1Please journalize and post each entry to T accounts 50 poin

1.Please journalize and post each entry to T accounts. (50 points)

JD Specialties performed the completed the following transactions:

Jan 2

Purchased $350 of supplies on account. (expense)

Jan 10

Performed services for client’s in the amount of $6,500 on account.

Jan 15

Paid wages of $1,500, insurance of $250, and travel expenses of $25.

Jan 28

Received $2,500 on account for services performed.

Jan 31

Received and paid utility bill in the amount of $750.

Supplies account

2.Prepare a trial balance from the information obtained in Problem 2. ( 20 points)

| Jan 2 | Purchased $350 of supplies on account. (expense) |

| Jan 10 | Performed services for client’s in the amount of $6,500 on account. |

| Jan 15 | Paid wages of $1,500, insurance of $250, and travel expenses of $25. |

| Jan 28 | Received $2,500 on account for services performed. |

| Jan 31 | Received and paid utility bill in the amount of $750. |

Solution

Solution:

Part 1 --- Journal Entries

Date

General Journal

Debit

Credit

Jan.2

Supplies Expense

$350

Accounts Payable

$350

(Recorded purchase of supplies on account -- as given in the question treated as expense)

Jan.10

Accounts Receivable

$6,500

Service Revenue

$6,500

(Recorded Service performed on account)

Jan.15

Wages Expense

$1,500

Insurance Expense

$250

Travel Expense

$25

Cash

$1,775

(Recorded expenses paid in cash)

Jan.28

Cash

$2,500

Accounts Receivable

$2,500

(Recorded amount collected on account)

Jan.31

Utility Expense

$750

Cash

$750

(Recorded payment of utility bill in cash)

Part 2 – T-Accounts

Supplies Expense

Jan.2

$350

Accounts Payable

Jan.2

$350

Accounts Receivable

Jan.10

$6,500

Jan.28

$2,500

Service Revenue

Jan.10

$6,500

Wages Expense

Jan.15

$1,500

Insurance Expense

Jan.15

$250

Travel Expense

Jan.15

$25

Cash

Jan.28

$2,500

Jan.15

$1,775

Jan.31

$750

Utility Expense

Jan.31

$750

Hope the above calculations, working and explanations are clear to you and help you in understanding the concept of question.... please rate my answer...in case any doubt, post a comment and I will try to resolve the doubt ASAP…thank you

As regards Trial Balance – Please provide the data of Problem 2.

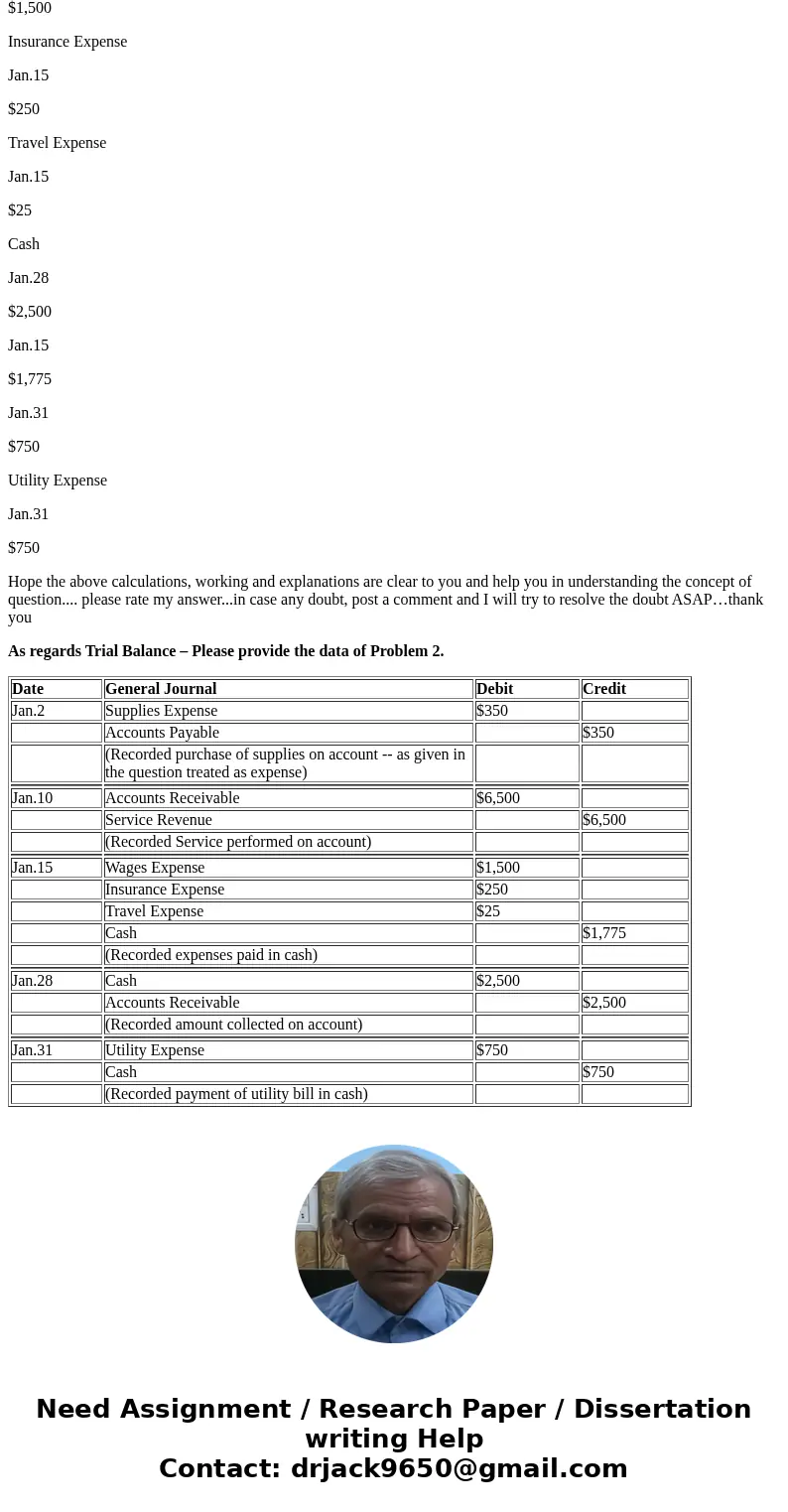

| Date | General Journal | Debit | Credit |

| Jan.2 | Supplies Expense | $350 | |

| Accounts Payable | $350 | ||

| (Recorded purchase of supplies on account -- as given in the question treated as expense) | |||

| Jan.10 | Accounts Receivable | $6,500 | |

| Service Revenue | $6,500 | ||

| (Recorded Service performed on account) | |||

| Jan.15 | Wages Expense | $1,500 | |

| Insurance Expense | $250 | ||

| Travel Expense | $25 | ||

| Cash | $1,775 | ||

| (Recorded expenses paid in cash) | |||

| Jan.28 | Cash | $2,500 | |

| Accounts Receivable | $2,500 | ||

| (Recorded amount collected on account) | |||

| Jan.31 | Utility Expense | $750 | |

| Cash | $750 | ||

| (Recorded payment of utility bill in cash) |

Homework Sourse

Homework Sourse