On January 2 2012 Marin Corporation issued 1050000 of 10 bon

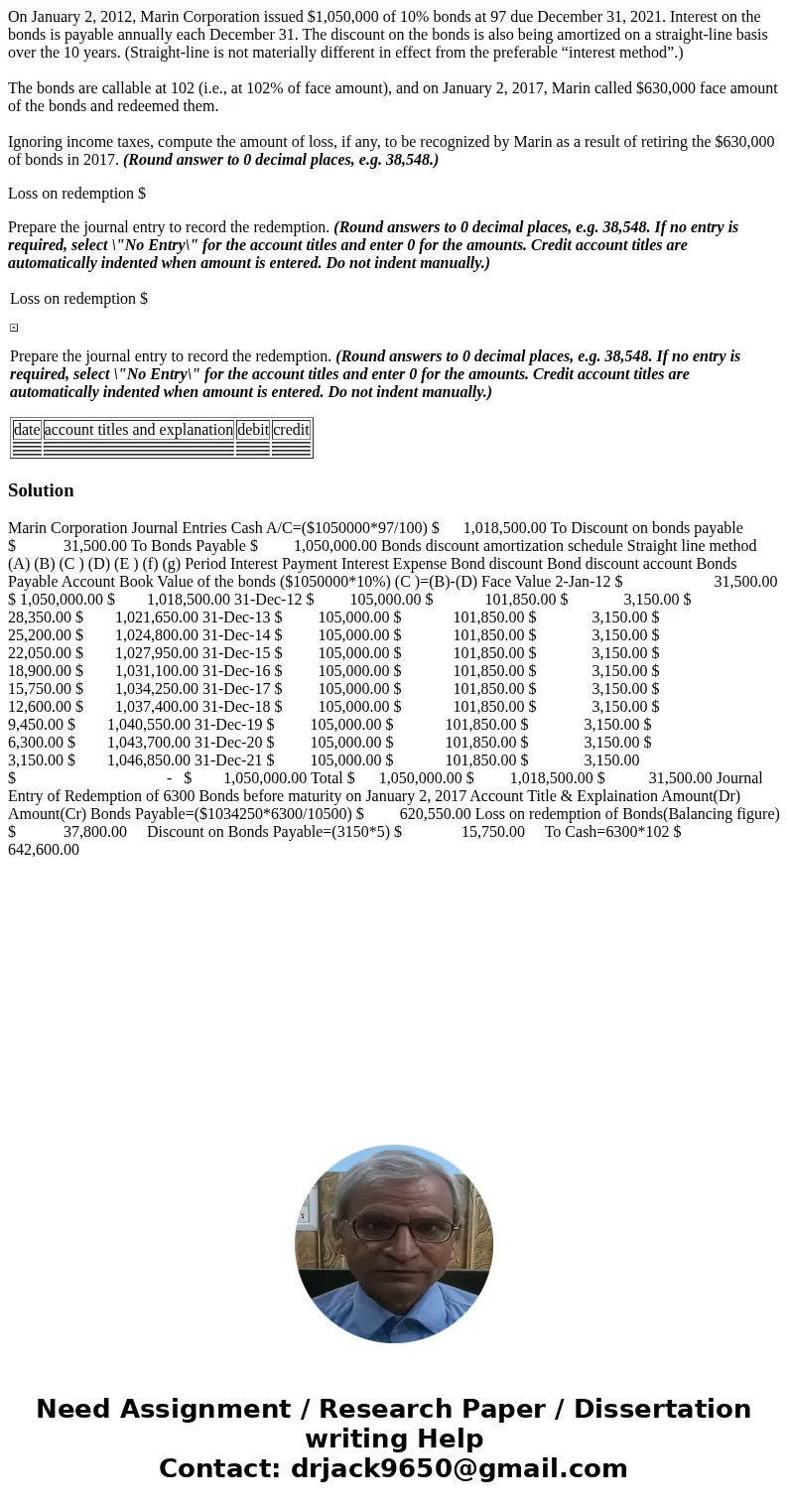

On January 2, 2012, Marin Corporation issued $1,050,000 of 10% bonds at 97 due December 31, 2021. Interest on the bonds is payable annually each December 31. The discount on the bonds is also being amortized on a straight-line basis over the 10 years. (Straight-line is not materially different in effect from the preferable “interest method”.)

The bonds are callable at 102 (i.e., at 102% of face amount), and on January 2, 2017, Marin called $630,000 face amount of the bonds and redeemed them.

Ignoring income taxes, compute the amount of loss, if any, to be recognized by Marin as a result of retiring the $630,000 of bonds in 2017. (Round answer to 0 decimal places, e.g. 38,548.)

Loss on redemption $

Prepare the journal entry to record the redemption. (Round answers to 0 decimal places, e.g. 38,548. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

| Loss on redemption $ Prepare the journal entry to record the redemption. (Round answers to 0 decimal places, e.g. 38,548. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

|

Solution

Marin Corporation Journal Entries Cash A/C=($1050000*97/100) $ 1,018,500.00 To Discount on bonds payable $ 31,500.00 To Bonds Payable $ 1,050,000.00 Bonds discount amortization schedule Straight line method (A) (B) (C ) (D) (E ) (f) (g) Period Interest Payment Interest Expense Bond discount Bond discount account Bonds Payable Account Book Value of the bonds ($1050000*10%) (C )=(B)-(D) Face Value 2-Jan-12 $ 31,500.00 $ 1,050,000.00 $ 1,018,500.00 31-Dec-12 $ 105,000.00 $ 101,850.00 $ 3,150.00 $ 28,350.00 $ 1,021,650.00 31-Dec-13 $ 105,000.00 $ 101,850.00 $ 3,150.00 $ 25,200.00 $ 1,024,800.00 31-Dec-14 $ 105,000.00 $ 101,850.00 $ 3,150.00 $ 22,050.00 $ 1,027,950.00 31-Dec-15 $ 105,000.00 $ 101,850.00 $ 3,150.00 $ 18,900.00 $ 1,031,100.00 31-Dec-16 $ 105,000.00 $ 101,850.00 $ 3,150.00 $ 15,750.00 $ 1,034,250.00 31-Dec-17 $ 105,000.00 $ 101,850.00 $ 3,150.00 $ 12,600.00 $ 1,037,400.00 31-Dec-18 $ 105,000.00 $ 101,850.00 $ 3,150.00 $ 9,450.00 $ 1,040,550.00 31-Dec-19 $ 105,000.00 $ 101,850.00 $ 3,150.00 $ 6,300.00 $ 1,043,700.00 31-Dec-20 $ 105,000.00 $ 101,850.00 $ 3,150.00 $ 3,150.00 $ 1,046,850.00 31-Dec-21 $ 105,000.00 $ 101,850.00 $ 3,150.00 $ - $ 1,050,000.00 Total $ 1,050,000.00 $ 1,018,500.00 $ 31,500.00 Journal Entry of Redemption of 6300 Bonds before maturity on January 2, 2017 Account Title & Explaination Amount(Dr) Amount(Cr) Bonds Payable=($1034250*6300/10500) $ 620,550.00 Loss on redemption of Bonds(Balancing figure) $ 37,800.00 Discount on Bonds Payable=(3150*5) $ 15,750.00 To Cash=6300*102 $ 642,600.00

Homework Sourse

Homework Sourse