Sweet Companys outstanding stock consists of 2000 shares of

Sweet Company\'s outstanding stock consists of 2,000 shares of noncumulative 3% preferred stock with a $10 par value and value. During the first three years of operation, the corporation declared and paid the following total cash dividends. O s a eso common ock with a 50 r Dividend Declared year l 3,000 year 2 8,000 year 3 $37,000 The total amount of dividends paid to preferred and common shareholders over the three-year period is: Multiple Choice $18,000 preferred: $30,000 common $14,000 preferred: $34,000 common $6,000 preferred; $42,000 common. $15,000 preferred: $33,000 common. $12,000 preferred; $36,000 common

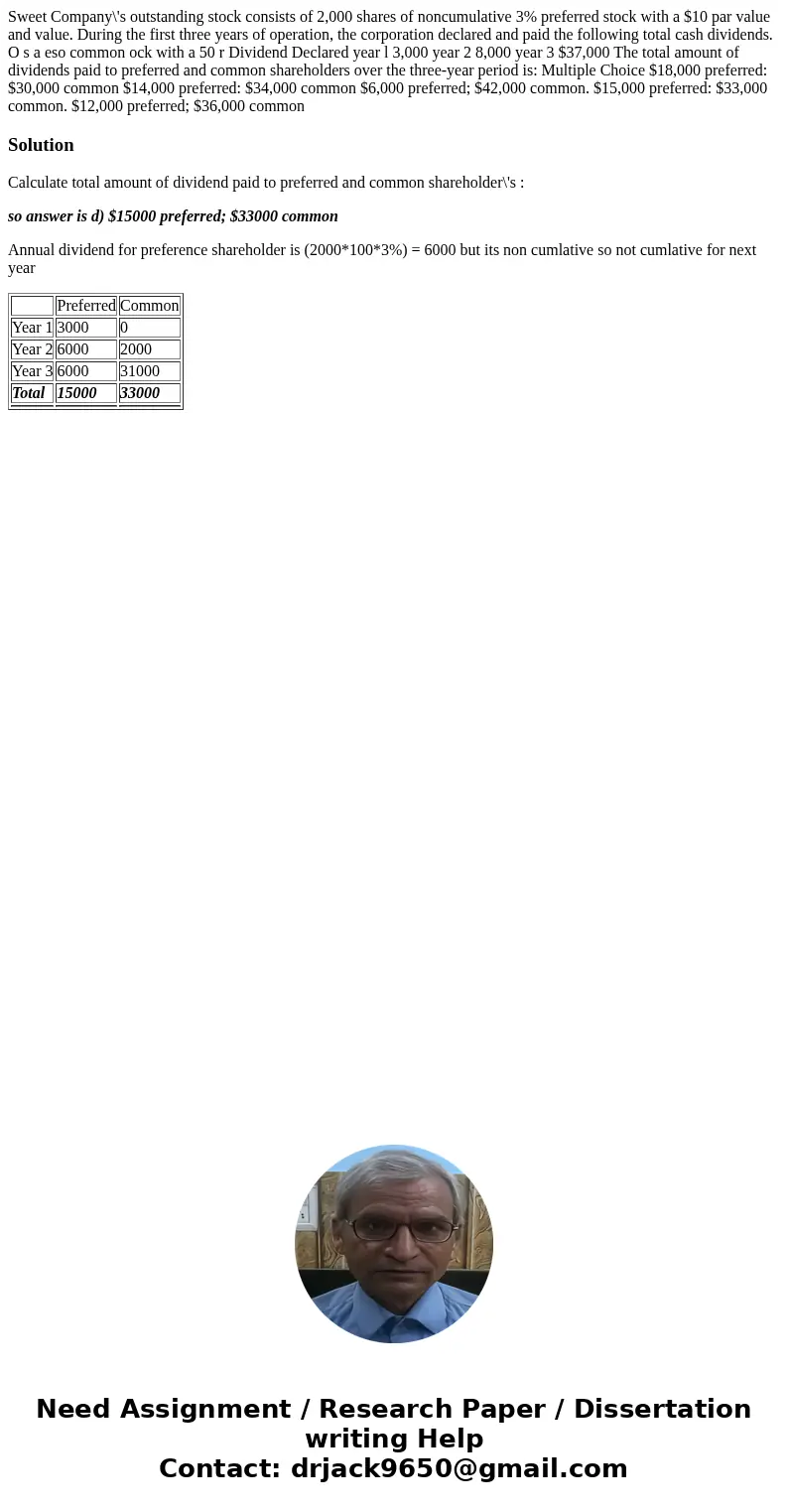

Solution

Calculate total amount of dividend paid to preferred and common shareholder\'s :

so answer is d) $15000 preferred; $33000 common

Annual dividend for preference shareholder is (2000*100*3%) = 6000 but its non cumlative so not cumlative for next year

| Preferred | Common | |

| Year 1 | 3000 | 0 |

| Year 2 | 6000 | 2000 |

| Year 3 | 6000 | 31000 |

| Total | 15000 | 33000 |

Homework Sourse

Homework Sourse