You are given the following regression statistics sort of RB

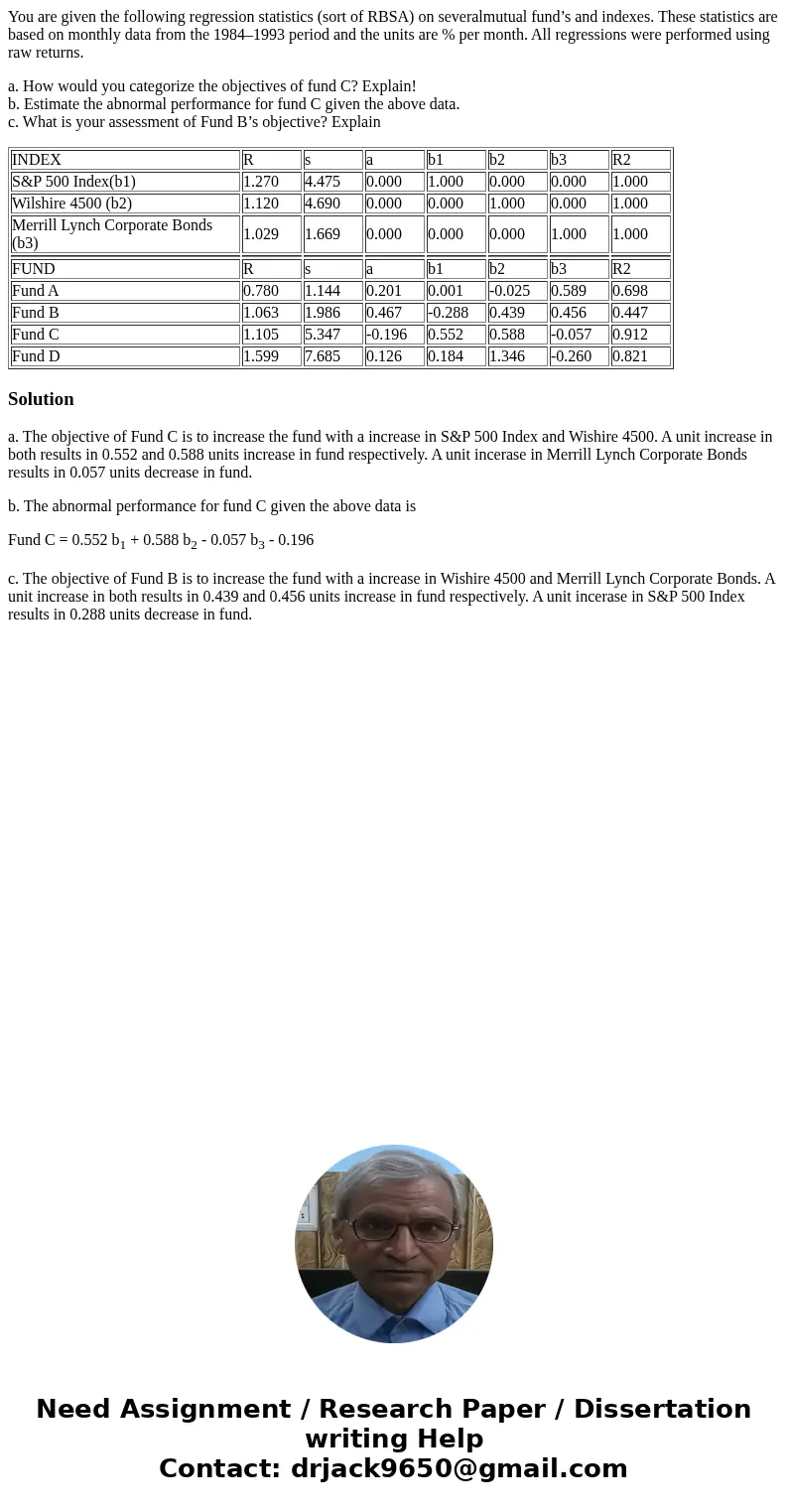

You are given the following regression statistics (sort of RBSA) on severalmutual fund’s and indexes. These statistics are based on monthly data from the 1984–1993 period and the units are % per month. All regressions were performed using raw returns.

a. How would you categorize the objectives of fund C? Explain!

b. Estimate the abnormal performance for fund C given the above data.

c. What is your assessment of Fund B’s objective? Explain

| INDEX | R | s | a | b1 | b2 | b3 | R2 |

| S&P 500 Index(b1) | 1.270 | 4.475 | 0.000 | 1.000 | 0.000 | 0.000 | 1.000 |

| Wilshire 4500 (b2) | 1.120 | 4.690 | 0.000 | 0.000 | 1.000 | 0.000 | 1.000 |

| Merrill Lynch Corporate Bonds (b3) | 1.029 | 1.669 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 |

| FUND | R | s | a | b1 | b2 | b3 | R2 |

| Fund A | 0.780 | 1.144 | 0.201 | 0.001 | -0.025 | 0.589 | 0.698 |

| Fund B | 1.063 | 1.986 | 0.467 | -0.288 | 0.439 | 0.456 | 0.447 |

| Fund C | 1.105 | 5.347 | -0.196 | 0.552 | 0.588 | -0.057 | 0.912 |

| Fund D | 1.599 | 7.685 | 0.126 | 0.184 | 1.346 | -0.260 | 0.821 |

Solution

a. The objective of Fund C is to increase the fund with a increase in S&P 500 Index and Wishire 4500. A unit increase in both results in 0.552 and 0.588 units increase in fund respectively. A unit incerase in Merrill Lynch Corporate Bonds results in 0.057 units decrease in fund.

b. The abnormal performance for fund C given the above data is

Fund C = 0.552 b1 + 0.588 b2 - 0.057 b3 - 0.196

c. The objective of Fund B is to increase the fund with a increase in Wishire 4500 and Merrill Lynch Corporate Bonds. A unit increase in both results in 0.439 and 0.456 units increase in fund respectively. A unit incerase in S&P 500 Index results in 0.288 units decrease in fund.

Homework Sourse

Homework Sourse