Widmer watercrafts predetermined overhead rate for the year

Solution

Solution:

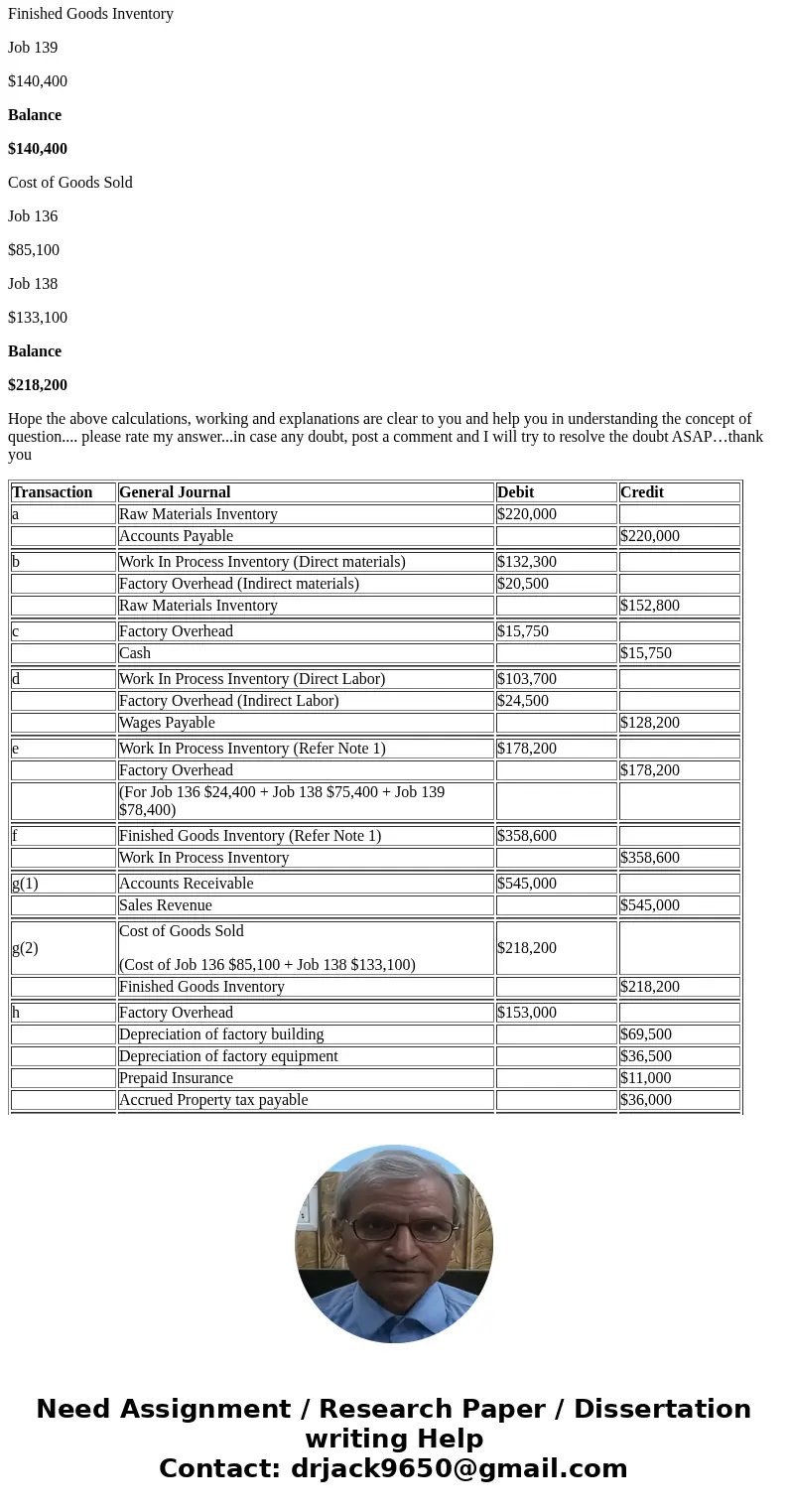

Part 2 --- Journal Entries

Transaction

General Journal

Debit

Credit

a

Raw Materials Inventory

$220,000

Accounts Payable

$220,000

b

Work In Process Inventory (Direct materials)

$132,300

Factory Overhead (Indirect materials)

$20,500

Raw Materials Inventory

$152,800

c

Factory Overhead

$15,750

Cash

$15,750

d

Work In Process Inventory (Direct Labor)

$103,700

Factory Overhead (Indirect Labor)

