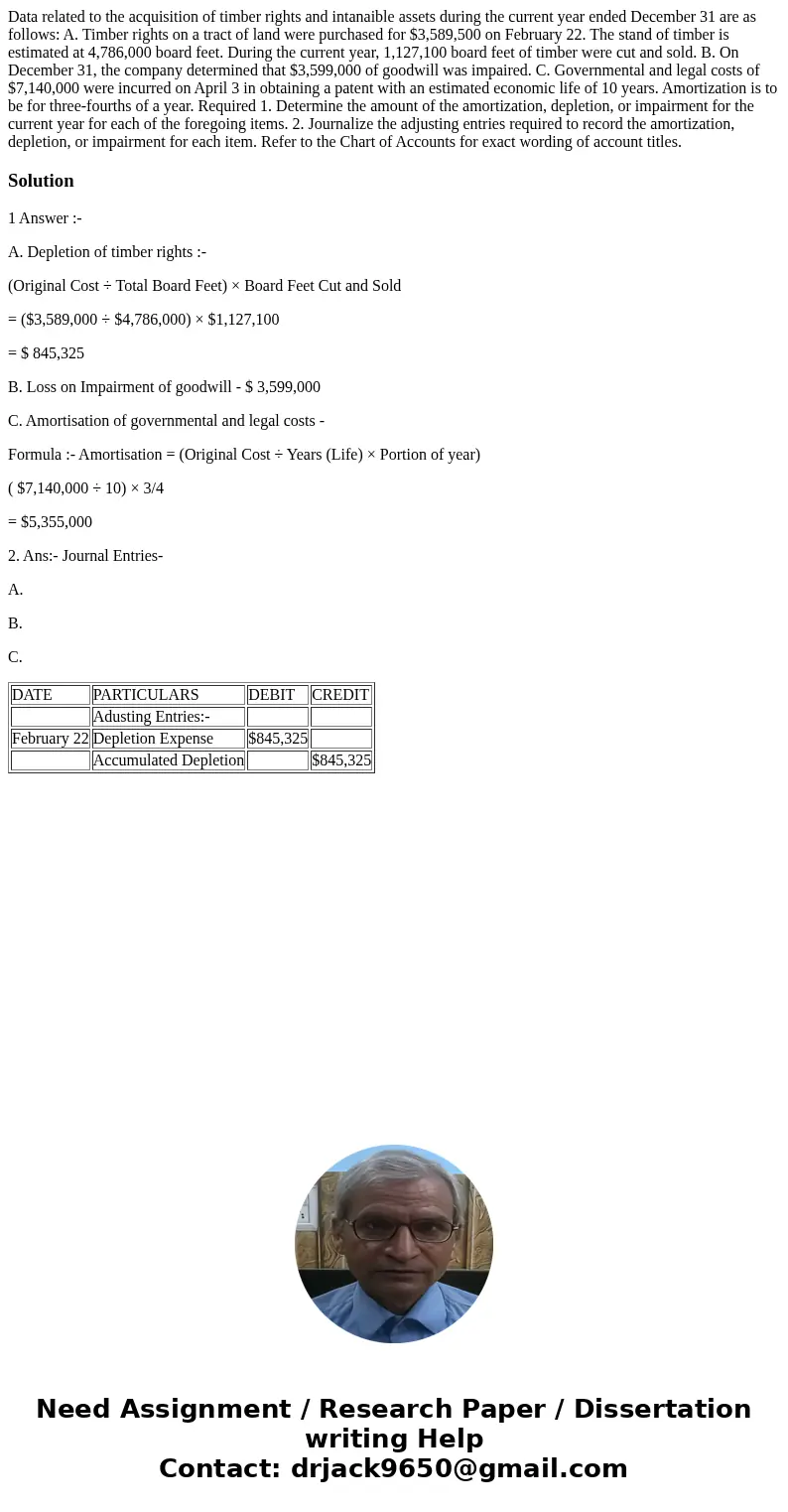

2. Ans:- Journal Entries-

A.

B.

C.

| DATE | PARTICULARS | DEBIT | CREDIT |

| Adusting Entries:- | |||

| February 22 | Depletion Expense | $845,325 | |

| Accumulated Depletion | $845,325 |

Homework Sourse

Homework Sourse