Problem 142A The stockholders equity accounts of Karp Compan

Solution

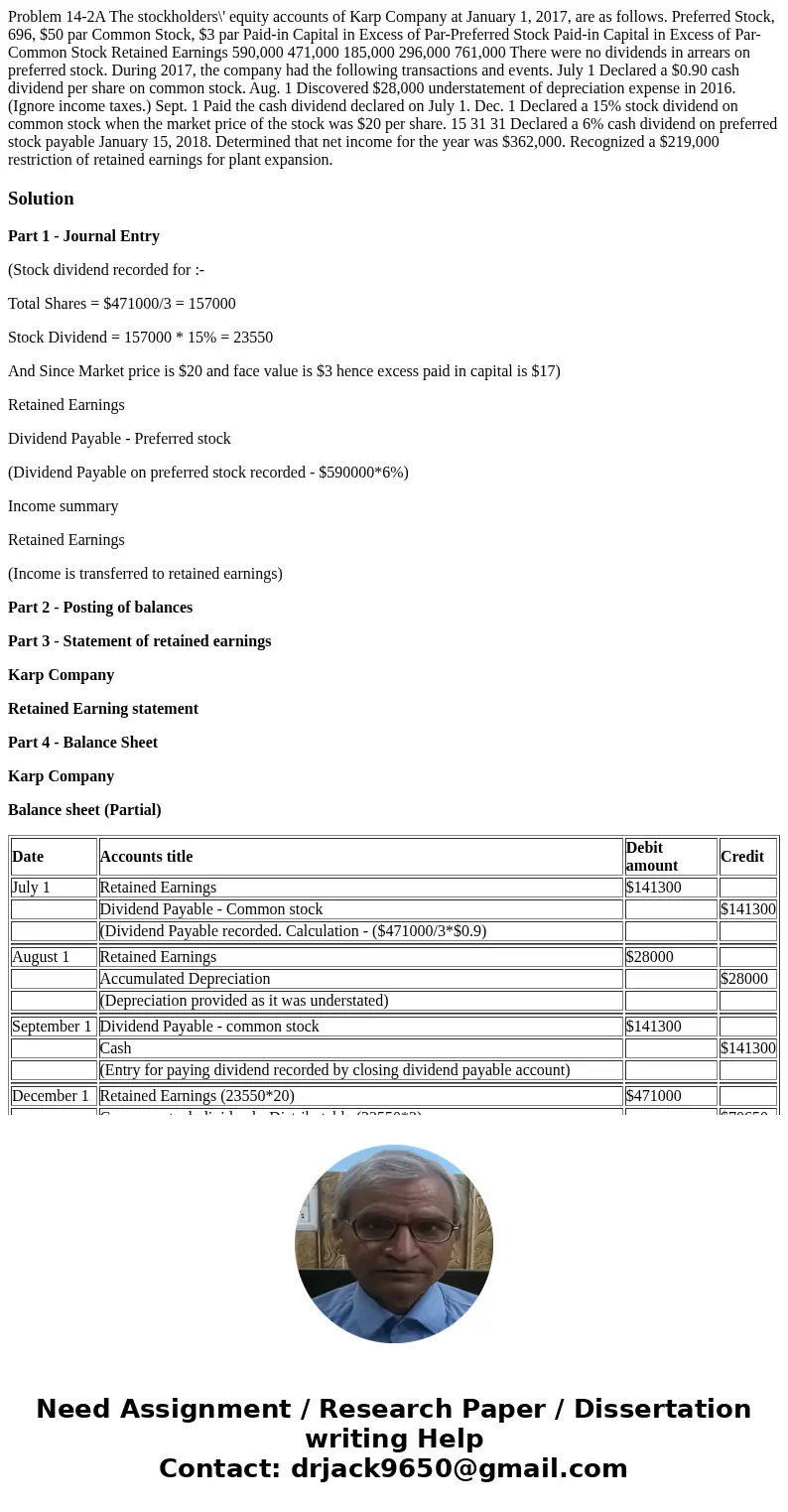

Part 1 - Journal Entry

(Stock dividend recorded for :-

Total Shares = $471000/3 = 157000

Stock Dividend = 157000 * 15% = 23550

And Since Market price is $20 and face value is $3 hence excess paid in capital is $17)

Retained Earnings

Dividend Payable - Preferred stock

(Dividend Payable on preferred stock recorded - $590000*6%)

Income summary

Retained Earnings

(Income is transferred to retained earnings)