$24,500

Wages Payable

$128,200

e

Work In Process Inventory (Refer Note 1)

$178,200

Factory Overhead

$178,200

(For Job 136 $24,400 + Job 138 $75,400 + Job 139 $78,400)

f

Finished Goods Inventory (Refer Note 1)

$358,600

Work In Process Inventory

$358,600

g(1)

Accounts Receivable

$545,000

Sales Revenue

$545,000

g(2)

Cost of Goods Sold

(Cost of Job 136 $85,100 + Job 138 $133,100)

$218,200

Finished Goods Inventory

$218,200

h

Factory Overhead

$153,000

Depreciation of factory building

$69,500

Depreciation of factory equipment

$36,500

Prepaid Insurance

$11,000

Accrued Property tax payable

$36,000

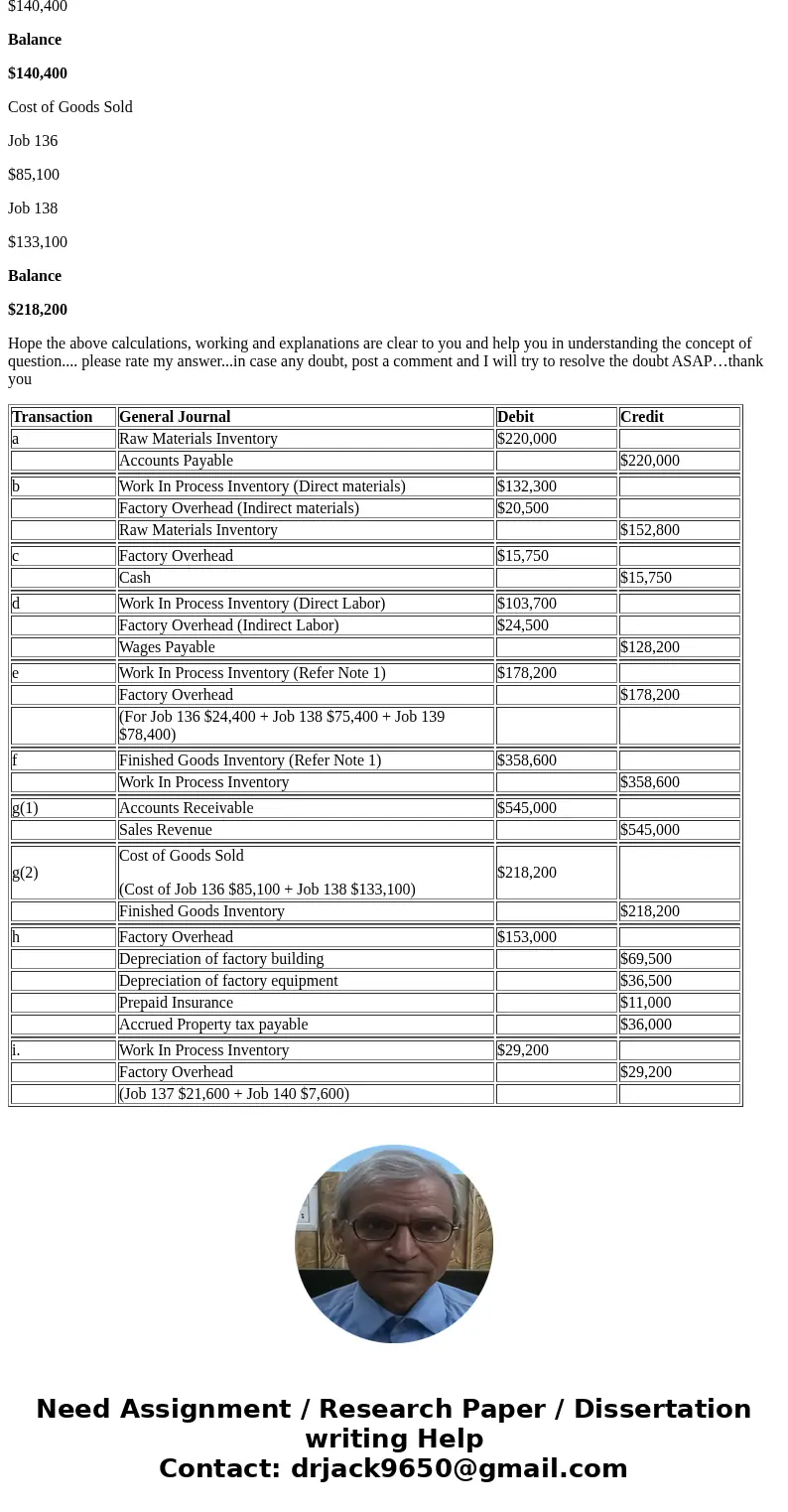

i.

