Required information The following information applies to th

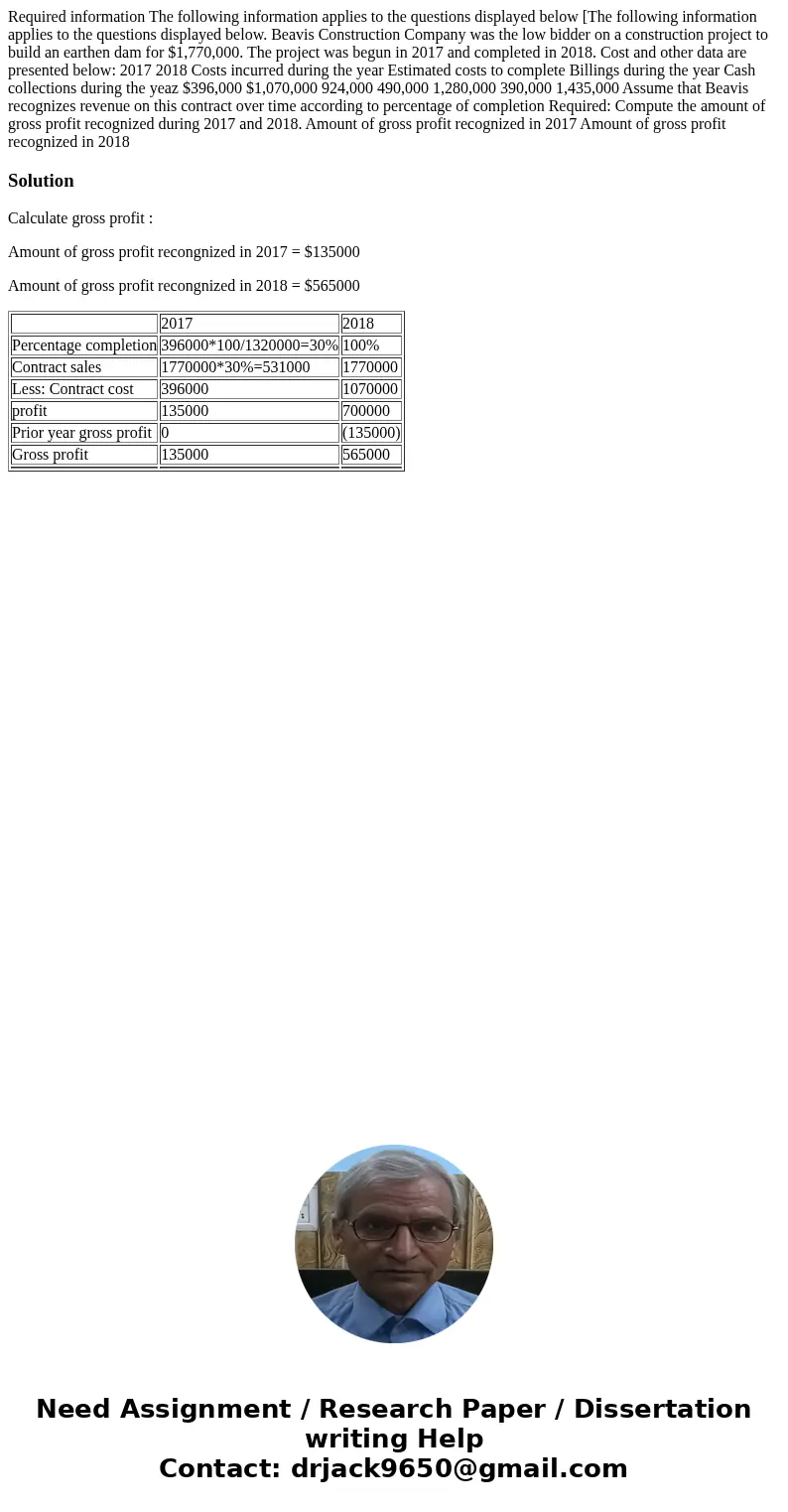

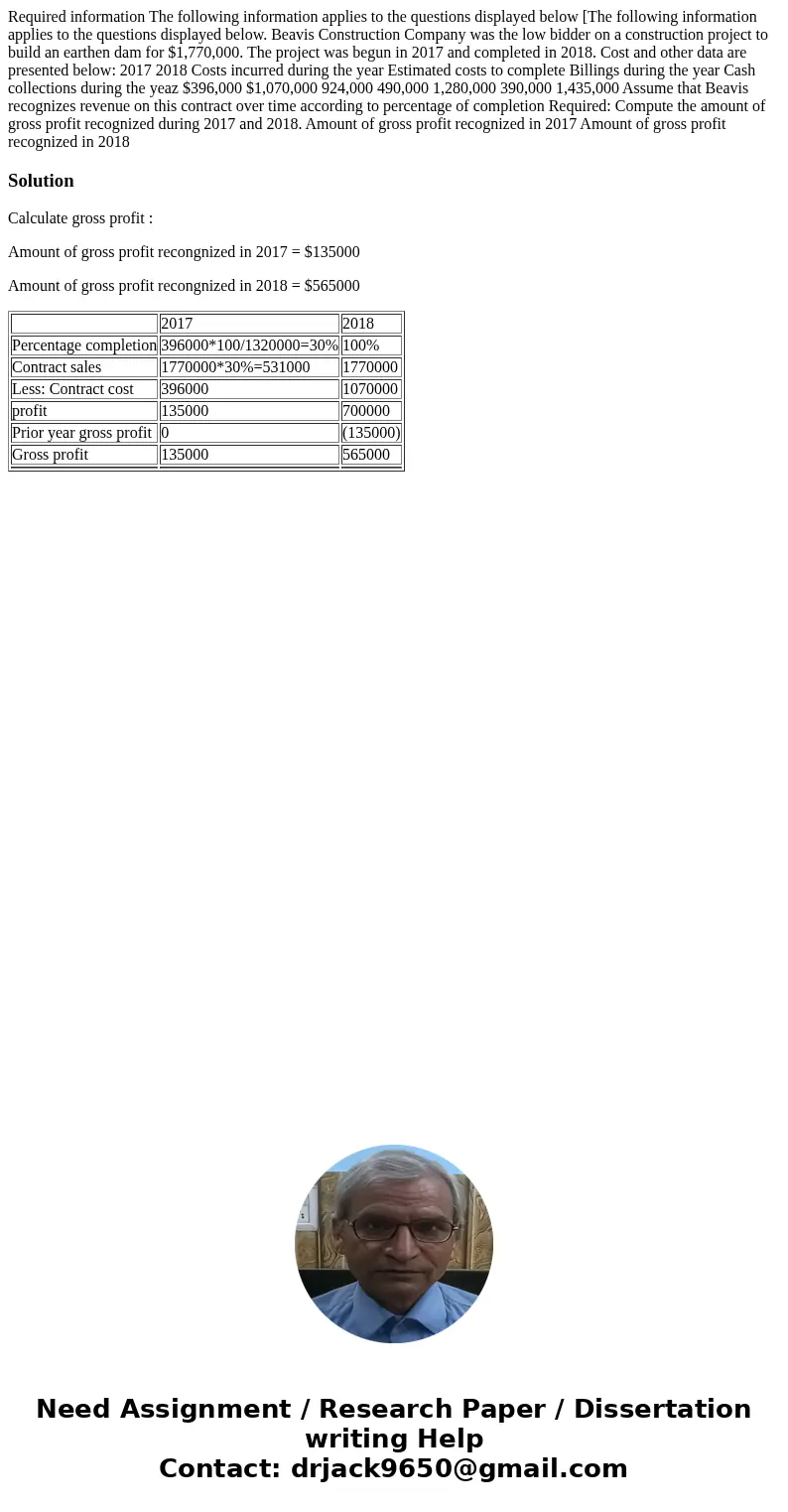

Required information The following information applies to the questions displayed below [The following information applies to the questions displayed below. Beavis Construction Company was the low bidder on a construction project to build an earthen dam for $1,770,000. The project was begun in 2017 and completed in 2018. Cost and other data are presented below: 2017 2018 Costs incurred during the year Estimated costs to complete Billings during the year Cash collections during the yeaz $396,000 $1,070,000 924,000 490,000 1,280,000 390,000 1,435,000 Assume that Beavis recognizes revenue on this contract over time according to percentage of completion Required: Compute the amount of gross profit recognized during 2017 and 2018. Amount of gross profit recognized in 2017 Amount of gross profit recognized in 2018

Solution

Calculate gross profit :

Amount of gross profit recongnized in 2017 = $135000

Amount of gross profit recongnized in 2018 = $565000

| 2017 | 2018 | |

| Percentage completion | 396000*100/1320000=30% | 100% |

| Contract sales | 1770000*30%=531000 | 1770000 |

| Less: Contract cost | 396000 | 1070000 |

| profit | 135000 | 700000 |

| Prior year gross profit | 0 | (135000) |

| Gross profit | 135000 | 565000 |

Homework Sourse

Homework Sourse