Part 2 - Posting of balances

Part 3 - Statement of retained earnings

Karp Company

Retained Earning statement

Part 4 - Balance Sheet

Karp Company

Balance sheet (Partial)

| Date | Accounts title | Debit amount | Credit |

| July 1 | Retained Earnings | $141300 | |

| Dividend Payable - Common stock | $141300 | ||

| (Dividend Payable recorded. Calculation - ($471000/3*$0.9) | |||

| August 1 | Retained Earnings | $28000 | |

| Accumulated Depreciation | $28000 | ||

| (Depreciation provided as it was understated) | |||

| September 1 | Dividend Payable - common stock | $141300 | |

| Cash | $141300 | ||

| (Entry for paying dividend recorded by closing dividend payable account) | |||

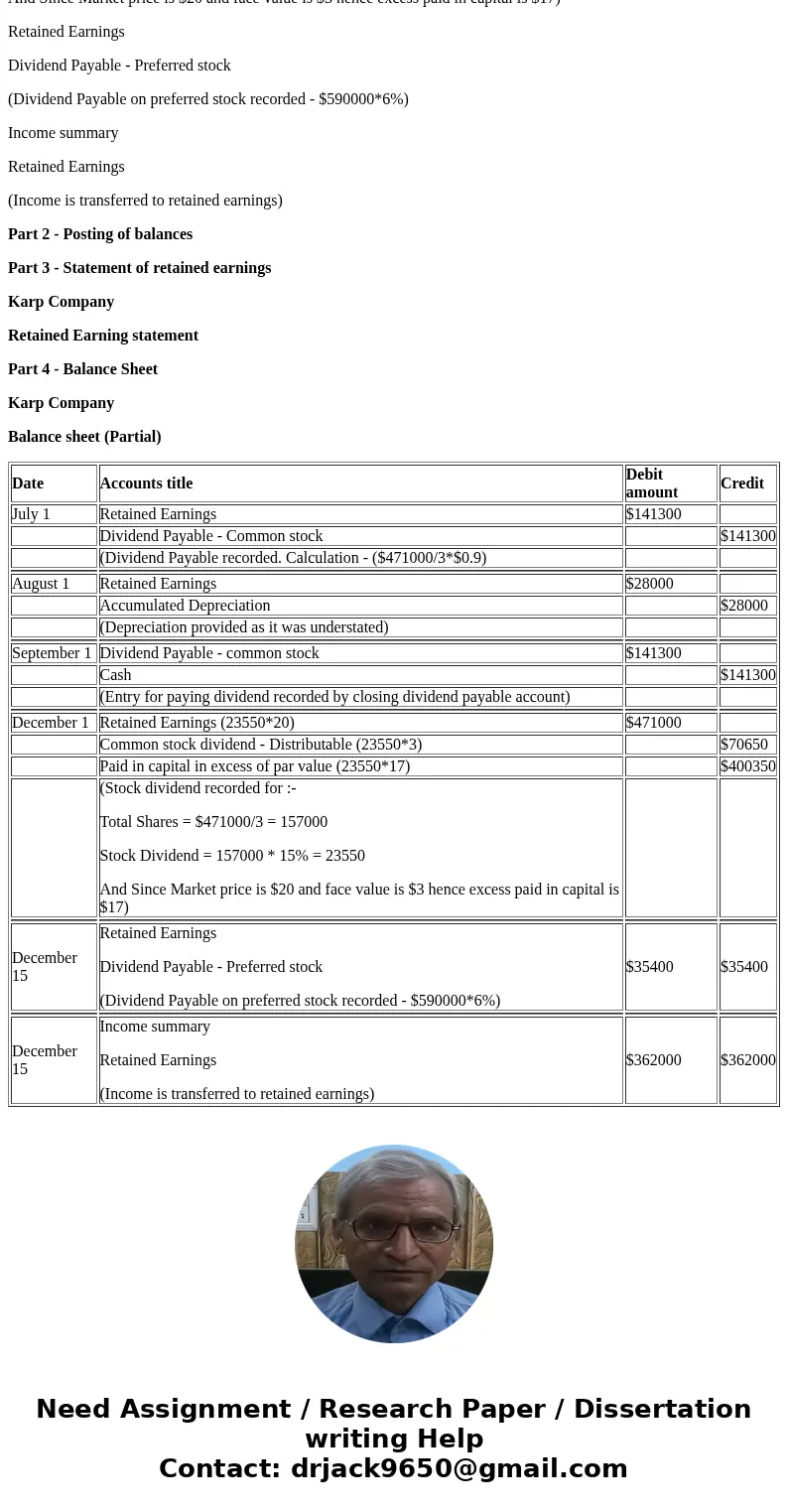

| December 1 | Retained Earnings (23550*20) | $471000 | |

| Common stock dividend - Distributable (23550*3) | $70650 | ||

| Paid in capital in excess of par value (23550*17) | $400350 | ||

| (Stock dividend recorded for :- Total Shares = $471000/3 = 157000 Stock Dividend = 157000 * 15% = 23550 And Since Market price is $20 and face value is $3 hence excess paid in capital is $17) | |||

| December 15 | Retained Earnings Dividend Payable - Preferred stock (Dividend Payable on preferred stock recorded - $590000*6%) | $35400 | $35400 |

| December 15 | Income summary Retained Earnings (Income is transferred to retained earnings) | $362000 | $362000 |

Homework Sourse

Homework Sourse