Work In Process Inventory

$29,200

Factory Overhead

$29,200

(Job 137 $21,600 + Job 140 $7,600)

Note 1 ---

Job 136

Job 137

Job 138

Job 139

Job 140

Total

Direct materials

$48,500

$34,000

$20,000

$22,800

$7,000

$132,300

Direct Labor

$12,200

$10,800

$37,700

$39,200

$3,800

$103,700

Applied Factory Overhead

(200% of direct labor cost)

$24,400

$21,600

$75,400

$78,400

$7,600

$207,400

Total Manufacturing Cost

$85,100

$66,400

$133,100

$140,400

$18,400

$443,400

Status

Completed & TRFD to Finished Goods

Not Completed

Completed & TRFD to Finished Goods

Completed & TRFD to Finished Goods

Not Completed

Cost of Completed and Transferred Jobs to Finished Goods

$85,100

$133,100

$140,400

$358,600

STATUS

SOLD

SOLD

Part 3 --- T Accounts

Raw Materials Inventory

Beg bal

$0

$132,300

Work in Process

Accounts Payable

$220,000

$20,500

Factory Overhead

Ending bal

$67,200

Work In Process Inventory

Beg bal

$0

Direct materials

$132,300

$358,600

Finished Goods

Direct labor

$103,700

Factory Overhead Applied

$178,200

Factory Overhead applied for Job 137 & 140)

$29,200

Ending Bal.

$84,800

Factory Overhead

Indirect materials

$20,500

$178,200

Work In Process (Factory Overhead Applied for Job 136, 138 & 139)

indirect labor

$24,500

$29,200

Work In Process (Factory Overhead Applied for Job 137 & 140)

Cash

$15,750

Depreciation of factory building

$69,500

Depreciation of factory equipment

$36,500

Prepaid Insurance

$11,000

Accrued Property tax payable

$36,000

Ending balance

$6,350

Finished Goods Inventory

Beg bal

$0

$218,200

Cost of Goods Sold

Work In Process

$358,600

Ending Bal.

$140,400

Cost of Goods Sold

Finished Goods Inventory

$218,200

Ending Bal.

$218,200

Part 4 – Report

Report of Job Costs

Work in Process Inventory

Job 137

$66,400

Job 140

$18,400

Balance

$84,800

Finished Goods Inventory

Job 139

$140,400

Balance

$140,400

Cost of Goods Sold

Job 136

$85,100

Job 138

$133,100

Balance

$218,200

Hope the above calculations, working and explanations are clear to you and help you in understanding the concept of question.... please rate my answer...in case any doubt, post a comment and I will try to resolve the doubt ASAP…thank you

| Transaction | General Journal | Debit | Credit |

| a | Raw Materials Inventory | $220,000 | |

| Accounts Payable | $220,000 | ||

| b | Work In Process Inventory (Direct materials) | $132,300 | |

| Factory Overhead (Indirect materials) | $20,500 | ||

| Raw Materials Inventory | $152,800 | ||

| c | Factory Overhead | $15,750 | |

| Cash | $15,750 | ||

| d | Work In Process Inventory (Direct Labor) | $103,700 | |

| Factory Overhead (Indirect Labor) | $24,500 | ||

| Wages Payable | $128,200 | ||

| e | Work In Process Inventory (Refer Note 1) | $178,200 | |

| Factory Overhead | $178,200 | ||

| (For Job 136 $24,400 + Job 138 $75,400 + Job 139 $78,400) | |||

| f | Finished Goods Inventory (Refer Note 1) | $358,600 | |

| Work In Process Inventory | $358,600 | ||

| g(1) | Accounts Receivable | $545,000 | |

| Sales Revenue | $545,000 | ||

| g(2) | Cost of Goods Sold (Cost of Job 136 $85,100 + Job 138 $133,100) | $218,200 | |

| Finished Goods Inventory | $218,200 | ||

| h | Factory Overhead | $153,000 | |

| Depreciation of factory building | $69,500 | ||

| Depreciation of factory equipment | $36,500 | ||

| Prepaid Insurance | $11,000 | ||

| Accrued Property tax payable | $36,000 | ||

| i. | Work In Process Inventory | $29,200 | |

| Factory Overhead | $29,200 | ||

| (Job 137 $21,600 + Job 140 $7,600) |

Homework Sourse

Homework Sourse