You want to buy a house within 3 years and you are currently

You want to buy a house within 3 years, and you are currently saving for the down payment. You plan to save $3,000 at the end of the first year, and you anticipate that your annual savings will increase by 15% annually thereafter. Your expected annual return is 12%. How much will you have for a down payment at the end of Year 3? Round your answer to two decimal places.

$

Solution

We use the formula:

A=P(1+r/100)^n

where

A=future value

P=present value

r=rate of interest

n=time period.

Hence

A=$3000(1.12)^2+3450(1.12)+3967.50

=$11594.70

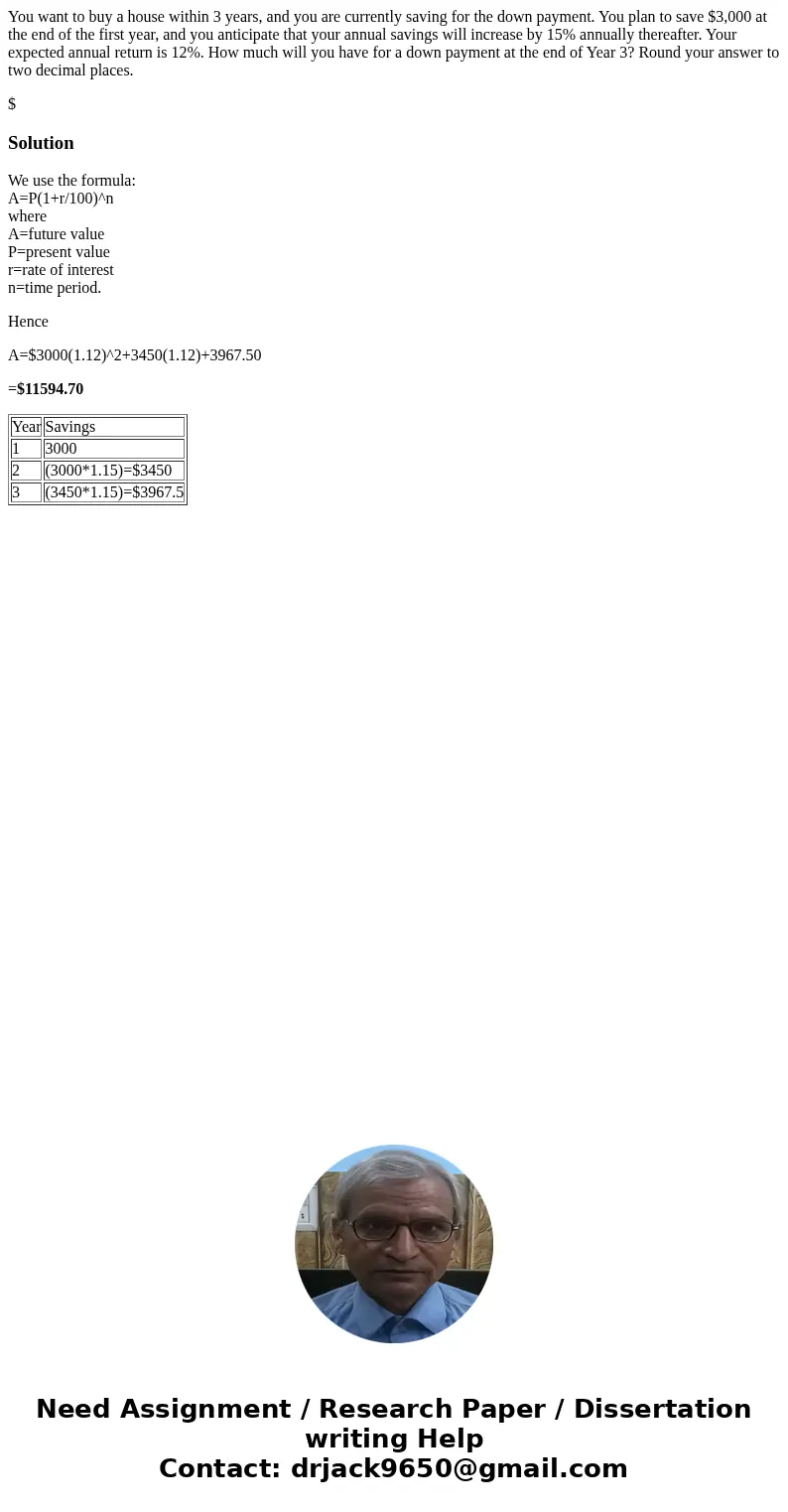

| Year | Savings |

| 1 | 3000 |

| 2 | (3000*1.15)=$3450 |

| 3 | (3450*1.15)=$3967.5 |

Homework Sourse

Homework Sourse