Complete each of the columns on the table below indicating i

Complete each of the columns on the table below, indicating in which section each item would be reported on the statement of cash flows (operating, investing, or financing), the amount that would be reported, and whether the item would create an increase or decrease in cash. For item that affect more than one section of the statement, indicate all affected. Assume the indirect method of reporting cash flows from operating activities.

The first item has been completed as an example.

Item

Statement Section

Amount to Report

+/– Effect on Cash

Depreciation of $15,000 for the period

Operating

$15,000

Increase

Issuance of common stock for

$35,000

Increase in accounts payable of

$7,000

Retirement of $100,000 bonds payable at 97

Purchase of long-term investments for

$94,500

Dividends declared and paid of $8,300

Increase in prepaid rent of $4,500

Decrease in Inventory of $5,300

Purchase of equipment for $17,600 cash

Sale of land originally costing

$134,000 for $130,000

Decrease in taxes payable of $2,100

]

Show all work

| Item | Statement Section | Amount to Report | +/– Effect on Cash |

| Depreciation of $15,000 for the period | Operating | $15,000 | Increase |

| Issuance of common stock for $35,000 | |||

| Increase in accounts payable of $7,000 | |||

| Retirement of $100,000 bonds payable at 97 | |||

| Purchase of long-term investments for $94,500 | |||

| Dividends declared and paid of $8,300 | |||

| Increase in prepaid rent of $4,500 | |||

| Decrease in Inventory of $5,300 | |||

| Purchase of equipment for $17,600 cash | |||

| Sale of land originally costing $134,000 for $130,000 | |||

| Decrease in taxes payable of $2,100 | ] |

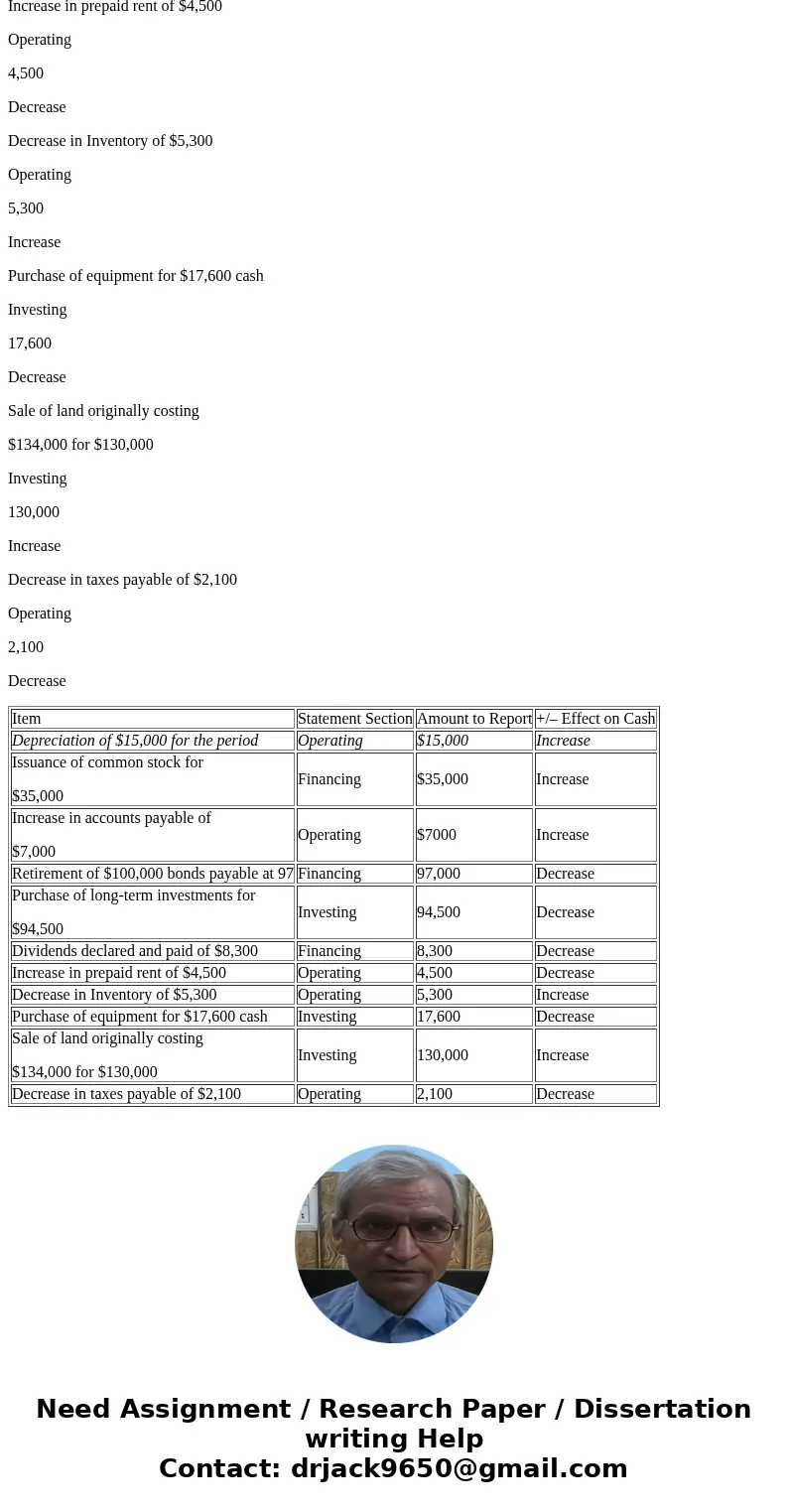

Solution

Item

Statement Section

Amount to Report

+/– Effect on Cash

Depreciation of $15,000 for the period

Operating

$15,000

Increase

Issuance of common stock for

$35,000

Financing

$35,000

Increase

Increase in accounts payable of

$7,000

Operating

$7000

Increase

Retirement of $100,000 bonds payable at 97

Financing

97,000

Decrease

Purchase of long-term investments for

$94,500

Investing

94,500

Decrease

Dividends declared and paid of $8,300

Financing

8,300

Decrease

Increase in prepaid rent of $4,500

Operating

4,500

Decrease

Decrease in Inventory of $5,300

Operating

5,300

Increase

Purchase of equipment for $17,600 cash

Investing

17,600

Decrease

Sale of land originally costing

$134,000 for $130,000

Investing

130,000

Increase

Decrease in taxes payable of $2,100

Operating

2,100

Decrease

| Item | Statement Section | Amount to Report | +/– Effect on Cash |

| Depreciation of $15,000 for the period | Operating | $15,000 | Increase |

| Issuance of common stock for $35,000 | Financing | $35,000 | Increase |

| Increase in accounts payable of $7,000 | Operating | $7000 | Increase |

| Retirement of $100,000 bonds payable at 97 | Financing | 97,000 | Decrease |

| Purchase of long-term investments for $94,500 | Investing | 94,500 | Decrease |

| Dividends declared and paid of $8,300 | Financing | 8,300 | Decrease |

| Increase in prepaid rent of $4,500 | Operating | 4,500 | Decrease |

| Decrease in Inventory of $5,300 | Operating | 5,300 | Increase |

| Purchase of equipment for $17,600 cash | Investing | 17,600 | Decrease |

| Sale of land originally costing $134,000 for $130,000 | Investing | 130,000 | Increase |

| Decrease in taxes payable of $2,100 | Operating | 2,100 | Decrease |

Homework Sourse

Homework Sourse