Your broker offers to sell you some shares of Bahnsen Co co

Your broker offers to sell you some shares of Bahnsen & Co. common stock that paid a dividend of $2.50 yesterday. Bahnsen\'s dividend is expected to grow at 4% per year for the next 3 years. If you buy the stock, you plan to hold it for 3 years and then sell it. The appropriate discount rate is 11%.

Find the expected dividend for each of the next 3 years; that is, calculate D1, D2, and D3. Note that D0 = $2.50. Round your answer to the nearest cent.

D1 = $

D2 = $

D3 = $

Given that the first dividend payment will occur 1 year from now, find the present value of the dividend stream; that is, calculate the PVs of D1, D2, and D3, and then sum these PVs. Round your answer to the nearest cent. Do not round your intermediate calculations.

$

You expect the price of the stock 3 years from now to be $41.78; that is, you expect to equal $41.78. Discounted at a 11% rate, what is the present value of this expected future stock price? In other words, calculate the PV of $41.78. Round your answer to the nearest cent. Do not round your intermediate calculations.

$

If you plan to buy the stock, hold it for 3 years, and then sell it for $41.78, what is the most you should pay for it today? Round your answer to the nearest cent. Do not round your intermediate calculations.

$

Use equation below to calculate the present value of this stock.

??????????

Assume that g = 4% and that it is constant. Do not round intermediate calculations. Round your answer to the nearest cent.

$

Solution

D1 = dividend for year 1

D2 = dividend for year 2

D3 = dividend for year 3

g = growth rate = 4%

D1 = D0 [1+g] = 2.50*1.04 = $2.60

D2 = D1 [1+g] = 2.60*1.04 = $2.704

D3 = D2 [1+g] = 2.704*1.04 = $2.81216

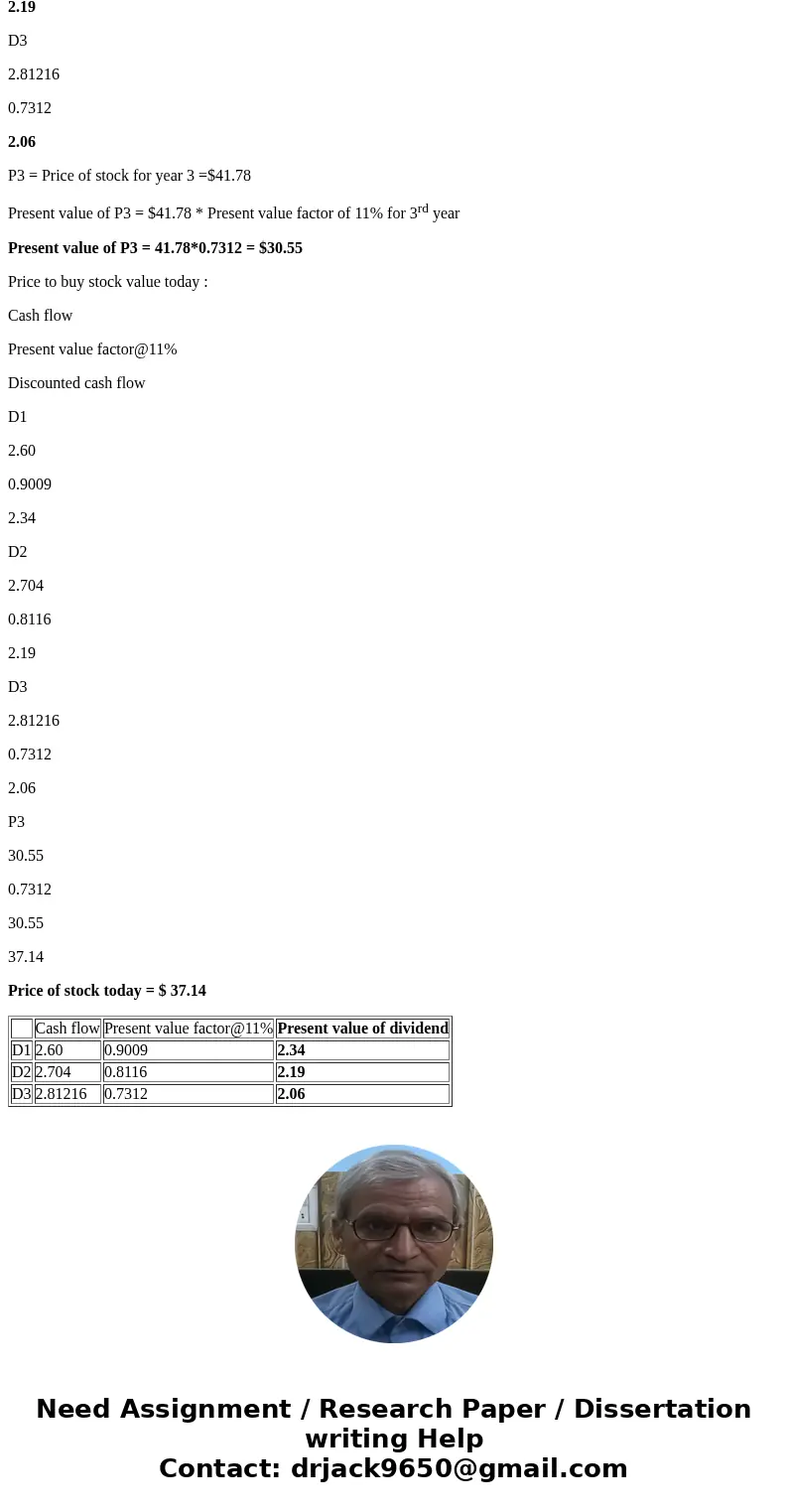

Cash flow

Present value factor@11%

Present value of dividend

D1

2.60

0.9009

2.34

D2

2.704

0.8116

2.19

D3

2.81216

0.7312

2.06

P3 = Price of stock for year 3 =$41.78

Present value of P3 = $41.78 * Present value factor of 11% for 3rd year

Present value of P3 = 41.78*0.7312 = $30.55

Price to buy stock value today :

Cash flow

Present value factor@11%

Discounted cash flow

D1

2.60

0.9009

2.34

D2

2.704

0.8116

2.19

D3

2.81216

0.7312

2.06

P3

30.55

0.7312

30.55

37.14

Price of stock today = $ 37.14

| Cash flow | Present value factor@11% | Present value of dividend | |

| D1 | 2.60 | 0.9009 | 2.34 |

| D2 | 2.704 | 0.8116 | 2.19 |

| D3 | 2.81216 | 0.7312 | 2.06 |

Homework Sourse

Homework Sourse